Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

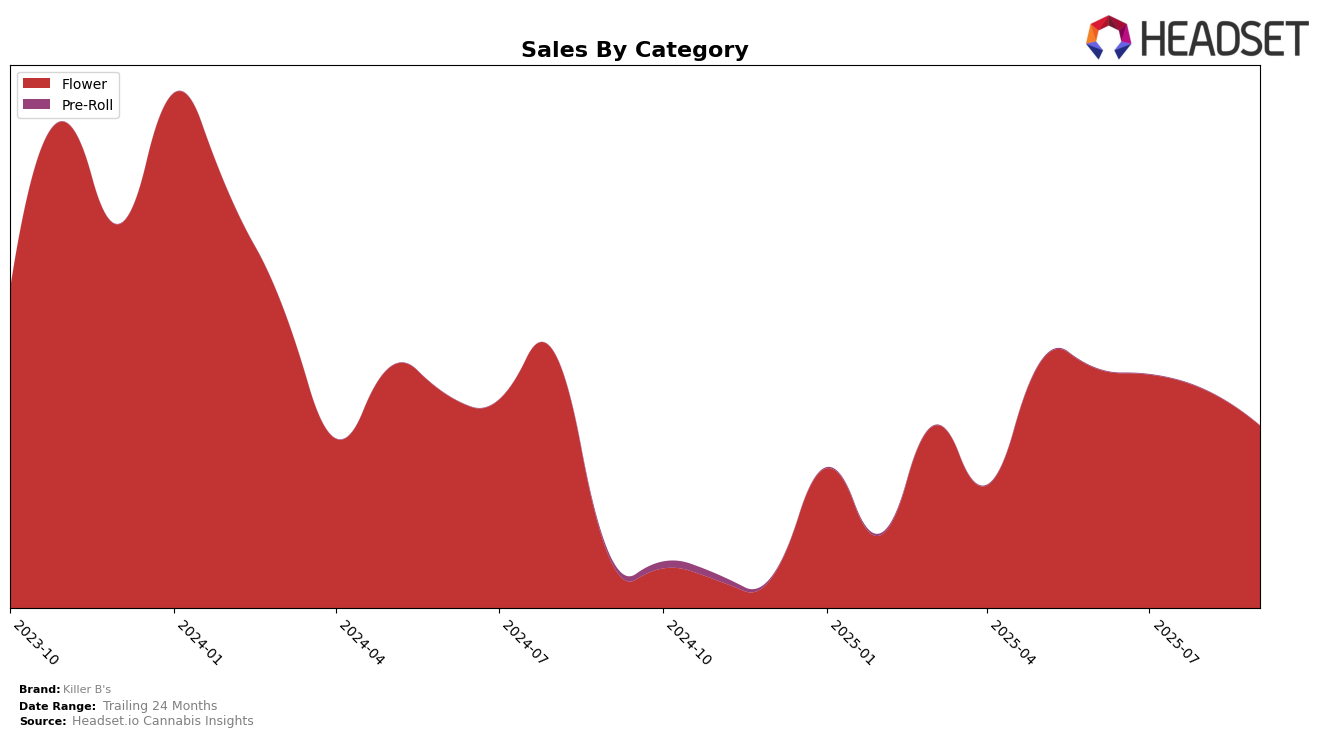

In the Nevada market, Killer B's has shown a noticeable downward trend in the Flower category rankings over the past few months. Starting at rank 22 in June 2025, the brand slipped to rank 30 by September 2025. This decline in rankings corresponds with a decrease in sales, from $217,556 in June to $165,536 in September. The consistent drop in both rank and sales suggests that Killer B's might be facing increased competition or a shift in consumer preferences within Nevada. The fact that they remained in the top 30, albeit at the lower end, indicates that while they are maintaining a presence, there is a need to strategize to regain higher positions.

Interestingly, the data for Killer B's in other states or provinces is not provided, which could imply that they are either not present or not performing within the top 30 in those regions. This situation presents both a challenge and an opportunity for the brand. While it highlights the need for expansion or improvement in other markets, it also suggests potential untapped areas for growth. The performance in Nevada could serve as a learning point for Killer B's as they consider strategies to enhance their market presence and ranking across different categories and states.

Competitive Landscape

In the Nevada flower category, Killer B's has experienced a notable decline in its market position over the past few months, dropping from 22nd place in June 2025 to 30th place by September 2025. This downward trend in rank coincides with a decrease in sales, which could be attributed to the rising competition from brands like GB Sciences, which improved its rank from 30th to 28th, and THC Design, which climbed from 52nd to 33rd during the same period. Additionally, Greenway Medical maintained a relatively stable presence, albeit with a slight dip, yet still outperformed Killer B's in terms of rank. The competitive landscape suggests that Killer B's may need to strategize effectively to regain its footing in the market, especially as brands like Polaris MMJ also show consistent performance, hovering around the 30th rank. These dynamics underscore the importance of understanding market trends to navigate the competitive pressures in Nevada's flower category.

Notable Products

In September 2025, the top-performing product for Killer B's was Collins Ave Nuggets (14g) in the Flower category, securing the number one rank with notable sales of 485 units. Following closely, Blue Bando Nuggets (14g) and Grandi Candi Popcorn (14g) took the second and third spots, respectively. Bubblegum Marker Nuggets (14g) ranked fourth, maintaining its position from August, while Lemoncello (14g) also held steady at fourth place, showing consistency in its performance. These rankings highlight a strong preference for Flower products from Killer B's, with Collins Ave Nuggets showing a significant leap in popularity compared to previous months. Overall, the consistent rankings of Lemoncello and Bubblegum Marker Nuggets suggest sustained consumer interest in these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.