Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

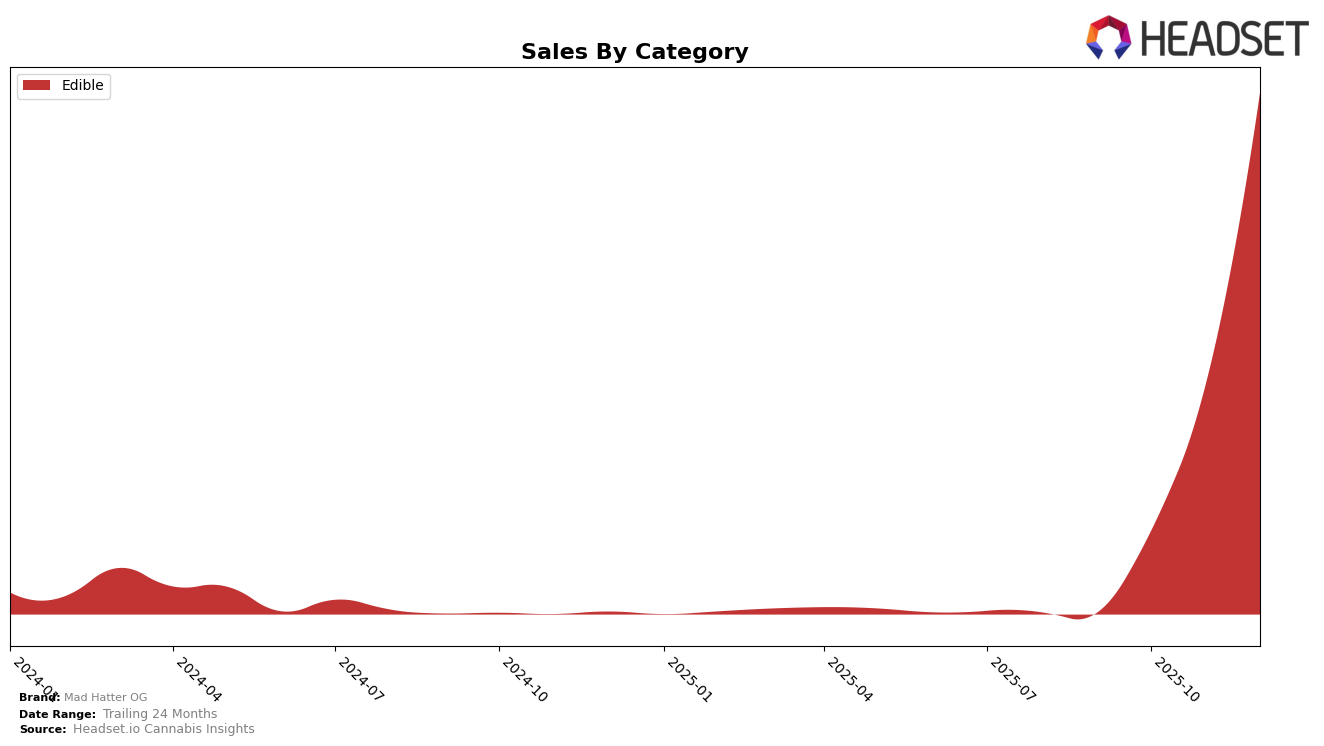

Mad Hatter OG has shown a noteworthy performance in the Edible category in Saskatchewan. After not ranking in the top 30 for September and October 2025, the brand made a significant breakthrough by ranking 12th in November and further climbing to 8th place in December. This upward trajectory indicates a positive reception and growing popularity of Mad Hatter OG's edible products in the region, suggesting successful market penetration strategies or perhaps an effective new product launch that resonated well with consumers.

The brand's sales figures in Saskatchewan reflect this positive trend, with December sales reaching over twice the amount recorded in November. The absence of Mad Hatter OG from the top 30 rankings in the earlier months of September and October highlights a period of growth and adaptation that eventually paid off. This performance suggests a strategic shift or an operational change that allowed the brand to capitalize on market opportunities and consumer preferences, leading to its improved standing in the Edible category by the end of the year.

