Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

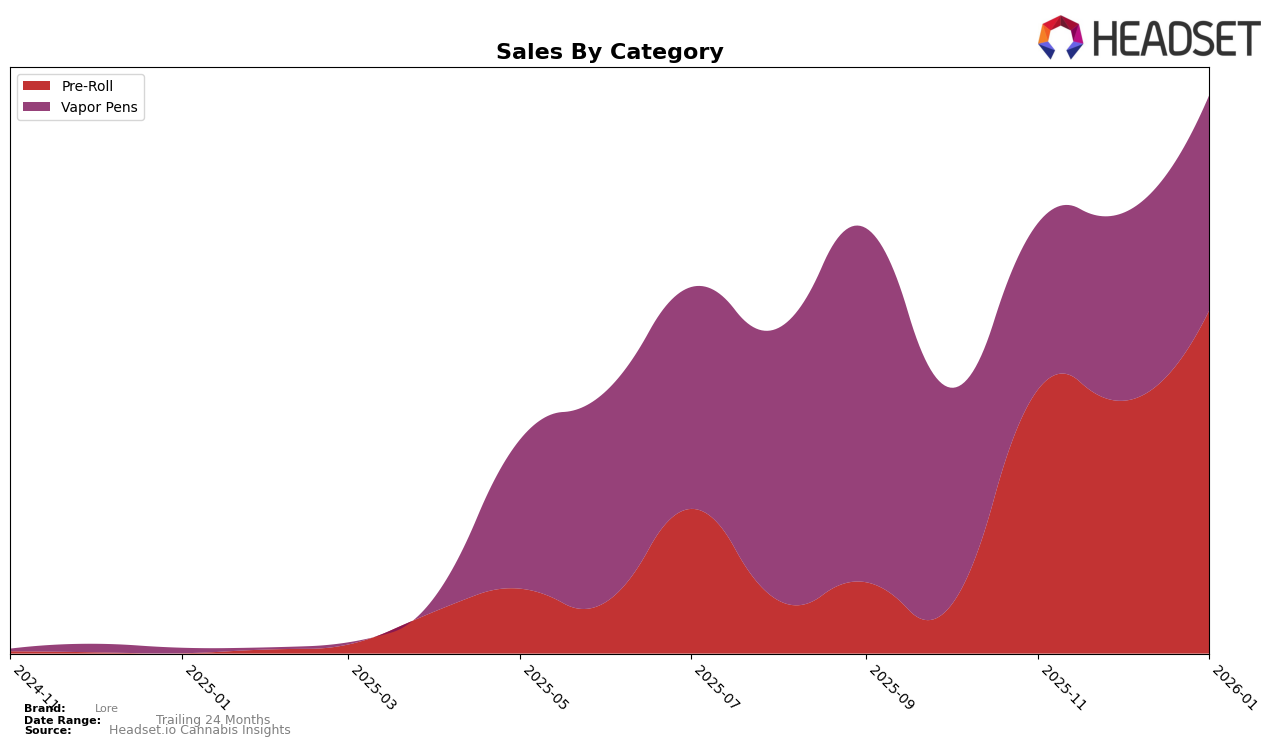

In the state of Maryland, Lore has shown varying performance across different cannabis categories. Notably, in the Pre-Roll category, Lore was absent from the top 30 brands in October 2025 but made a significant comeback by December 2025, ranking 29th. This indicates a positive upward trend in this category, as evidenced by an increase in sales from November to December. However, the absence of a ranking in October suggests there was a period of underperformance or increased competition that Lore had to overcome.

Conversely, in the Vapor Pens category, Lore has consistently remained outside the top 30 brands, with rankings fluctuating between 43rd and 49th from October 2025 to January 2026. Despite this, there was a noticeable recovery in sales from November to January, indicating a potential turnaround or strategic adjustments that might be paying off. Lore's persistence in the Vapor Pens category, despite not breaking into the top 30, suggests they are maintaining a steady presence, possibly setting the stage for future growth in Maryland.

Competitive Landscape

In the Maryland pre-roll category, Lore has shown a dynamic shift in its market positioning over the recent months. Starting from a non-ranked position in October 2025, Lore ascended to rank 33 in November, slightly dipped to 34 in December, and improved to 29 by January 2026. This upward trajectory suggests a positive reception and growing market presence. In contrast, KOA Exotics experienced fluctuations, peaking at 17 in November before dropping to 26 in January, indicating potential volatility in their sales strategy. Meanwhile, Khalifa Kush maintained a relatively stable position, hovering around the late 20s to early 30s, which might suggest a consistent yet unremarkable performance. Notably, Beezle Extracts showed a consistent climb from rank 38 in October to 25 by January, reflecting a significant improvement in their market strategy. These insights highlight Lore's potential for growth amidst a competitive landscape, with opportunities to capitalize on the fluctuating performances of its competitors.

Notable Products

In January 2026, the top-performing product for Lore was Amnesia OG Double Diamonds Infused Pre-Roll (1g) in the Pre-Roll category, achieving the number one rank with sales of 823 units. This product improved from third place in November and second in December. Gelato OG Double Diamonds Infused Pre-Roll (1g) climbed to second place, showing consistent growth from fifth in November and third in December. Goji Dough Infused Pre-Roll 2-Pack (1g) dropped to third place, despite leading in December. In the Vapor Pens category, Berry Gelato Distillate Cartridge (1g) made a notable entry at fourth place, marking its first appearance in the rankings since October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.