Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

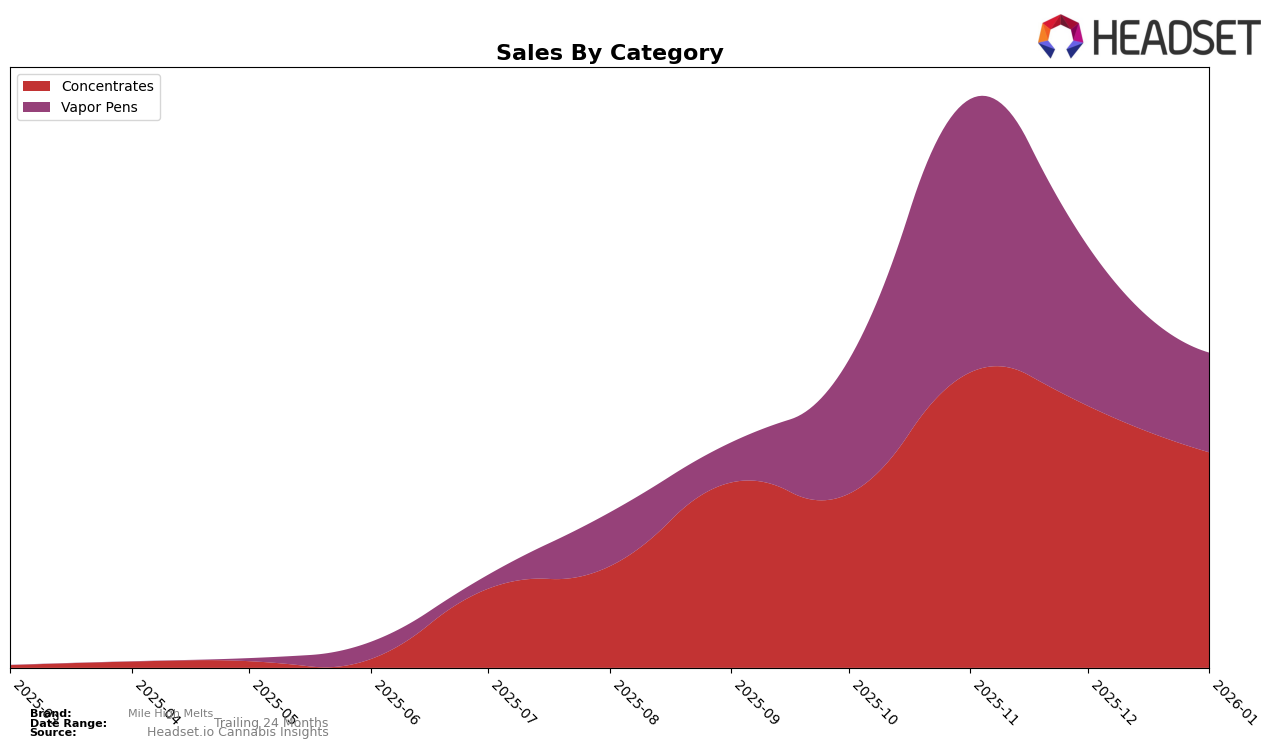

Mile High Melts has shown a fluctuating performance in the Illinois concentrates category over the past few months. The brand experienced a notable improvement from October to November 2025, climbing from the 27th to the 22nd position. However, this momentum did not sustain, as it fell back to the 27th position by January 2026. Despite these ranking shifts, the sales figures highlight a significant increase in November, indicating a strong market presence during that period. This suggests that while the brand can capture market attention, maintaining a consistent top-tier position remains a challenge.

In the vapor pens category within Illinois, Mile High Melts did not manage to break into the top 30, as evidenced by its rankings ranging from 62nd to 77th place. The brand's peak in November 2025, reaching the 62nd position, was followed by a decline in subsequent months. This pattern of performance suggests that while Mile High Melts has the potential to increase its market share, particularly in the concentrates category, it faces significant competition in vapor pens. The brand's ability to leverage its strengths in one category might be key to enhancing its overall market position.

Competitive Landscape

In the Illinois concentrates market, Mile High Melts experienced notable fluctuations in its ranking from October 2025 to January 2026, reflecting a dynamic competitive landscape. Initially ranked 27th in October, Mile High Melts improved significantly to 22nd in November and maintained this position in December, before dropping back to 27th in January. This volatility suggests a highly competitive environment where brands like nuEra and Avexia consistently outperformed Mile High Melts, with nuEra starting at 18th and ending at 25th, and Avexia maintaining a stable position around 28th. Despite Mile High Melts' temporary rise in rank during November and December, its sales trajectory mirrored its rank changes, indicating that while it can capture market share, sustaining it against competitors like Amber, which remained relatively stable around the 25th position, remains a challenge. These insights highlight the importance for Mile High Melts to strategize effectively to maintain and improve its competitive position in the Illinois concentrates market.

Notable Products

In January 2026, the top-performing product for Mile High Melts was Pomelo Fruit Snax Live Rosin Disposable (0.5g) in the Vapor Pens category, maintaining its first-place ranking from October and November 2025, with sales of 155 units. Following closely in second place was Pomelo Fruit Snax Live Rosin (1g) in the Concentrates category, making a notable entry into the rankings. Biscotti Sundae Cold Cure Live Rosin (1g), also in the Concentrates category, climbed to third place, having previously ranked fifth in December 2025. Super Boof Live Rosin Jam (1g) dropped from second place in December 2025 to fourth place in January 2026. Pablo's Revenge #34 Cold Cure Live Rosin (1g) made its debut in the rankings, securing the fourth spot in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.