Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

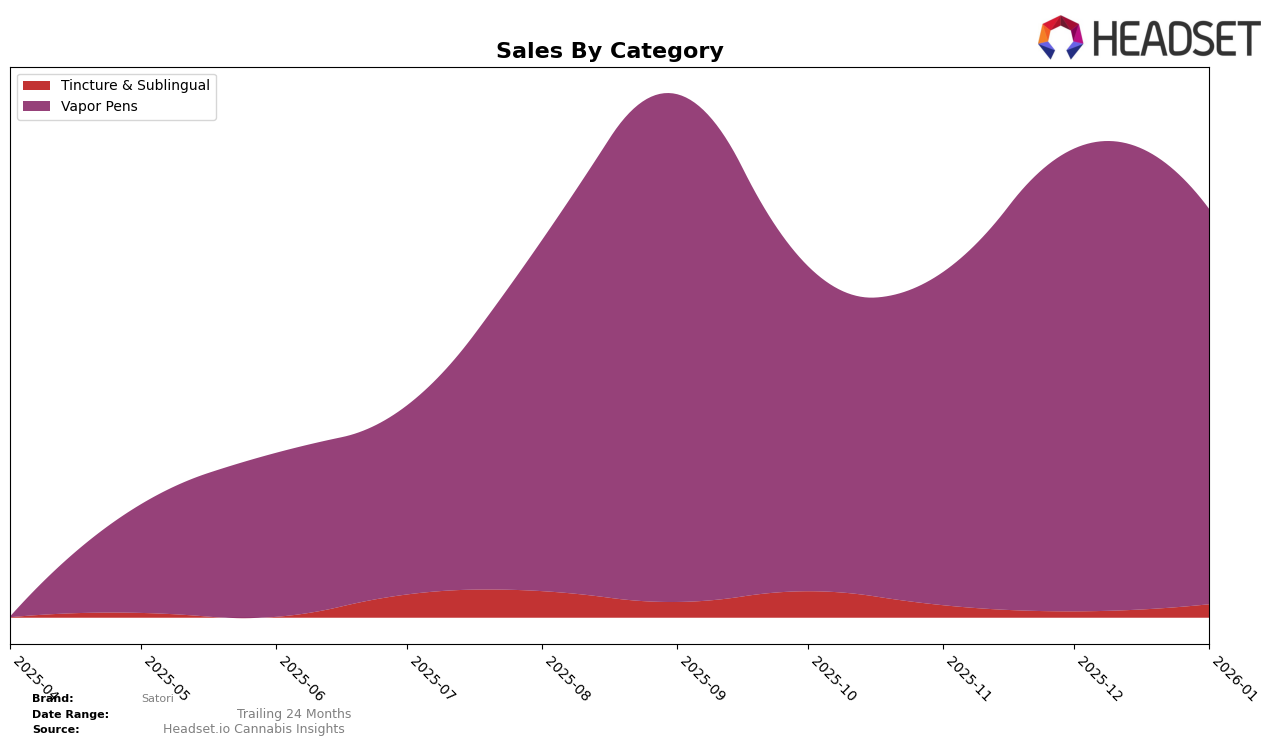

In examining the performance of Satori across various categories and states, notable trends emerge in the Vapor Pens category within New York. Satori's rank in this category has shown a subtle yet consistent upward trajectory from October 2025 to January 2026, moving from 67th to 64th position. This improvement, albeit slow, suggests a strengthening presence in a competitive market. It's important to note that while Satori has not yet broken into the top 30 brands in New York for Vapor Pens, the gradual increase in rank indicates potential for further growth if current trends continue.

Despite not being in the top tier of rankings, Satori's sales figures in New York's Vapor Pens category reflect a significant spike in December 2025, followed by a slight decrease in January 2026. This fluctuation in sales could be indicative of seasonal purchasing patterns or promotional activities that temporarily boosted sales. While the brand's rank did not see a dramatic leap, the sales data suggests that there is consumer interest that could be harnessed for future growth. Observing these patterns over a longer period could provide more insights into the brand's potential for climbing higher in the rankings.

```Competitive Landscape

In the competitive landscape of vapor pens in New York, Satori has shown a promising upward trajectory in recent months. From October 2025 to January 2026, Satori improved its rank from 67th to 64th, indicating a positive trend in market presence. This improvement is notable when compared to competitors like Flav, which saw a decline from 44th to 66th during the same period, and Revert Cannabis New York, which also experienced a drop from 55th to 62nd. Interestingly, 1937 made a significant leap from 90th to 63rd, surpassing Satori in January 2026. Despite this, Satori's sales have shown resilience, with a notable increase in December 2025, suggesting a strengthening consumer base. Meanwhile, Heady Tree demonstrated volatility, with ranks fluctuating from 75th to 57th, then back to 65th, reflecting inconsistent market performance. Overall, Satori's steady climb in rank and sales growth positions it as a brand to watch in the New York vapor pen market.

Notable Products

In January 2026, the top-performing product from Satori was the Sour Diesel Distillate Disposable (1g), maintaining its number one rank for the second consecutive month with sales of 414 units. The Lemon Cookie Distillate Disposable (1g) followed closely, climbing back to the second position from fourth in November, with notable sales growth to 408 units. Starburst OG Distillate Disposable (1g) secured the third spot, showing a consistent upward trend from its fourth rank in December. The GMO Distillate Disposable (1g) dropped to fourth place despite steady sales figures. A new entry, Berry Delight Rosin Disposable (0.5g), debuted in fifth place, indicating potential for future growth in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.