Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

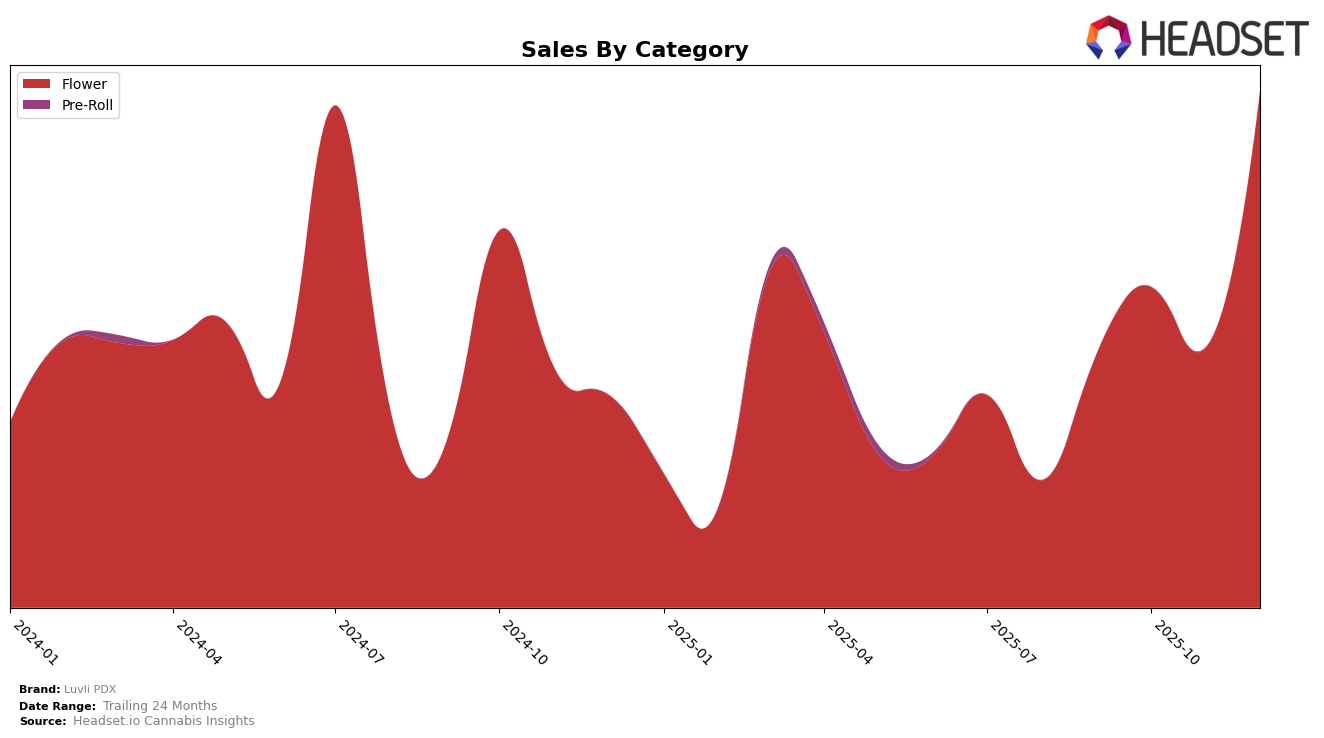

Luvli PDX has shown a significant fluctuation in its performance across the Flower category in Oregon over the last few months of 2025. Noteworthy is their impressive climb in December, where they jumped from being ranked 62nd in November to an impressive 28th position. This leap suggests a strong resurgence in market presence, potentially driven by strategic changes or seasonal demand. However, Luvli PDX was not ranked in the top 30 for September through November, indicating challenges in maintaining a consistent top-tier position during those months. Their sales figures reflect this volatility, with December's sales nearly doubling from November, highlighting a strong finish to the year.

In terms of category rankings, Luvli PDX's performance in the Flower category demonstrates both resilience and the potential for growth. The absence from the top 30 brands in earlier months could be viewed as a setback, yet their December ranking suggests a capacity to capitalize on market opportunities when they arise. This pattern of fluctuation might indicate a highly competitive landscape in Oregon, where consumer preferences or market conditions can rapidly shift brand standings. The data suggests that while Luvli PDX has faced challenges in maintaining steady top-tier performance, their ability to rebound strongly in December is a positive sign for future growth potential.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Luvli PDX has demonstrated a notable upward trajectory in its rankings, moving from 60th place in September 2025 to an impressive 28th place by December 2025. This improvement is indicative of a strong performance, particularly when compared to competitors like Noble Farms, which also saw a significant rise from 58th to 26th place in the same period. Meanwhile, Self Made Farm maintained a relatively stable presence, fluctuating slightly but remaining in the top 30. Garden First experienced a dip from 18th to 29th place, and Derby's Farm held steady around the 27th position. Luvli PDX's sales growth, particularly in December, suggests a strengthening market position, potentially driven by strategic marketing or product differentiation, setting a promising stage for continued competition in the Oregon flower category.

Notable Products

In December 2025, Dogwalker OG (Bulk) emerged as the top-performing product for Luvli PDX, climbing from its previous fifth position in October to first place, with sales reaching 1,470 units. Grandmas Gun Chest (Bulk) maintained a strong performance, consistently holding the second rank from October through December with sales of 1,327 units in December. Leftovers B-buds (Bulk) entered the rankings in December, securing the third position with notable sales figures. Freezer Jam (1g) experienced a slight decline, moving from second in November to fourth in December. Gorilla Glue 4 (Bulk) remained stable, albeit with a downward trend, finishing in fifth place for December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.