Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

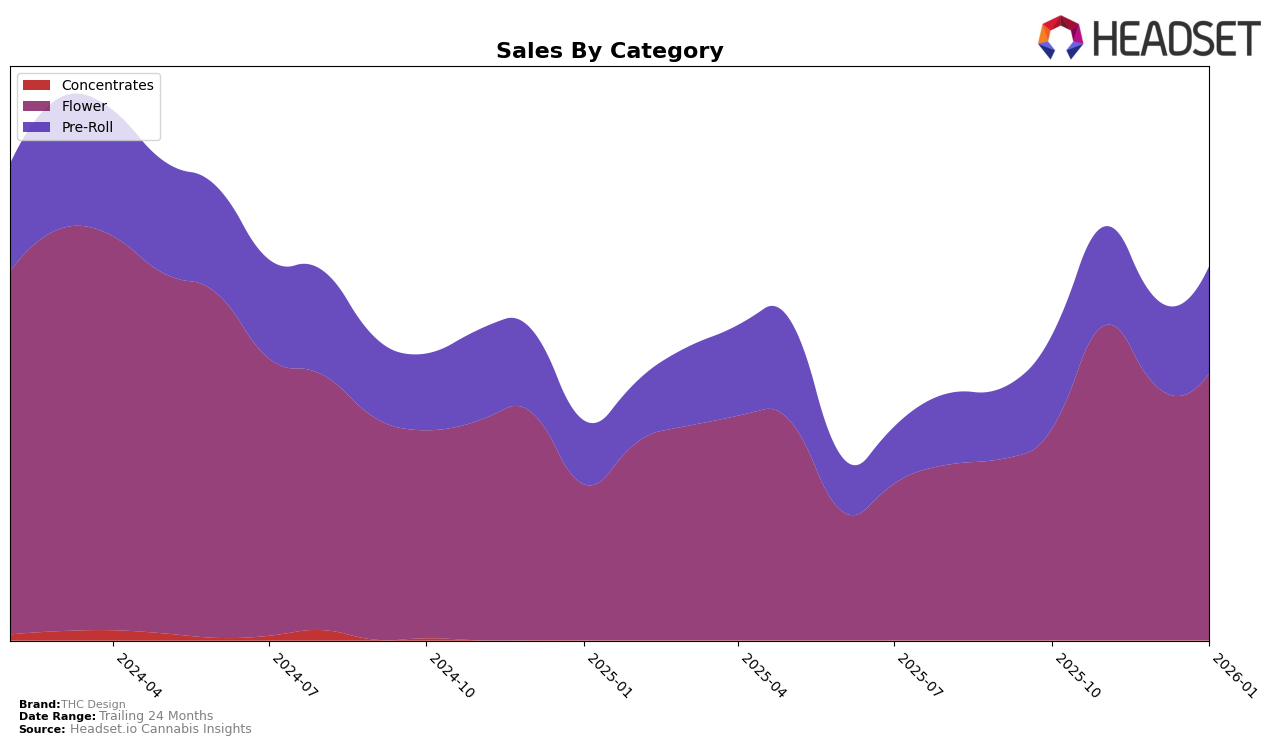

THC Design's performance in the California market shows notable fluctuations across both the Flower and Pre-Roll categories. In the Flower category, THC Design experienced a significant drop in ranking from October 2025 to January 2026, starting at 75th place, peaking at 54th in November, and then declining to 82nd by January. This movement suggests challenges in maintaining a consistent position within the top 30 brands, as they were consistently outside this range. Conversely, their performance in the Pre-Roll category showed improvement, moving from 88th to 60th over the same period, indicating a stronger presence and possibly a growing consumer preference for their pre-roll products in California.

In Nevada, THC Design demonstrates a more robust presence, particularly in the Flower category. The brand improved its ranking from 39th in October 2025 to 22nd by January 2026, showcasing a positive trend and potential market capture in this segment. The Pre-Roll category in Nevada also saw THC Design maintaining a relatively stable position, fluctuating between 16th and 26th. This stability, coupled with the upward trend in the Flower category, highlights Nevada as a key market for THC Design's growth strategy. However, the absence of a top 30 ranking in certain months for both categories in California suggests there are areas for improvement to achieve similar success as seen in Nevada.

Competitive Landscape

In the competitive landscape of the Nevada flower category, THC Design has shown a notable upward trend in its ranking from October 2025 to January 2026. Starting at rank 39 in October, THC Design improved to rank 22 by January, indicating a positive trajectory in market presence. This improvement is significant when compared to competitors like Polaris MMJ, which fluctuated in its rankings, peaking at 14 in December but dropping to 20 by January. Green Life Productions maintained a relatively stable position, hovering around the 20th rank, while Khalifa Kush experienced a slight decline, ending at rank 24 in January. Neon Moon saw a significant drop from rank 8 in October to 23 in January, highlighting the dynamic shifts in the market. THC Design's sales also reflected this upward trend, with a notable increase from November to January, suggesting a strengthening brand presence and consumer preference in the Nevada flower market.

Notable Products

In January 2026, THC Design's top-performing product was Crescendo (3.5g) in the Flower category, maintaining its rank from December 2025 as the number one product with sales of 2416 units. Crescendo Pre-Roll (1g) rose to the second position in the Pre-Roll category, improving from fourth place in December 2025, with significant sales growth. XJ-13 Pre-Roll (1g) slipped from the top spot in December 2025 to third place in January 2026, despite remaining a strong contender in the Pre-Roll category. The newly introduced Crescendo Pre-Roll 6-Pack (3.5g) debuted at fourth place, indicating a successful entry into the market. Mandarin Fuel Pre-Roll (1g) also entered the rankings this month, securing the fifth position in the Pre-Roll category, highlighting a diverse product lineup from THC Design.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.