Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

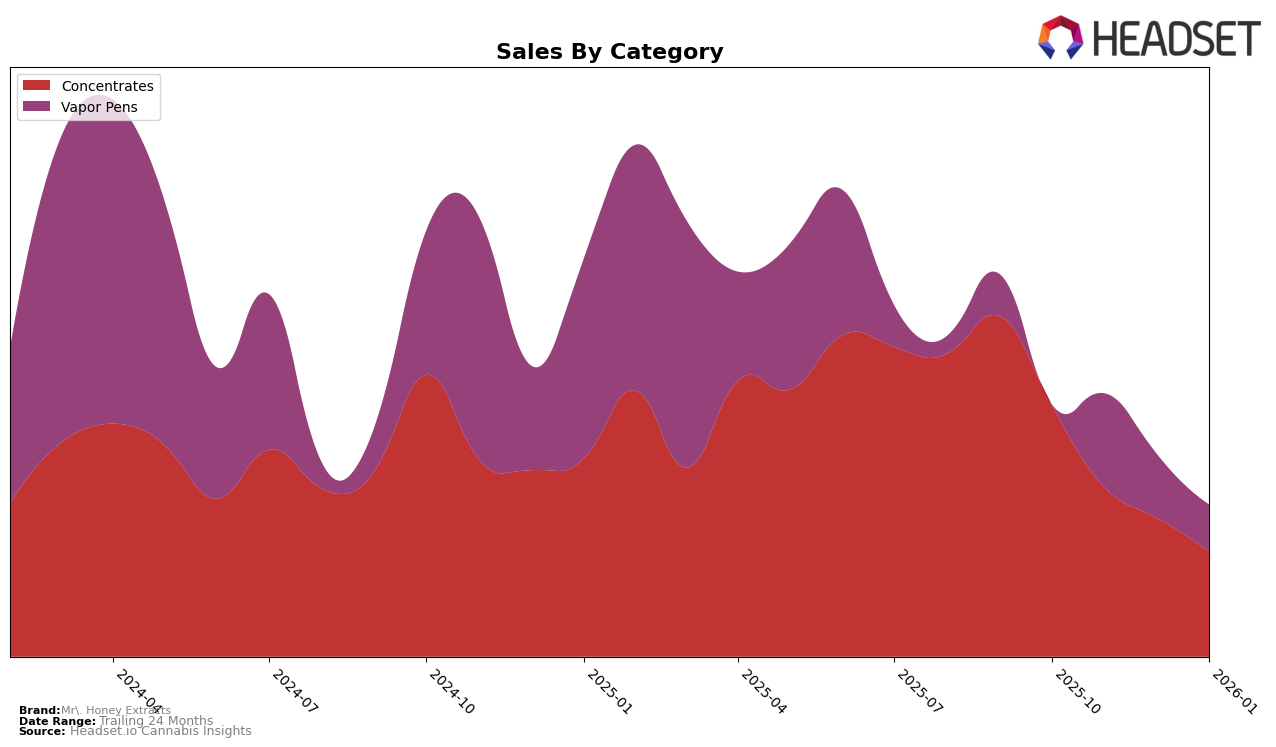

Mr. Honey Extracts has shown a notable performance in the Arizona concentrates market over the past few months. Ranking 5th in October 2025, the brand experienced a gradual decline, moving to 6th in November, 9th in December, and finally 10th in January 2026. This downward trend in ranking is mirrored by a consistent decrease in sales, which might be a point of concern for the brand's strategists. Despite this decline, maintaining a position within the top 10 suggests a strong market presence and consumer base in the concentrates category, which could be leveraged for strategic adjustments moving forward.

In contrast, Mr. Honey Extracts' performance in the vapor pens category in Arizona shows a different trajectory. Starting at 42nd in October, the brand improved its position to 33rd in November and 32nd in December, before slightly slipping back to 33rd in January 2026. This upward movement, although modest, indicates a positive reception in the vapor pens category, suggesting potential for growth if the brand can capitalize on this momentum. It's important to note that while they did not break into the top 30, the consistent improvement highlights a growing interest in their vapor pen products, which could be an opportunity for further market penetration.

Competitive Landscape

In the competitive landscape of the Arizona concentrates market, Mr. Honey Extracts has experienced a notable shift in its ranking over the past few months. Initially positioned at a strong 5th place in October 2025, the brand has seen a gradual decline, slipping to 10th place by January 2026. This downward trend in rank correlates with a decrease in sales, suggesting potential challenges in maintaining market share. Meanwhile, competitors like iLava have shown consistent performance, climbing from 8th to 6th place before settling back at 8th, indicating stable consumer interest. 22Red has made a significant leap from outside the top 20 to 13th place, reflecting a successful strategy in capturing market attention. Additionally, Curaleaf and Tru Infusion have maintained relatively stable positions, with Tru Infusion even improving slightly. These dynamics highlight the competitive pressures Mr. Honey Extracts faces and underscore the importance of strategic adjustments to regain its previous standing.

Notable Products

In January 2026, Mr. Honey Extracts saw Honey Banana Budder (1g) leading the sales as the top product with a significant sales figure of 763 units. Jack Widow Live Resin Disposable (1g) followed closely, securing the second position, while Strawberry Diesel Live Resin Disposable (1g) took the third spot. Notably, Purple Punch Cured Budder (1g) and Black Razzberry Sugar (1g) rounded out the top five, ranking fourth and fifth respectively. Compared to previous months, these products have shown strong performance, with Honey Banana Budder (1g) making a remarkable debut at the top. The consistent ranking of Vapor Pens in the top three highlights a growing consumer preference for this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.