Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

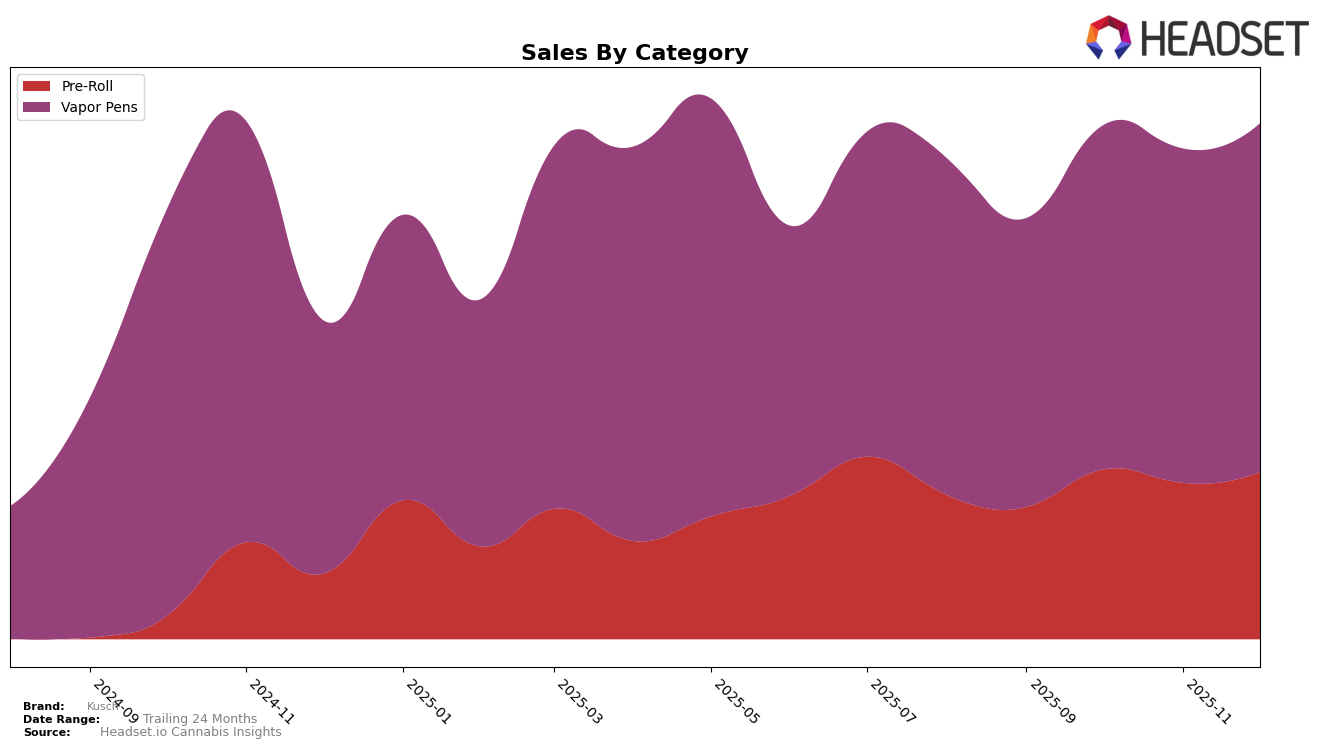

In the Missouri market, Kusch has shown notable progress in the Pre-Roll category. The brand climbed from the 40th position in September 2025 to break into the top 30 by December 2025, indicating a positive trend in consumer preference and market penetration. This steady ascent is a promising sign for Kusch, as they were not initially in the top 30. The increase in rank is complemented by a consistent rise in sales figures, suggesting a growing acceptance and demand for their products in this category.

Meanwhile, in the Vapor Pens category in Missouri, Kusch has maintained a more stable position, hovering just outside the top 30. Despite not breaking into the top tier, they moved from the 33rd to the 31st position by December 2025. This slight upward movement, along with robust sales figures, indicates a steady presence in the market. However, the fact that Kusch has not yet solidified a top 30 position in this category suggests there is room for growth and potential strategies to increase their market share further.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Kusch has demonstrated a steady improvement in its ranking, moving from 33rd in September 2025 to 31st by December 2025. This upward trend in rank is indicative of a positive momentum in sales, which aligns with the increasing sales figures over the same period. However, Kusch faces stiff competition from brands like Proper Cannabis, which consistently ranks higher, maintaining a position within the top 30 throughout the last quarter of 2025. Meanwhile, Curio Wellness has also shown a notable improvement, climbing from 36th to 29th, suggesting a competitive pressure on Kusch to maintain its upward trajectory. Despite these challenges, Kusch's consistent rank improvement and sales growth indicate a robust market presence, but continued strategic efforts will be necessary to close the gap with higher-ranked competitors.

Notable Products

For December 2025, the top-performing product from Kusch was the Orange 43 x Lemon Cherry Gelato Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, securing the first rank with sales of 961 units. The Legacy Series - Strawberry Cough Liquid Gold Distillate Cartridge (1g) in the Vapor Pens category climbed back to the second position after dropping to fifth place in November. The Rainbow Belts x Orange 43 Pre-Roll 7-Pack (3.5g) entered the rankings at third place, showing strong sales performance. The Legacy Series - Maui Wowie Distillate Cartridge (1g) was ranked fourth, marking its debut in the rankings. Meanwhile, the Legacy Series- Granddaddy Purple Liquid Gold Distillate Cartridge (1g) fell from the first position in November to fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.