Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

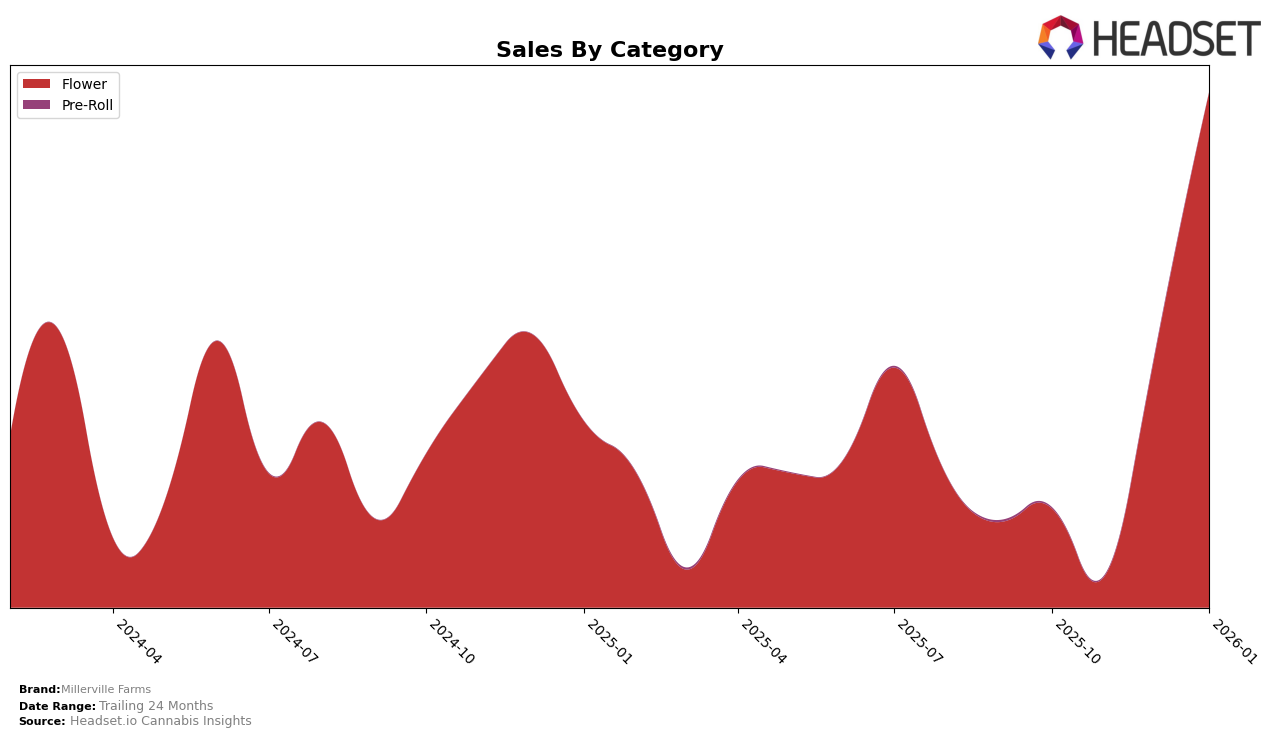

Millerville Farms has experienced some notable shifts in its market presence, particularly in the Oregon cannabis market. While the brand was absent from the top 30 rankings in the Flower category for the months of October, November, and December 2025, it made a significant leap to 17th position by January 2026. This upward movement suggests a strategic adjustment or possibly a successful marketing campaign that resonated with consumers. Such a jump in ranking is indicative of a positive reception and growing brand strength in the region.

The sales figures for Millerville Farms in Oregon also reflect this upward trajectory, with a substantial increase from December 2025 to January 2026. The brand's ability to break into the top 20 after not ranking in the previous months highlights a potential turnaround or a new product launch that captured consumer interest. However, the absence from the rankings in the earlier months could point to challenges or competition within the Flower category that Millerville Farms had to overcome. This trend of fluctuating rankings and sales performance indicates a dynamic market environment that the brand is navigating with varying degrees of success.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Millerville Farms has demonstrated a significant upward trajectory in recent months. After not being in the top 20 brands in October and November 2025, Millerville Farms surged to rank 57 in December 2025 and further improved to rank 17 by January 2026. This rise coincides with a notable increase in sales, indicating a successful strategy in capturing market share. In comparison, Noble Farms also showed a remarkable climb from rank 99 in October 2025 to rank 19 by January 2026, suggesting a competitive push in the market. Meanwhile, Mother Magnolia Medicinals maintained a steady presence, consistently ranking 16 in December 2025 and January 2026, while Herbal Dynamics improved from rank 51 in October 2025 to rank 18 in January 2026. Hecate Gardens also showed strong performance, moving from rank 38 in October 2025 to rank 15 in January 2026, boasting the highest sales among the competitors. Millerville Farms' recent gains in rank and sales suggest a growing consumer preference and effective market positioning against these formidable competitors.

Notable Products

In January 2026, Gush Mints (28g) emerged as the top-performing product for Millerville Farms, with sales reaching 3606 units. Blueberry Muffins (Bulk) maintained its strong position, holding steady at rank 2 since December 2025. Pressure (1g) also retained its rank 3 position from the previous month, indicating consistent demand. Lava Cake (Bulk) improved its ranking to 4, up from 5 in December, showcasing a positive sales trend. Jager (Bulk) re-entered the top 5, moving from an unranked position in December to rank 5 in January, highlighting its regained popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.