Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

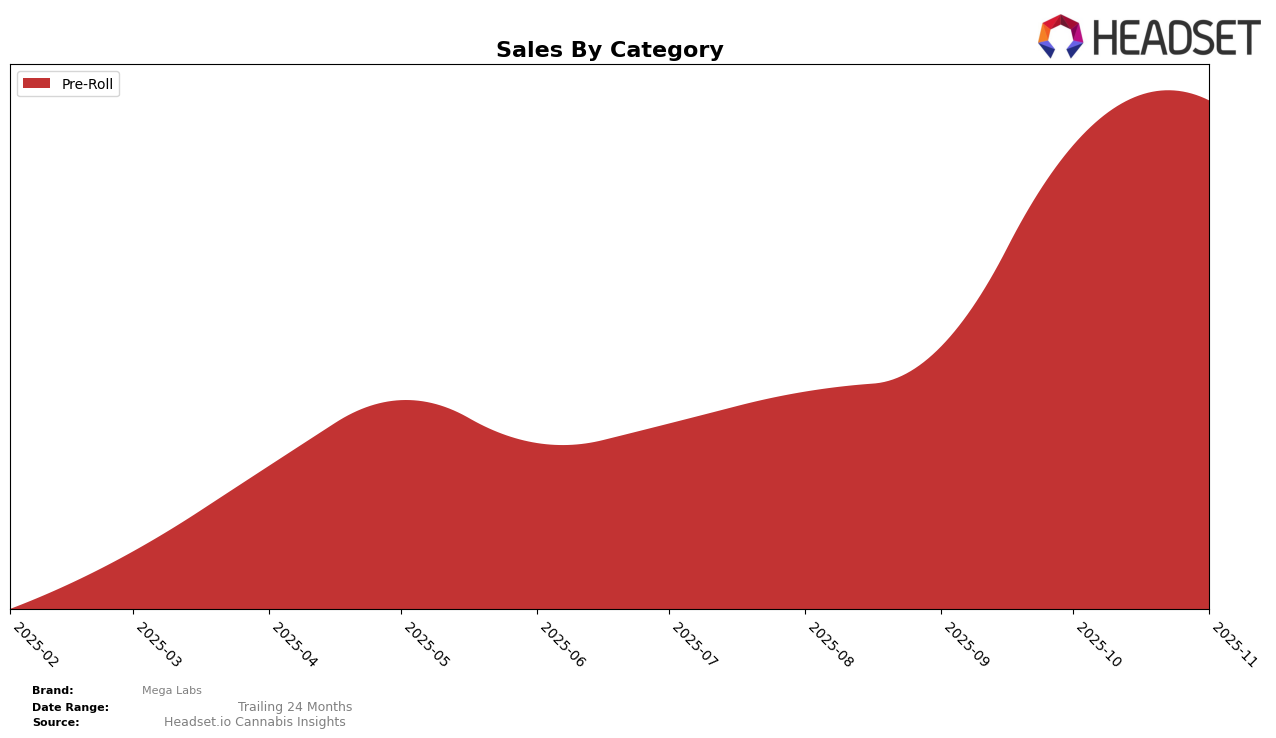

Mega Labs has shown a notable upward trajectory in the pre-roll category in Massachusetts over the past few months. Starting from a rank of 82 in August 2025, the brand has climbed to 29 by November 2025, indicating a significant improvement in their market positioning. This rise is accompanied by a steady increase in sales figures, reflecting their growing popularity among consumers. Such a leap in ranking suggests that Mega Labs is effectively capturing market share and resonating well with the target audience in this state.

While Mega Labs has made impressive strides in Massachusetts, their absence from the top 30 brands in other states or categories could indicate areas for potential growth or challenges they might be facing. The lack of presence in other regions or categories might suggest either a strategic focus on Massachusetts or an opportunity for expansion that has yet to be tapped into. Monitoring their future movements could provide insights into whether they will maintain their upward trend or diversify their market presence across other states and categories.

Competitive Landscape

In the Massachusetts Pre-Roll category, Mega Labs has demonstrated a remarkable upward trajectory in its market position over the past few months. Starting from outside the top 20 in August 2025, Mega Labs climbed to an impressive 29th rank by November 2025, showcasing a significant improvement in its competitive standing. This ascent is particularly notable when compared to other brands like Dogwalkers, which experienced a decline from 14th to 30th place during the same period. Similarly, Cheech & Chong's fluctuated in rankings, ultimately landing at 27th, while Resinate and Trees Co. (TC) maintained relatively stable but lower positions. The consistent increase in Mega Labs' sales figures, coupled with its rising rank, indicates a growing consumer preference and market penetration, setting a positive trend for the brand's future performance in the Massachusetts Pre-Roll market.

Notable Products

In November 2025, the top-performing product from Mega Labs was Waves- Blue Raspberry Infused Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place ranking for four consecutive months with a notable sales figure of 5465 units. Waves- Grape Soda Infused Pre-Roll (1g) made a significant debut, securing the second position with impressive sales. Wavez - Green Monstah Infused Pre-Roll (1g) also entered the rankings for the first time, achieving third place. Cotton Candy Infused Pre-Roll (1g) reappeared in the rankings at fourth place, having last been seen in August. Wavez - Apples & Bananas Infused Pre-Roll (1g) sustained its fifth-place position from October, indicating consistent performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.