Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

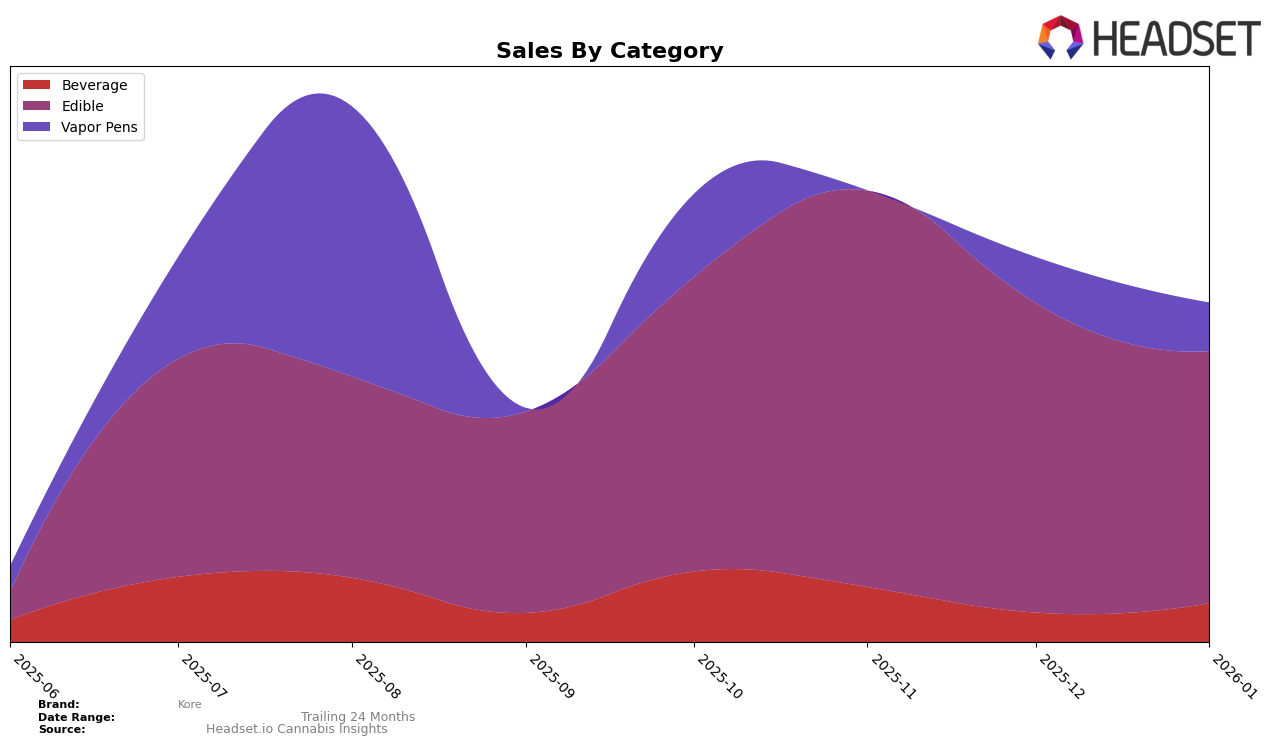

Kore's performance in the New Jersey market shows fluctuating rankings in the Edible category over recent months. While Kore was not consistently among the top 30 brands, it managed to improve its ranking from 50th in October 2025 to 44th in November 2025. However, this upward trend was short-lived as it slipped back to 49th in December 2025 and further declined to 52nd by January 2026. This movement indicates a volatile presence in the New Jersey edible market, suggesting potential challenges in maintaining a strong foothold amid competition.

The sales figures for Kore in New Jersey's Edible category reflect this inconsistency, with a notable increase in November 2025, where sales rose to $32,180. Despite this peak, subsequent months saw a decline in sales, dropping to $25,177 in December 2025 and further down to $20,549 in January 2026. Such trends may indicate seasonal influences or changes in consumer preferences that Kore has yet to adapt to effectively. The absence of Kore in the top 30 rankings during these months highlights the competitive nature of the market and the need for strategic adjustments to regain momentum and improve rankings.

Competitive Landscape

In the competitive landscape of the edible cannabis market in New Jersey, Kore has shown a dynamic performance in recent months. From October 2025 to January 2026, Kore's rank fluctuated between 44th and 52nd position, indicating a competitive but stable presence. Notably, Kore's sales peaked in November 2025, showcasing a significant increase compared to October, before experiencing a decline in December and January. This trend suggests a potential seasonal or promotional influence on sales. In contrast, Brute's Roots demonstrated a notable improvement in rank, climbing to 42nd in January 2026, which may pose a competitive threat to Kore. Meanwhile, HAZE experienced a volatile ranking, similar to Kore, but with a more pronounced sales drop in November. Additionally, Dreamt and Rosin King of Jersey maintained lower ranks, with Rosin King of Jersey missing from the top 20 in October and November, indicating less immediate competition. These insights highlight the competitive pressures Kore faces and the importance of strategic marketing efforts to maintain and improve its market position.

Notable Products

In January 2026, Peach Gummies 10-Pack (100mg) maintained its top spot as the leading product for Kore, with sales reaching 556 units. Cherry Limeade Gummies 10-Pack (100mg) held steady in second place, while Strawberry Mango Gummies 10-Pack (100mg) improved its rank to third. Watermelon Gummies 10-Pack (100mg) dropped to fourth place after previously holding the top position in December 2025. Purple Reign Syrup (100mg) saw a decline, moving to fifth place from its previous second-place ranking in October 2025. This shift in rankings highlights the fluctuating consumer preferences within the Edible category for Kore products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.