Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

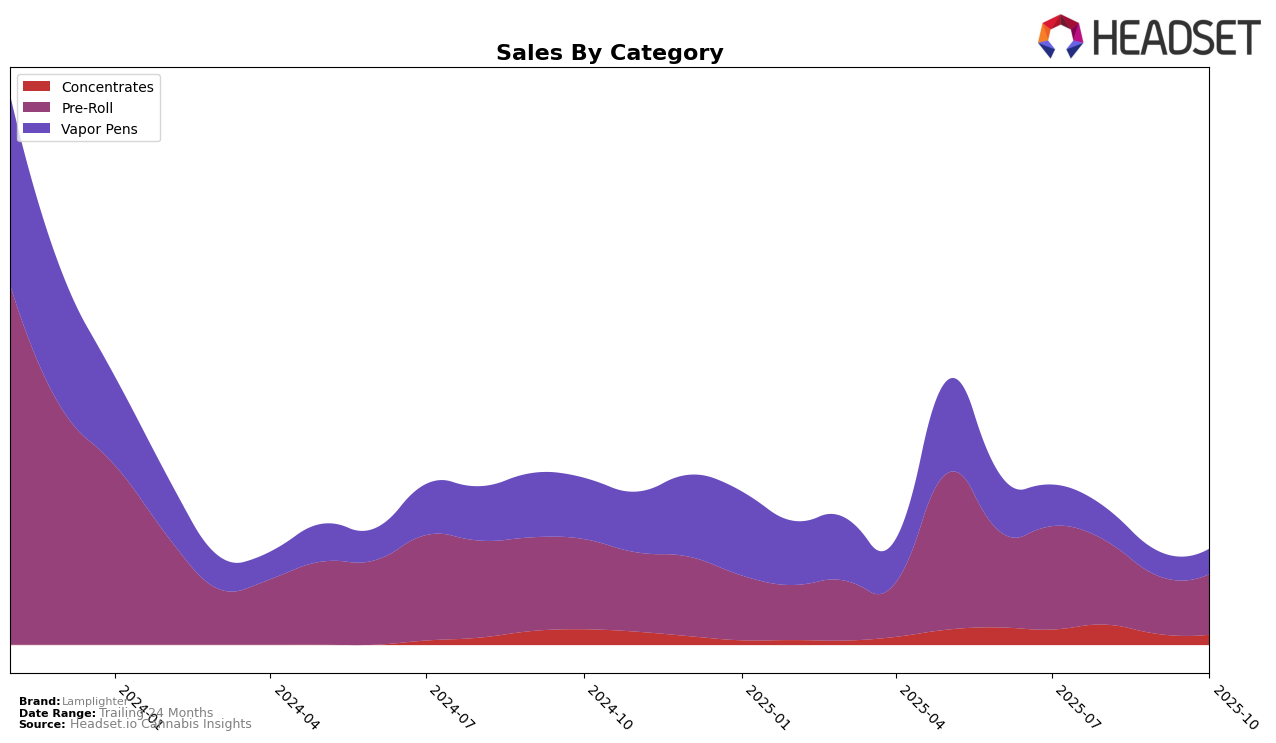

Lamplighter's performance in the Canadian cannabis market has shown varied results across different product categories and provinces. In Alberta, the brand has maintained a presence in the top 30 for Concentrates, with a slight improvement from 23rd in July 2025 to 28th in October 2025. However, their Pre-Roll category did not make it into the top 30, indicating a potential area for growth. Meanwhile, their Vapor Pens saw fluctuations, moving from 44th place in July to 46th in October, suggesting a steady but not dominant position in the market. This mixed performance in Alberta highlights both opportunities and challenges for Lamplighter as they navigate the competitive landscape.

In Ontario, Lamplighter's Pre-Roll category experienced a decline in rankings, starting at 74th in July and dropping to 93rd by October 2025. This downward trend in Ontario contrasts with their performance in Alberta and signals potential issues in market penetration or consumer preference. The Vapor Pens category in Ontario also saw a decline, with the brand not ranking in the top 30 by October, further emphasizing the competitive nature of the market. These insights suggest that while Lamplighter has maintained some market presence, strategic adjustments may be necessary to enhance their standing and capitalize on growth opportunities in these provinces.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Lamplighter has experienced fluctuating ranks from July to October 2025, starting at 74th and ending at 93rd. Despite a decline in rank, Lamplighter's sales showed resilience with a slight increase from September to October. This suggests a potential stabilization or recovery in consumer demand. In contrast, competitors like LowKey and DEALR have maintained higher ranks, with LowKey starting at 62nd and ending at 92nd, and DEALR consistently outperforming Lamplighter by ending at 91st. Notably, Deep Space and Valhalla Flwr were not in the top 20 for September, indicating potential volatility in their market presence. These dynamics highlight the competitive pressures Lamplighter faces, underscoring the need for strategic marketing and product differentiation to regain and improve its market position.

Notable Products

In October 2025, Lamplighter's top-performing product was the Tiger Berry Infused Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its rank at number 1 for four consecutive months, with sales of 4554 units. The Pineapple Coconut Escape Liquid Diamonds Dispenser (1g) in the Concentrates category climbed to the second position, improving from its fourth rank in September. The Tiger Berry Distillate Disposable (1g) in the Vapor Pens category held steady at third place since its introduction in September. The Honeydew Lime Distillate Cartridge (1g), another Vapor Pens product, entered the rankings at fourth place in October. Lastly, the Tiger Berry Liquid Diamonds Dispenser (1g) dropped from second to fifth place from September to October, indicating a shift in consumer preferences within the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.