Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

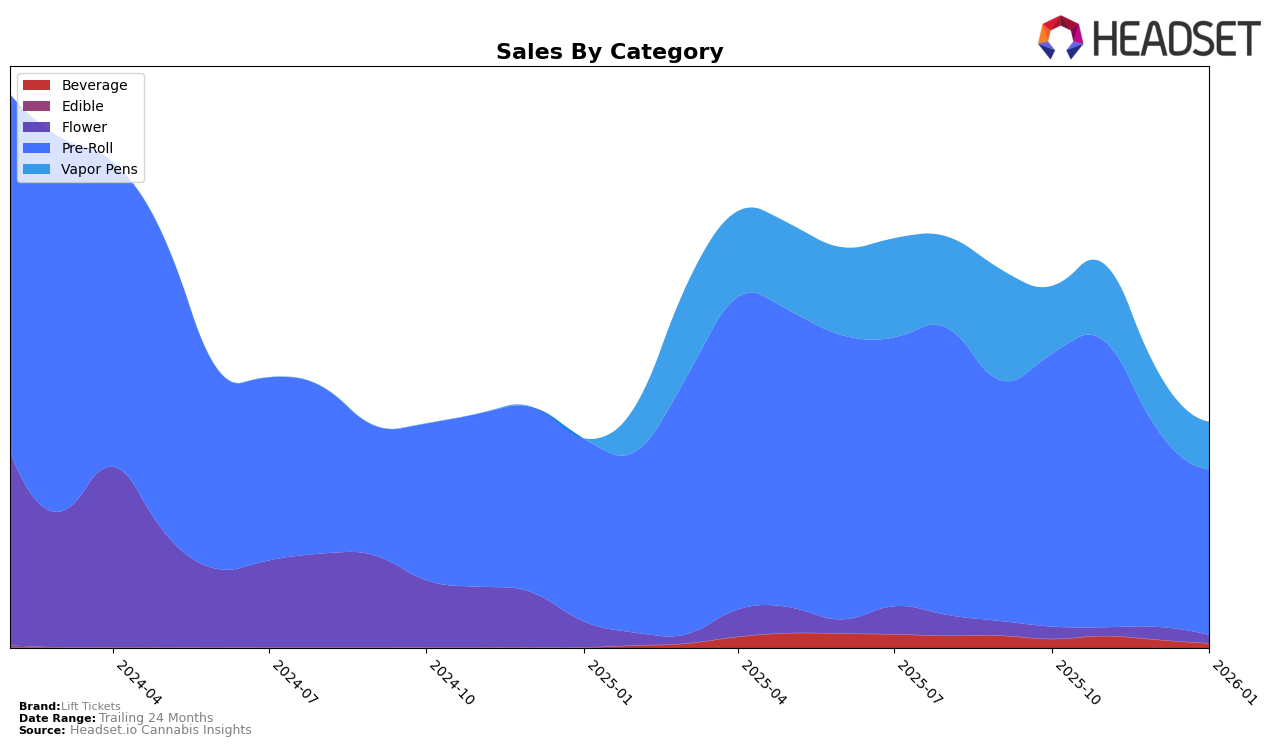

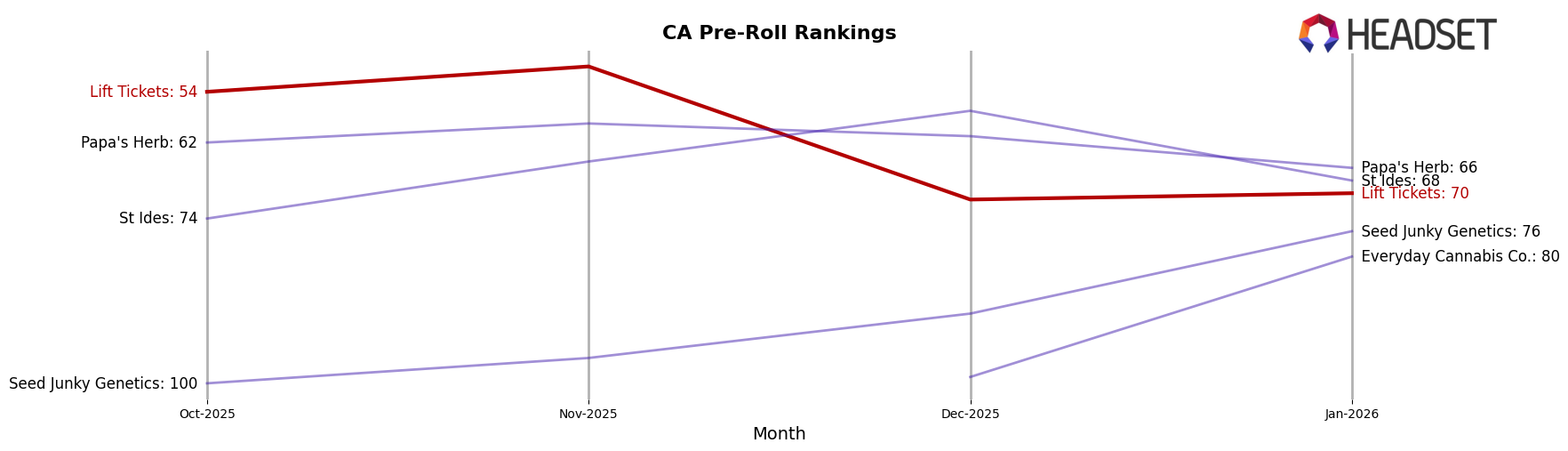

Lift Tickets, a prominent player in the cannabis industry, has shown varied performance across different categories and states. In the pre-roll category in California, the brand has experienced some fluctuations in its rankings over the months from October 2025 to January 2026. Starting at a rank of 54 in October, Lift Tickets managed to climb slightly to 50 in November; however, it faced a downturn, dropping to 71 in December and then to 70 in January. This decline in rankings is mirrored by a decrease in sales from November to January, indicating potential challenges the brand might be facing in maintaining its market position in California's competitive pre-roll segment.

It's noteworthy that Lift Tickets did not secure a spot in the top 30 brands in California's pre-roll category throughout this period, which could be a cause for concern or an opportunity for strategic realignment. Despite the setbacks, the brand's ability to maintain a presence in the rankings, albeit lower than desired, suggests a resilience that could be leveraged for future growth. Observing trends like these can provide insights into market dynamics and consumer preferences, which are crucial for any brand looking to strengthen its foothold in the cannabis market. For more detailed insights and strategic recommendations, further analysis would be required.

Competitive Landscape