Competitive Landscape

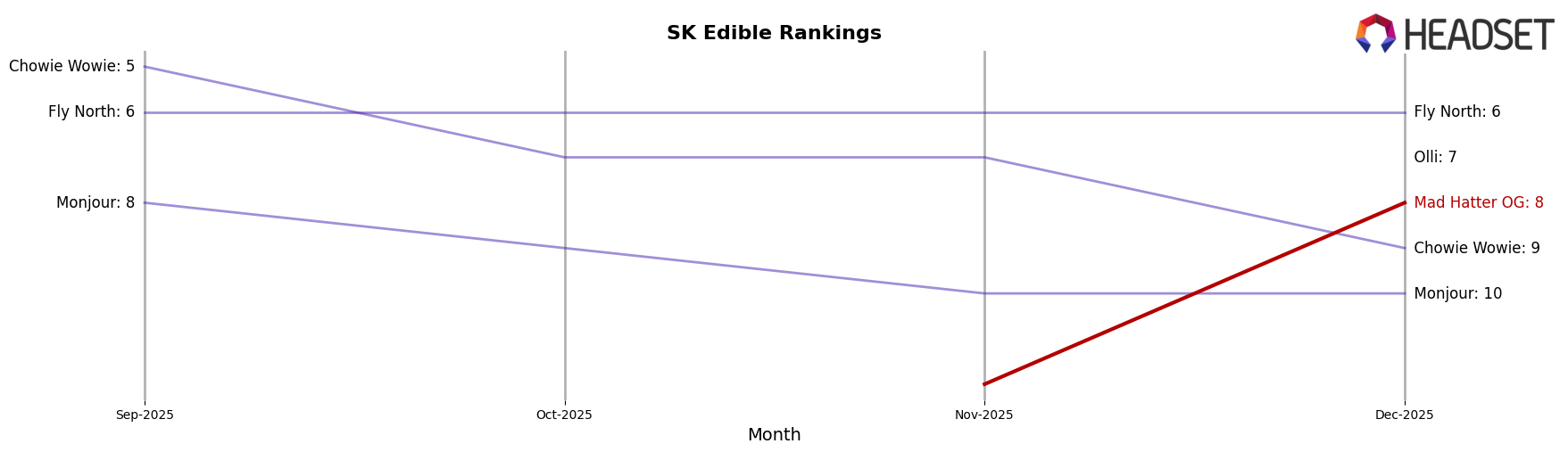

In the Saskatchewan edible cannabis market, Mad Hatter OG has shown a promising upward trajectory, moving from not being in the top 20 to securing the 12th rank in November 2025 and climbing further to 8th in December 2025. This rise is noteworthy, especially when compared to competitors like Chowie Wowie, which saw a decline from 5th to 9th place over the same period, and Monjour, which fluctuated but ended at 10th place in December. Meanwhile, Fly North maintained a consistent 6th position, indicating stable performance. The entrance of Olli directly to the 7th rank in December suggests a competitive landscape. Mad Hatter OG's sales growth from November to December, nearly doubling, highlights its increasing consumer preference and market penetration, positioning it as a rising contender in the Saskatchewan edibles sector.

Notable Products

In December 2025, the top-performing product from Mad Hatter OG was the Delta-8/THC 10:1 Raspberry Lime Zinger Gummies 10-Pack (100mg Delta-8, 10mg THC) in the Edible category, maintaining its number one rank from both October and November. This product achieved significant sales growth, reaching 1336 units sold, up from 604 in November. The Mango Habanero Soft Chews 2-Pack (10mg), also in the Edible category, which was ranked first in September, did not appear in the rankings from October onwards. The consistent performance of the Raspberry Lime Zinger Gummies indicates a strong consumer preference for this product over the months. These rankings highlight the growing popularity and dominance of Delta-8/THC infused edibles in the market.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.