Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

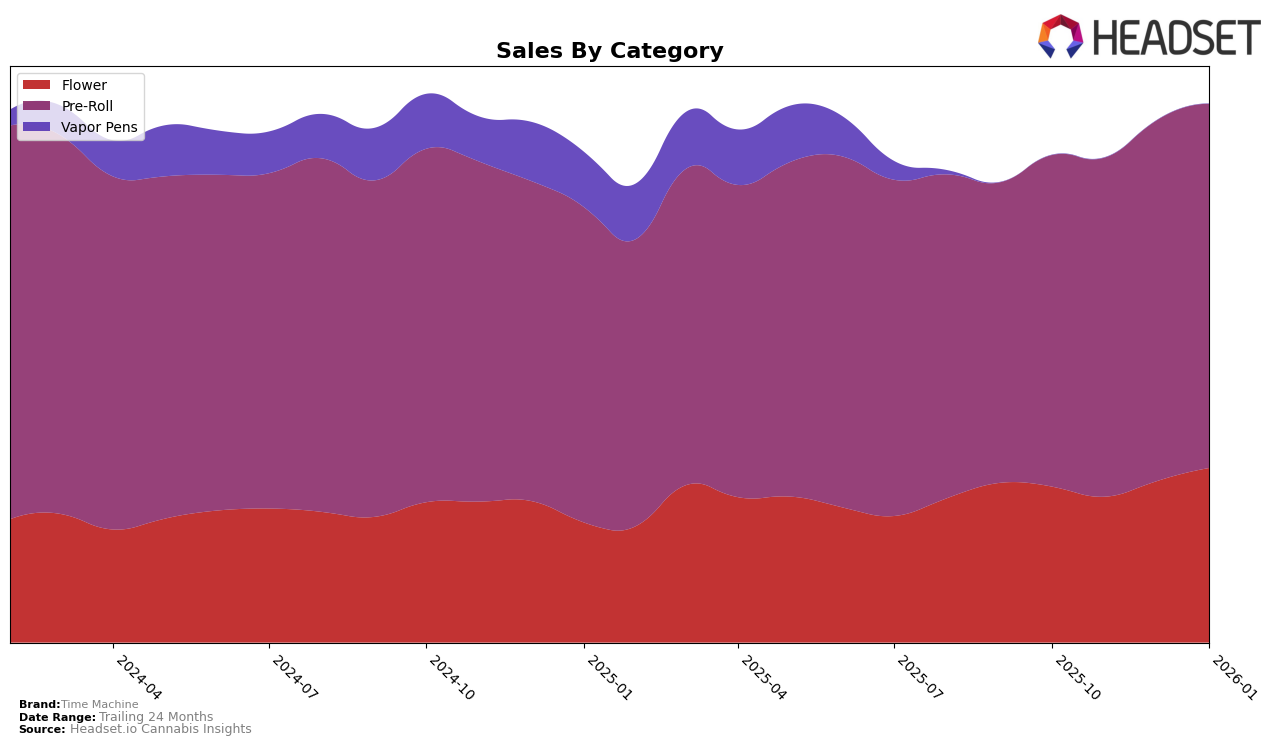

In the competitive landscape of cannabis brands, Time Machine has shown notable performance across various categories and states. In California, Time Machine's presence in the Flower category has been on a gradual upward trajectory. Despite not being in the top 30 brands initially, the brand improved its ranking from 51st in October 2025 to 43rd by January 2026. This indicates a positive trend in consumer preference or strategic positioning within the Flower category. On the other hand, their performance in the Pre-Roll category has been more consistent, maintaining a steady position at 11th place from October through December 2025, before moving up to 10th place in January 2026. This stability and slight improvement suggest a solid foothold in the Pre-Roll market.

The data highlights Time Machine's strategic focus on the California market, where it continues to strengthen its brand presence. While the Flower category showed a significant sales increase from November to January, reaching over half a million dollars, it is the Pre-Roll category where Time Machine seems to have found its niche. The consistent ranking in the top 11 and the sales growth in this category underscore the brand's competitive edge and consumer loyalty. However, the absence of Time Machine in the top 30 for certain months in other categories or states could indicate areas needing strategic improvement or market expansion. Understanding these dynamics offers valuable insights into Time Machine's market strategy and potential growth areas.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in California, Time Machine has shown a notable upward trend in its ranking and sales performance. From October 2025 to January 2026, Time Machine improved its rank from 11th to 10th, indicating a positive trajectory amidst stiff competition. Notably, Heavy Hitters experienced a decline from 10th to 12th place, which may have contributed to Time Machine's rise. Meanwhile, CannaBiotix (CBX) and Claybourne Co. maintained stronger positions, although CannaBiotix (CBX) saw a slight dip from 6th to 8th. Despite these competitive pressures, Time Machine's consistent increase in sales, culminating in a January 2026 figure that surpassed its October 2025 sales, underscores its growing market presence. Additionally, Quiet Kings also climbed the ranks, moving from 17th to 11th, suggesting a dynamic market environment where Time Machine's strategic efforts are effectively enhancing its competitive stance.

Notable Products

In January 2026, Blue Dream Pre-Roll 28-Pack (14g) maintained its top position as the best-selling product for Time Machine, with sales reaching 4084 units. Wedding Cake Pre-Roll 28-Pack (14g) also held steady in second place, although its sales saw a decrease compared to previous months. Cereal Milk Pre-Roll 28-Pack (14g) remained in third place, continuing its consistent performance from December 2025. Gorilla Glue #4 Pre-Roll 28-Pack (14g) secured the fourth position, showing a steady climb from its fifth-place ranking in November 2025. Notably, P.R. OG Pre-Roll 28-Pack (14g) entered the rankings for the first time in January 2026, taking the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.