Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

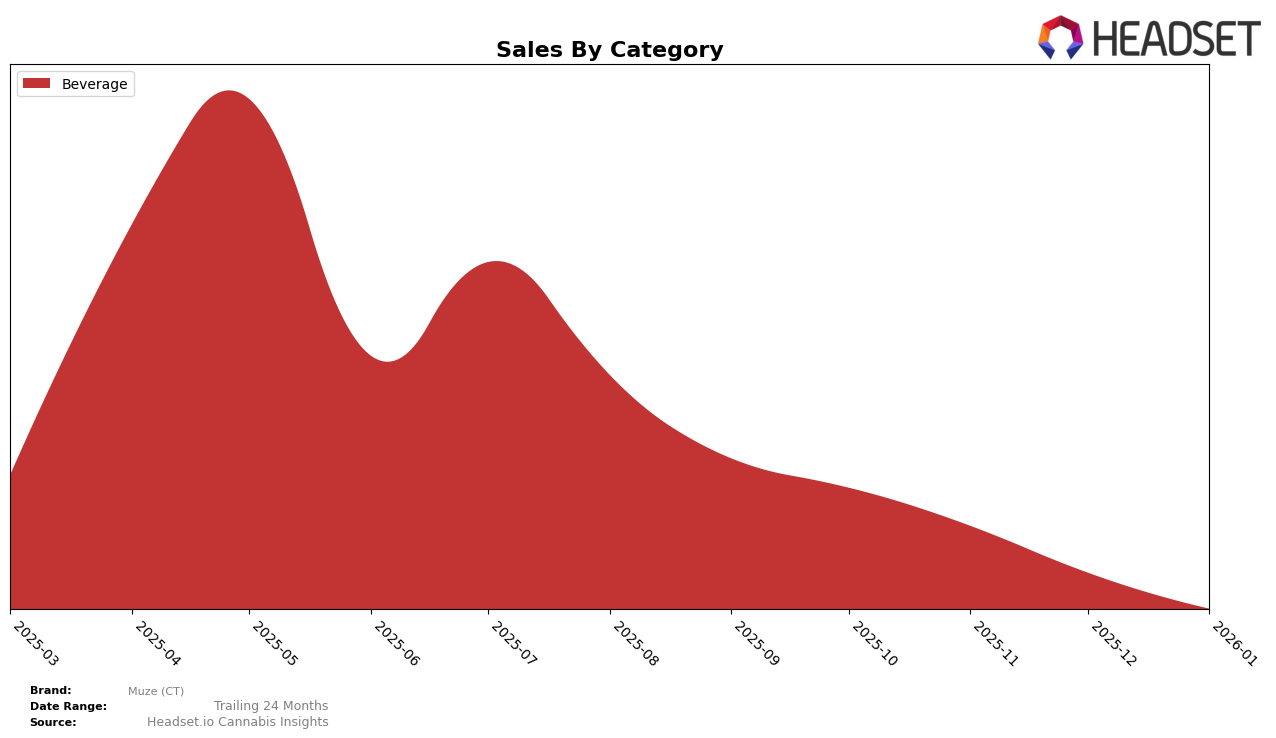

In the state of Connecticut, Muze (CT) has shown consistent performance in the Beverage category, maintaining a stable position in the top five over the last four months. Starting from a rank of 3 in October 2025, the brand experienced a slight drop to rank 4 by November, which it maintained through January 2026. Despite this minor shift in ranking, it's notable that Muze (CT) has managed to remain a strong contender within the top echelon of the market. This steady ranking suggests a robust presence and a loyal customer base, even as the market dynamics evolved over the months.

However, it's important to highlight that Muze (CT) did not make it into the top 30 brands in other states or categories, which could be seen as a limitation in their market reach beyond Connecticut. This indicates potential areas for growth and expansion if the brand aims to enhance its footprint across different regions and product categories. The sales figures for Muze (CT) in the Beverage category also reflect a downward trend, with a noticeable decrease from October 2025 to January 2026. This decline in sales might suggest increasing competition or changing consumer preferences, which could be critical factors for the brand to address moving forward.

```Competitive Landscape

In the competitive landscape of the beverage category in Connecticut, Muze (CT) has experienced a notable shift in its market position over recent months. Despite maintaining a consistent rank of 4th place from November 2025 to January 2026, Muze (CT) has faced declining sales, indicating potential challenges in maintaining its market share. This trend is particularly significant when compared to competitors like Soundview, which has shown a strong performance, consistently ranking in the top three and even securing the top spot in October 2025. Meanwhile, CANN Social Tonics has also been a formidable competitor, frequently oscillating between the 2nd and 3rd positions with robust sales figures. The absence of Zero Proof from the rankings in December 2025 and January 2026 suggests a potential opportunity for Muze (CT) to capture some of its market share, although the brand must address its declining sales trend to capitalize on this. Additionally, Wynk has maintained a steady presence in the rankings, albeit with lower sales figures, indicating a stable but less competitive threat. Overall, Muze (CT) must strategize to enhance its market appeal and sales performance to improve its competitive standing in the Connecticut beverage market.

Notable Products

In January 2026, the top-performing product from Muze (CT) was the CBG/THC 5:1 Raspberry Lime Seltzer, which maintained its leading position with sales of 1023 units. The CBG/THC 5:1 Lemon Seltzer climbed to the second spot with a notable increase in sales compared to previous months. The CBG/THC 5:1 Black Cherry Seltzer, previously ranked first in December, fell to third place in January. Meanwhile, the CBG/THC 5:1 Peach Seltzer held steady at fourth place, showing consistent performance. The CBG/THC 5:1 Pure Seltzer remained in fifth place, reflecting its stable but lower sales figures compared to the other products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.