Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

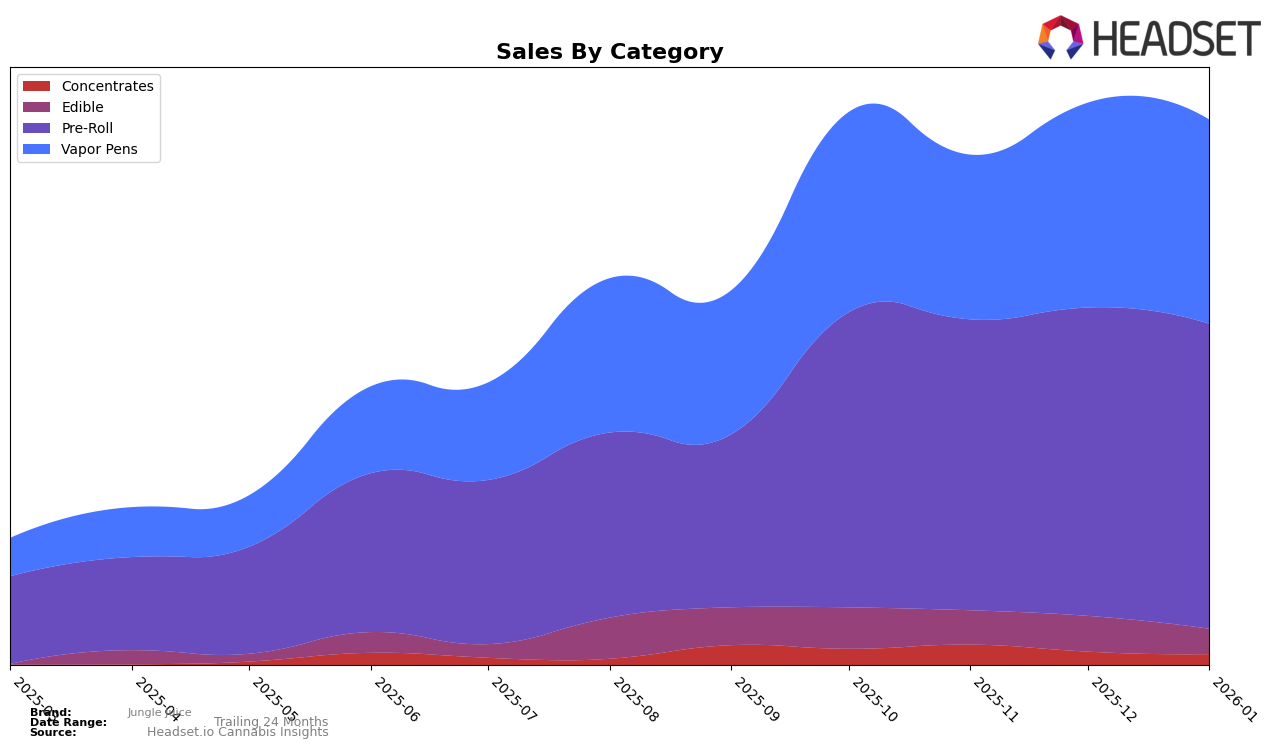

Jungle Juice has demonstrated varied performance across different product categories in Michigan. In the Pre-Roll category, the brand has consistently maintained a strong position, fluctuating between the 9th and 10th ranks over the past four months. This stability suggests a strong consumer preference and a solid market presence. However, in the Concentrates category, Jungle Juice has not made it into the top 30, indicating potential challenges in capturing market share. Despite an increase in sales from October to November, the subsequent decline in both sales and rank highlights a struggle to sustain momentum in this segment.

In the Vapor Pens category, Jungle Juice's performance has been relatively stable, with ranks ranging from 14th to 20th. This suggests a moderate but consistent demand for their products in this category. Meanwhile, the Edibles category shows a slight downward trend, with the brand slipping from 42nd to 50th rank over the four-month period. This decline could be attributed to increased competition or changing consumer preferences. While Jungle Juice's sales figures provide some insights, the brand's absence from the top 30 in certain categories indicates areas where they might need to focus on strategic improvements to enhance their competitive edge in the Michigan market.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll category, Jungle Juice has shown resilience and adaptability, maintaining a steady presence in the top 10 rankings over the past few months. Despite fierce competition, Jungle Juice improved its rank from 10th in October 2025 to 9th in November 2025, though it briefly slipped back to 10th in December before regaining the 9th spot in January 2026. This fluctuation in rank is indicative of a highly competitive market, with brands like Pro Gro and STIIIZY closely trailing or leading in sales. Notably, Glorious Cannabis Co. consistently outperformed others, maintaining a top 7 position, which suggests a strong brand presence. Meanwhile, Simpler Daze held steady at 8th place, indicating stable sales performance. Jungle Juice's ability to regain its rank in January, despite the competitive pressure, highlights its potential for growth and the effectiveness of its marketing strategies in the Michigan market.

Notable Products

In January 2026, Jungle Juice's top-performing product was Runtz Pre-Roll (1g), which secured the number one rank with sales reaching 12,439 units. Sour Tangie Pre-Roll (1g) climbed back to the second position from third in December, showing a significant increase in sales to 11,755 units. Gorilla Glue Pre-Roll (1g) entered the ranks at third place, demonstrating a strong performance compared to previous months where it wasn't ranked. Wedding Cake Pre-Roll (1g) rose to the fourth position after being unranked in December, while Rainbow Belts Pre-Roll (1g) maintained a steady presence, ranking fifth. The January rankings reflect a dynamic shift from previous months, with notable sales growth across the board.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.