Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

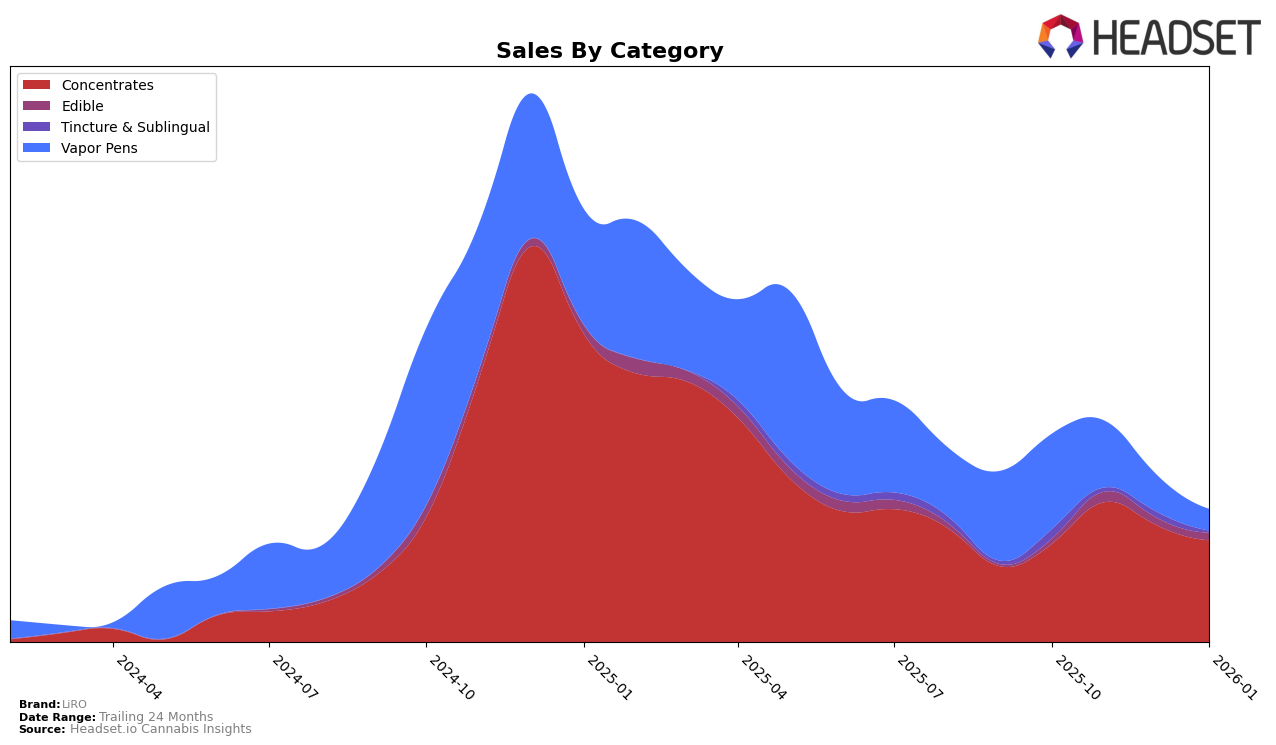

LiRO's performance in the Missouri market has shown some interesting trends across different product categories. In the Concentrates category, LiRO has consistently stayed outside the top 30 brands, with rankings of 39th in October 2025 and slipping to 42nd by January 2026. Despite not breaking into the top 30, LiRO did experience some fluctuations in sales, peaking in November 2025. However, this was followed by a decline towards the end of the year, indicating potential challenges in maintaining a competitive edge within this category.

In contrast, LiRO's presence in the Vapor Pens category in Missouri was less prominent, with a ranking of 86th in October 2025 and no subsequent appearances in the top 30. This absence suggests significant competition within the category or potential shifts in consumer preferences that may not favor LiRO's offerings. Such patterns highlight the dynamic nature of the cannabis market in Missouri and underscore the importance of strategic positioning and adaptability for brands like LiRO to improve their market standings.

Competitive Landscape

In the Missouri concentrates market, LiRO has experienced fluctuating rankings, moving from 39th in October 2025 to 42nd by January 2026. This downward trend in rank, despite a temporary rise to 36th in November, suggests competitive pressures from brands like Plume Cannabis (MO), which has maintained a relatively stable position, ranking 37th to 38th over the same period. Meanwhile, Cloud Cover (C3) has seen a significant drop from 4th to being out of the top 20 by January 2026, indicating potential market shifts that could impact LiRO's strategy. Additionally, CODES showed a slight improvement from 16th to 18th, suggesting they are gaining traction. These dynamics highlight the competitive landscape LiRO faces, with sales figures reflecting a decrease from November to January, emphasizing the need for strategic adjustments to regain and improve market positioning.

Notable Products

In January 2026, the top-performing products for LiRO were Onlyglands Live Rosin and Remedy Live Rosin, both ranking first in the Concentrates category, each with sales figures of 61.0. Space Boss Live Rosin maintained its strong position, ranking second with a slight decrease in sales compared to December 2025. Private Reserve Live Rosin consistently held the third position over the past few months, while Sizzler Live Rosin Disposable fell to fourth place in the Vapor Pens category. Notably, Onlyglands Live Rosin saw a significant rise from fifth place in October 2025 to the top spot in January 2026, indicating a growing consumer preference for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.