Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

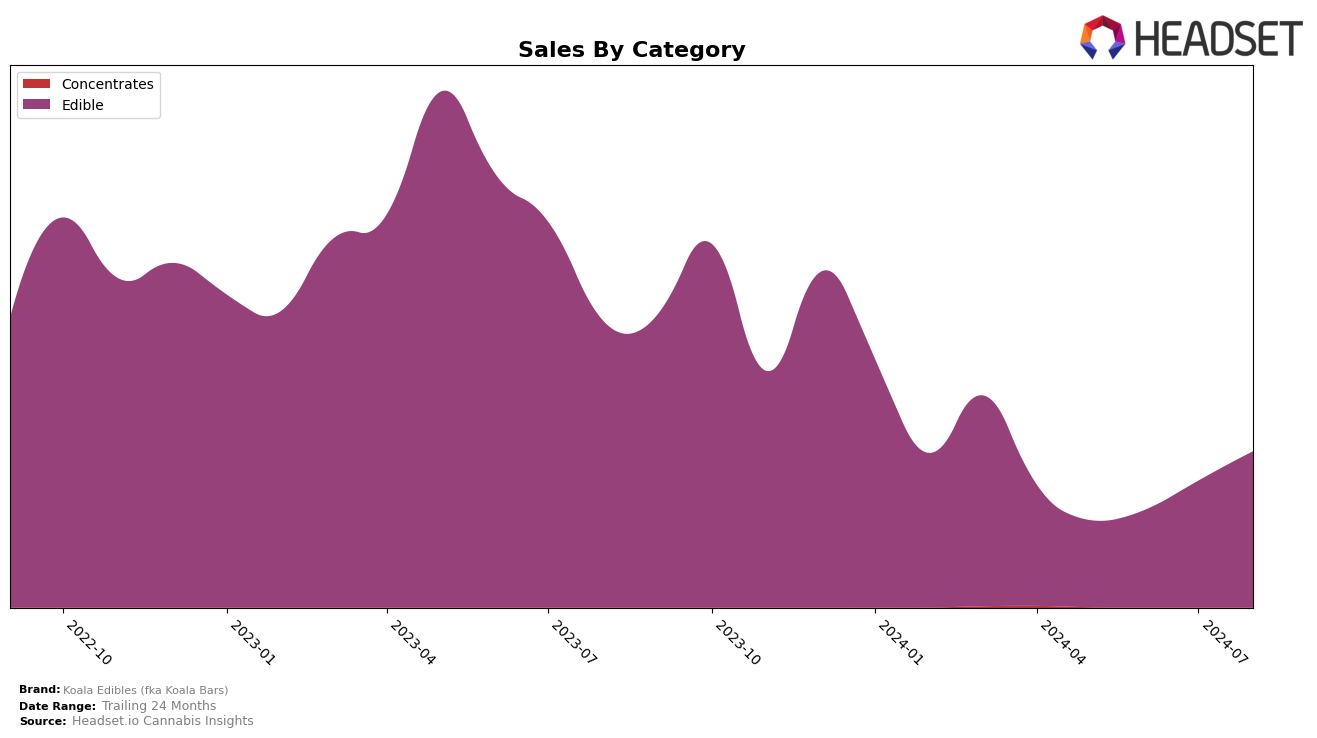

Koala Edibles (fka Koala Bars) has displayed a noteworthy performance in the Colorado market, particularly within the Edible category. Over the past few months, the brand has shown a steady upward trend, moving from rank 29 in both May and June 2024 to rank 24 in July 2024, before slightly dipping to rank 26 in August 2024. This movement suggests a growing consumer interest and potential market penetration, as evidenced by a significant increase in sales from $36,732 in May to $62,159 in August 2024. The brand’s ability to maintain a presence within the top 30 rankings in Colorado highlights its competitive stance in a crowded market.

In contrast, Koala Edibles has faced challenges in the Ohio market, where it did not appear in the top 30 Edible brands from May to July 2024. The brand finally emerged at rank 42 in August 2024. This late entry into the rankings could indicate either a recent push into the Ohio market or a struggle to gain traction among consumers. The sales figure of $20,890 in August 2024, while modest, shows that there is some level of market engagement, but it also underscores the need for strategic efforts to improve brand visibility and consumer preference in Ohio. This disparity between Colorado and Ohio highlights the varied reception and competitive landscape Koala Edibles faces across different states.

Competitive Landscape

In the competitive landscape of the Colorado edibles market, Koala Edibles (fka Koala Bars) has shown a notable upward trend in rankings and sales over the past few months. Starting from a rank of 29 in May 2024, Koala Edibles improved to 24 by July 2024, before slightly declining to 26 in August 2024. This positive trajectory is indicative of growing consumer preference and effective marketing strategies. In comparison, Sweet Mary Jane maintained a consistent rank of 23 from May to July 2024 but dropped to 24 in August 2024, suggesting a stable yet slightly declining performance. Meanwhile, Billo showed significant improvement from being unranked in May to reaching 26 in June, before stabilizing around the mid-20s. Zoobies experienced fluctuating ranks, peaking at 25 in June but dropping to 28 by August. Interestingly, Happy Fruit saw a remarkable jump from 32 in May to 25 in August, indicating a strong upward momentum. These shifts highlight the dynamic nature of the market, with Koala Edibles' steady rise positioning it favorably against its competitors.

Notable Products

In August 2024, the top-performing product from Koala Edibles (fka Koala Bars) was the Chocolate Turtle Bar 10-Pack (100mg), maintaining its number one ranking from previous months with sales reaching 1234 units. The Banana Pudding White Chocolate Bar (100mg) held steady at the second position, continuing its consistent performance with 867 units sold. The Cookies & Cream Kicked Up Chocolate Bar (100mg) also retained its third rank, showing strong sales of 823 units. The Peanut Butter Crunch Rosin Chocolate (100mg) remained in fourth place, although its sales dipped slightly to 635 units. Finally, the Smores Dark Chocolate Bar (100mg) stayed at the fifth spot, with an increase in sales to 561 units. These rankings have remained unchanged from May to August 2024, indicating stable consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.