Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

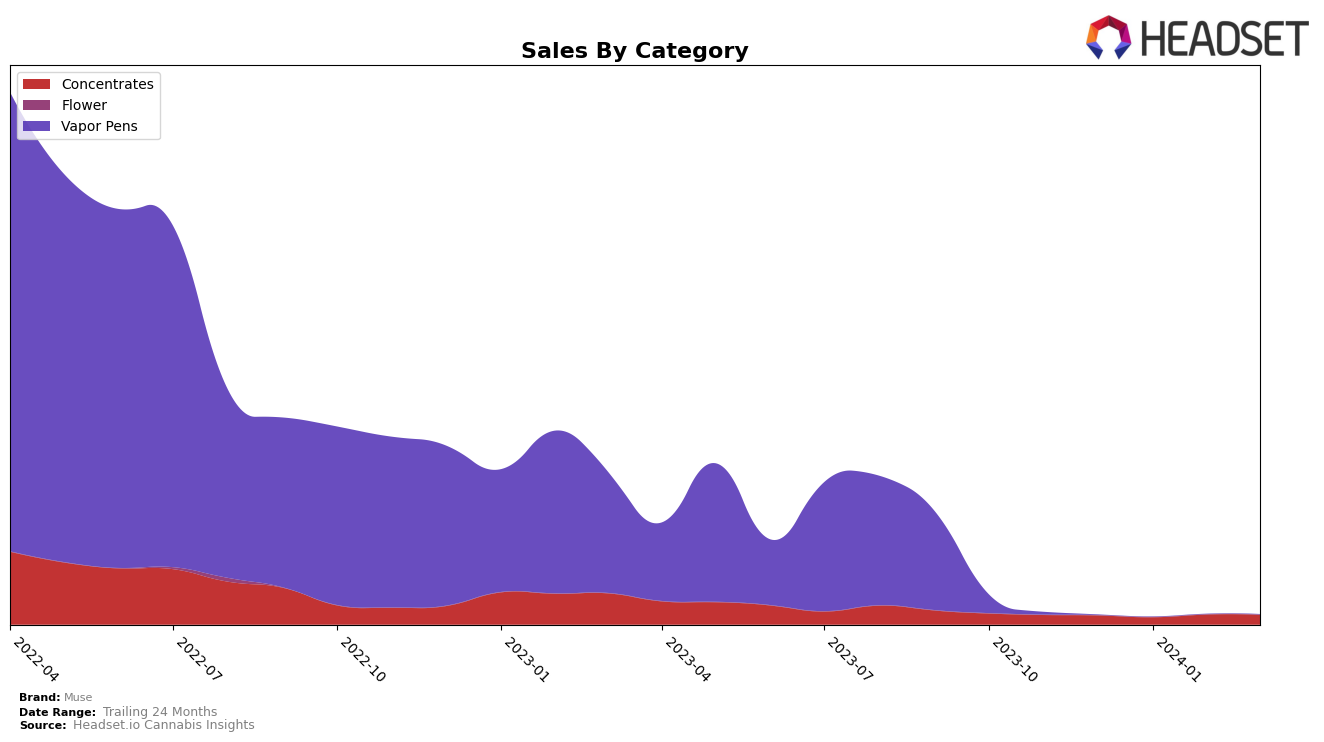

In the competitive cannabis market of Maryland, the brand Muse has shown a notable presence in the Concentrates category, maintaining its position within the top 30 brands over the recent months. From December 2023 to March 2024, Muse experienced a slight fluctuation in rankings, moving from 24th to 23rd place, despite a dip in January to 25th. This resilience in ranking is particularly commendable given the minor setback in January 2024, where sales dropped to 7,359 from December 2023's 9,237, before rebounding significantly in February and March. The ability of Muse to recover and even improve its sales and rankings in such a competitive category highlights a potentially strong market demand and consumer loyalty to the brand within the state of Maryland.

However, Muse's performance in the Vapor Pens category tells a different story. Initially ranked at 51st in December 2023, Muse did not make it into the top 30 brands for the following months up to March 2024. This absence from the top rankings could be interpreted as a significant challenge for Muse, indicating either a highly competitive market for vapor pens in Maryland or potential areas for improvement in Muse's product offerings or marketing strategies in this category. The initial sales figure of 186 in December 2023, while modest, suggests there was some market presence, but not enough to sustain or improve its ranking in the subsequent months. This contrast between the two categories underlines the importance of strategic focus and adaptation to consumer preferences and market dynamics in different product segments.

Competitive Landscape

In the competitive landscape of the concentrates category in Maryland, Muse has experienced fluctuations in its market position, indicating a challenging environment. Initially ranked 24th in December 2023, Muse saw a slight decline to 25th in January 2024, before stabilizing at 25th in February and then slightly improving to 23rd in March 2024. This trajectory suggests Muse is navigating a competitive market with resilience, despite not breaking into the top 20. Competitors like gLeaf (Green Leaf Medical) and Equity Extracts have shown varying degrees of market movement, with gLeaf experiencing a decline out of the top 20 by February and March, while Equity Extracts made a notable jump into the 22nd spot by March after not ranking in the top 30 in December. Other brands such as Strane and Kind Tree Cannabis also fluctuated, but remained outside the top 20, similar to Muse. These dynamics underscore the competitive nature of Maryland's concentrate market, where Muse's slight improvement in rank amidst competitors' varied performances highlights its potential for growth and the importance of strategic positioning.

Notable Products

In March 2024, Muse's top-performing product was Hippie Crasher #16 Live Budder (1g) from the Concentrates category, maintaining its number one rank from January and February with sales reaching 165.0 units. Earthquake Live Resin Budder (1g) took the second spot, an improvement from its February rank, despite a significant drop in sales to 93.0 units from its previous high. The third position was secured by Hippie Crasher Live Resin Budder (1g), showing a steady rise in its ranking from fourth in February. Super Lemon G Live Budder (1g) was ranked fourth, consistent with its February performance, indicating stable consumer preference. Lastly, Jet Fuel Live Budder (1g) made it to the top five, despite not being ranked in February, showcasing a potential resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.