Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

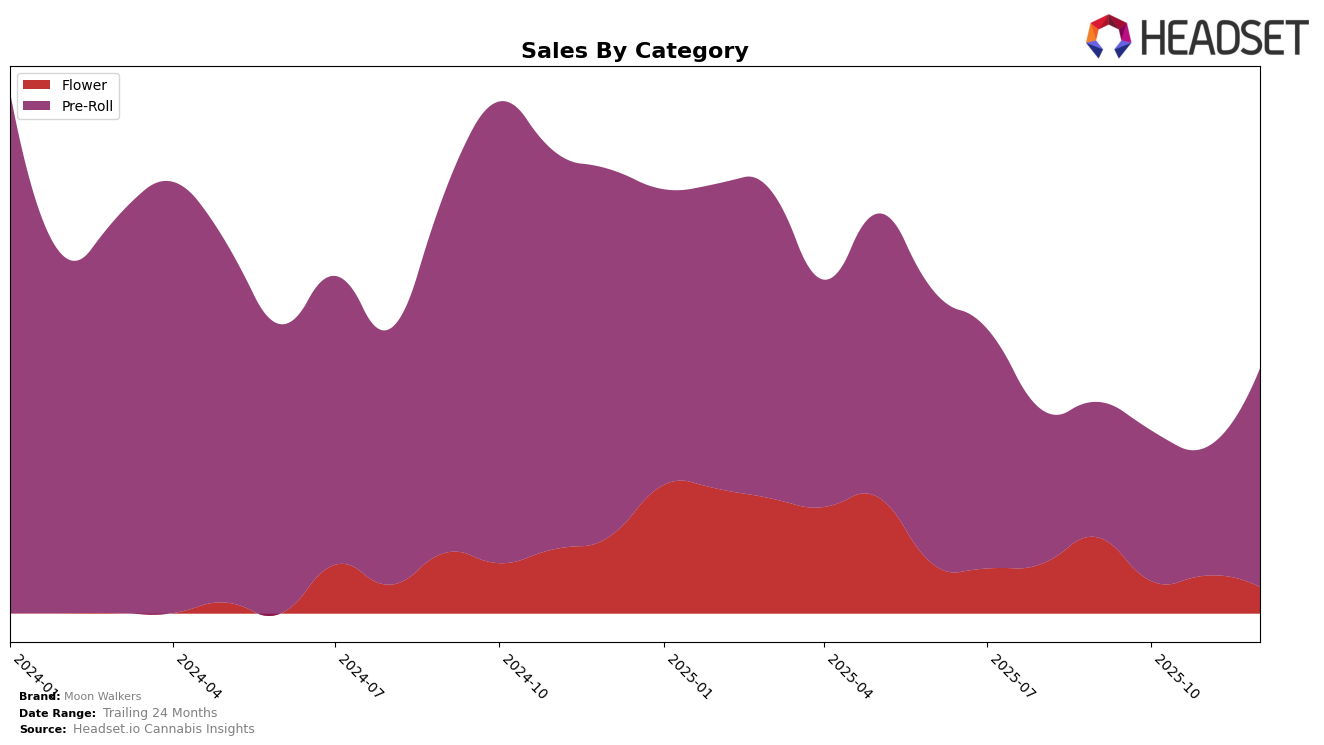

Moon Walkers has demonstrated varied performance across different categories within the state of Illinois. In the Flower category, the brand has experienced a downward trend, with its ranking slipping from 66th in September 2025 to 87th by December 2025. This decline indicates potential challenges in maintaining competitiveness or consumer interest in this category. Conversely, the Pre-Roll category tells a more promising story, where Moon Walkers improved its standing from 41st in September to breaking into the top 30 by December, securing the 30th position. This upward movement in Pre-Roll rankings suggests a growing consumer preference or effective brand strategies in this segment.

The contrasting performance in these two categories highlights the brand's strengths and weaknesses within Illinois. While the Flower category may require strategic adjustments to regain momentum, the Pre-Roll category's success could serve as a model or focus for future growth. Notably, the Pre-Roll category not only saw Moon Walkers maintain a consistent presence in the rankings but also achieve a significant sales increase in December. This dual performance across categories offers insights into consumer behavior and potential areas for strategic investment or reevaluation for Moon Walkers.

Competitive Landscape

In the competitive landscape of the Illinois pre-roll category, Moon Walkers has demonstrated a notable upward trajectory in the rankings from September to December 2025. Starting at rank 41 in September, Moon Walkers climbed to rank 30 by December, indicating a significant improvement in market positioning. This rise is particularly impressive when compared to competitors such as Binske, which saw a decline from rank 20 to 31 over the same period, and Legacy Cannabis (IL), which dropped from rank 24 to 32. Meanwhile, Verano maintained a relatively stable position, fluctuating slightly between ranks 25 and 27. The sales trends further highlight Moon Walkers' growth, as it managed to increase its sales from October to December, contrasting with the declining sales of Binske and Legacy Cannabis (IL). This positive momentum suggests that Moon Walkers is effectively capturing market share and enhancing its brand appeal in the Illinois pre-roll sector.

Notable Products

In December 2025, the top-performing product for Moon Walkers was the Honey Bun Live Diamond Rosin Infused Blunt (1g), reclaiming its top spot after a dip in November, with notable sales of 978 units. The Purple Pineapple Liquid Diamonds Rosin Infused Pre-Roll (1g) achieved the second position, showing a significant rise from its previous fourth rank in October. The Lemon Cherry Gelato Liquid Diamonds Infused Pre-Roll (1g) entered the rankings for the first time, securing the third position. The Bogeyman Live Diamonds Rosin Infused Blunt (1g) slipped to fourth place from its previous third rank in November. Finally, the Mandarin Cookies Infused Blunt (1g) made its debut on the list at fifth place in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.