In the competitive landscape of the California pre-roll market, Lift Tickets experienced a notable decline in rank from October 2025 to January 2026, dropping from 54th to 70th position. This decline in rank is accompanied by a significant decrease in sales, with January 2026 figures showing a drop to nearly half of what they were in October 2025. In contrast, Papa's Herb maintained a more stable performance, with a relatively consistent rank and sales figures, even surpassing Lift Tickets in sales by January 2026. Meanwhile, St Ides showed a fluctuating rank but managed to achieve higher sales than Lift Tickets in December 2025. Seed Junky Genetics and Everyday Cannabis Co. have been climbing the ranks, with Seed Junky Genetics improving its position from 100th to 76th, and Everyday Cannabis Co. entering the top 100 by December 2025 and further improving by January 2026. These shifts suggest a dynamic market where Lift Tickets faces increasing competition and may need to strategize to regain its competitive edge.

Notable Products

In January 2026, the top-performing product from Lift Tickets was the Mega Wellness OG Infused Pre-Roll 5-Pack, which claimed the number one rank with sales reaching 637 units. This marks a significant rise from its fifth-place standing in November 2025. The Jackapulco Infused Pre-Roll 5-Pack followed closely as the second best-seller, while the Dark Rainbow Infused Pre-Roll 5-Pack secured the third position. The Lift Tickets x No Till Kings - Blue Dream Infused Pre-Roll 5-Pack and the Lights On THCV/THC Kiwi Apple Energy Drink rounded out the top five, showing strong sales in their respective categories. Notably, all these products appeared in the rankings for the first time in January, indicating a fresh surge in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.