Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

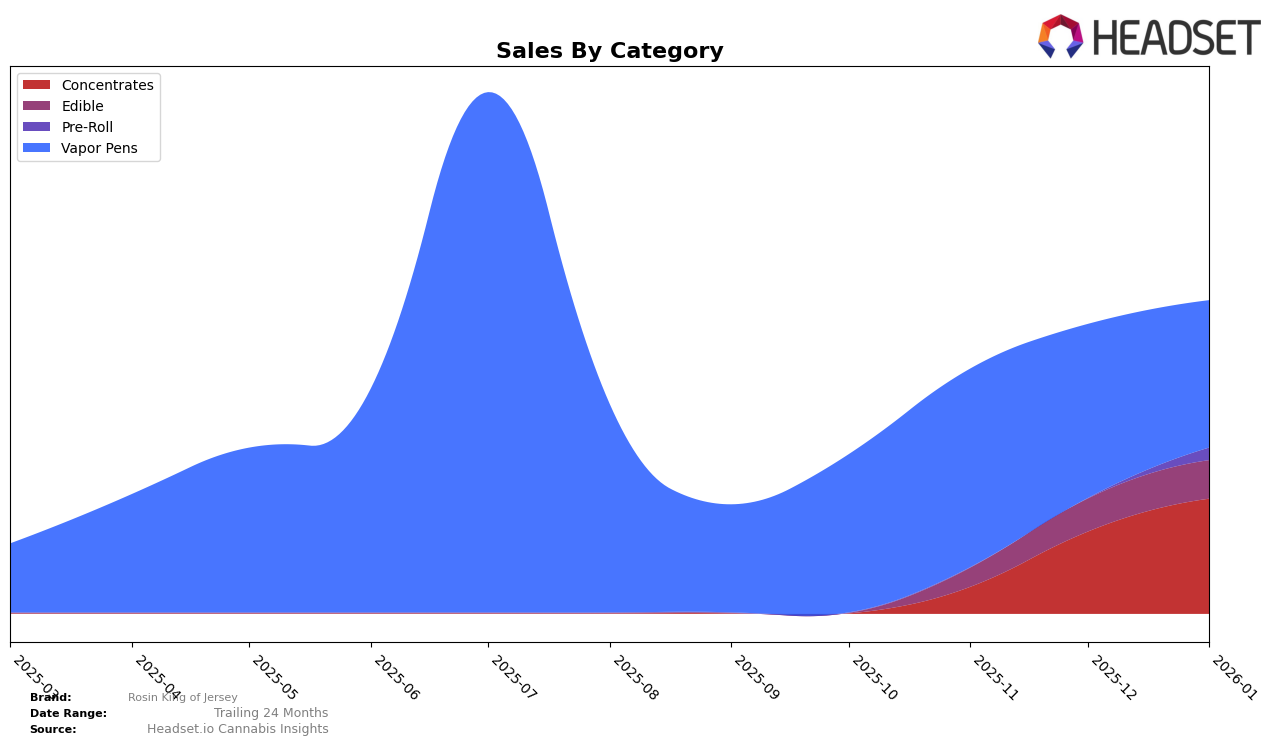

Rosin King of Jersey has shown a notable trajectory in the Concentrates category within New Jersey. After not ranking in the top 30 in October 2025, the brand made a significant leap to 40th in November, 26th in December, and further improved to 23rd by January 2026. This upward movement suggests a growing consumer interest and potentially effective marketing or product enhancements. The brand's sales in this category also reflect a positive trend, with substantial growth from November to January, indicating a strong market presence and increasing consumer loyalty.

In contrast, the Edible category presents a different picture for Rosin King of Jersey in New Jersey. The brand was absent from the top 30 rankings in the last quarter of 2025, only breaking into the 62nd position by December and slightly improving to 57th in January 2026. This suggests challenges in penetrating the Edible market, despite a modest increase in sales during this period. Meanwhile, in the Vapor Pens category, the brand experienced fluctuating rankings, moving from 55th in October to 43rd in November, then back to 55th in December, and finally to 57th in January. This inconsistency might reflect competitive pressures or varying consumer preferences, highlighting areas for potential strategic adjustments.

Competitive Landscape

In the competitive landscape of Vapor Pens in New Jersey, Rosin King of Jersey has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. In October 2025, Rosin King of Jersey was ranked 55th, improving to 43rd in November, but then dropping to 55th in December and slightly recovering to 57th in January 2026. This volatility suggests a competitive market where brands like Space Ranger and Full Tilt Labs have also shown significant movements. Notably, Space Ranger climbed from 64th in October to 47th in December, maintaining a strong position relative to Rosin King of Jersey. Meanwhile, Full Tilt Labs had a notable absence from the top 20 in November but surged to 41st in December, indicating potential for rapid changes in brand performance. These shifts highlight the importance of strategic marketing and product differentiation for Rosin King of Jersey to maintain and improve its market position amidst strong competition.

Notable Products

In January 2026, the top-performing product for Rosin King of Jersey was the Apricot Peach Live Rosin Gummies 10-Pack (100mg) in the Edible category, maintaining its number one rank from December 2025 with sales of 289.0 units. The Blueberry Octane Cold Cured Live Rosin (1g) in the Concentrates category emerged as a strong contender, securing the second position with notable sales. Orange Soda Live Rosin Gummies 10-Pack (100mg) ranked third, slipping one position from December 2025, while Tropical Smoothie Live Rosin Gummies 10-Pack (100mg) held steady at fourth place. The Fuhgeddaboudit Papaya Crush x Papaya Crus Diamonds Infused Pre-Roll (1g) debuted in the rankings at fifth place. Overall, the Edible category dominated the top ranks, showing consistent consumer preference for gummies.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.