Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

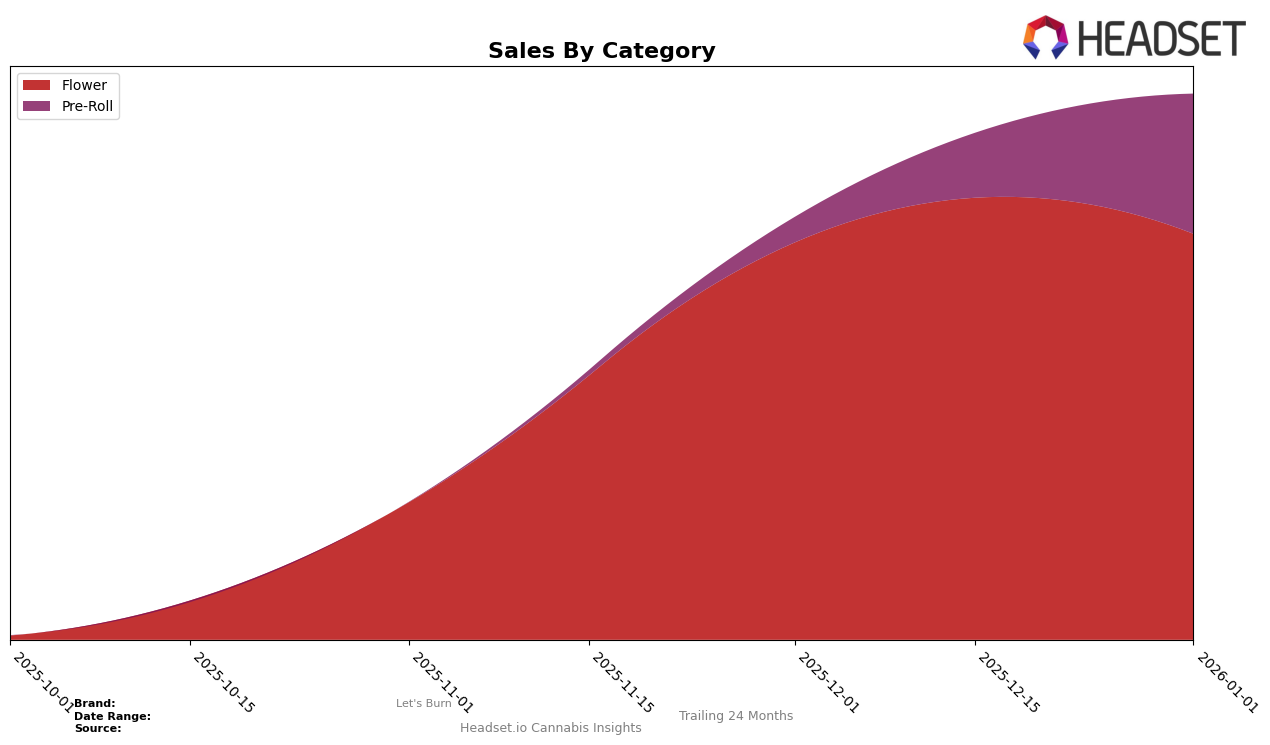

In the state of Connecticut, Let's Burn has shown notable progress in the Flower category. Initially absent from the top 30 brands in October 2025, the brand made a significant leap to rank 16th by November and further improved to the 13th position by December and January. This consistent upward movement indicates a strengthening market presence and growing consumer preference for Let's Burn's Flower products. The sales figures support this trend, with a dramatic increase from $83,432 in October to $241,477 in November, maintaining momentum into the following months. This suggests a successful strategy in capturing the Connecticut market's interest in the Flower category.

In the Pre-Roll category in Connecticut, Let's Burn also demonstrated a positive trajectory. Although they were not in the top 30 brands in October, they emerged in the rankings by December at the 17th position, advancing to 13th by January. This upward movement reflects a growing acceptance and demand for Let's Burn's Pre-Roll products. The sales increase from December to January further underscores this trend, highlighting the brand's capacity to penetrate and expand within this category. However, the absence of a top 30 ranking in earlier months suggests there may have been initial challenges or a late entry into the market, which they have since overcome.

```Competitive Landscape

In the competitive landscape of the flower category in Connecticut, Let's Burn has shown a promising upward trajectory in recent months. Initially absent from the top 20 rankings in October 2025, Let's Burn made a notable entry at rank 16 in November 2025, climbing to 13th place by December 2025 and maintaining this position into January 2026. This upward movement indicates a positive trend in brand recognition and consumer preference. In contrast, Earl Baker experienced a decline, dropping from 10th place in October and November 2025 to 15th by January 2026, suggesting a potential shift in consumer loyalty. Meanwhile, Good Green re-entered the rankings at 14th in December 2025 and improved to 11th by January 2026, indicating competitive pressure on Let's Burn to maintain its upward momentum. Additionally, Grassroots appeared in the rankings at 12th place in January 2026, further intensifying the competition. Despite these challenges, Let's Burn's consistent sales growth and stable ranking position highlight its potential to capture a larger market share in the Connecticut flower category.

Notable Products

In January 2026, Let's Burn's top product was CT Kush Cake Pre-Roll (1g) in the Pre-Roll category, which rose to the number one spot with sales of 4049 units. Mule Fuel (3.5g) maintained its strong performance in the Flower category, holding steady at second place with significant sales figures. CT Kush Cake (3.5g) experienced a slight drop, moving from first place in previous months to third place in January. Mikado Mintz Pre-Roll (1g) secured the fourth position, showing a decline from its previous third-place ranking in December 2025. The newly introduced Mule Fuel Pre-Roll (1g) entered the rankings at fifth place, indicating a promising start for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.