Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

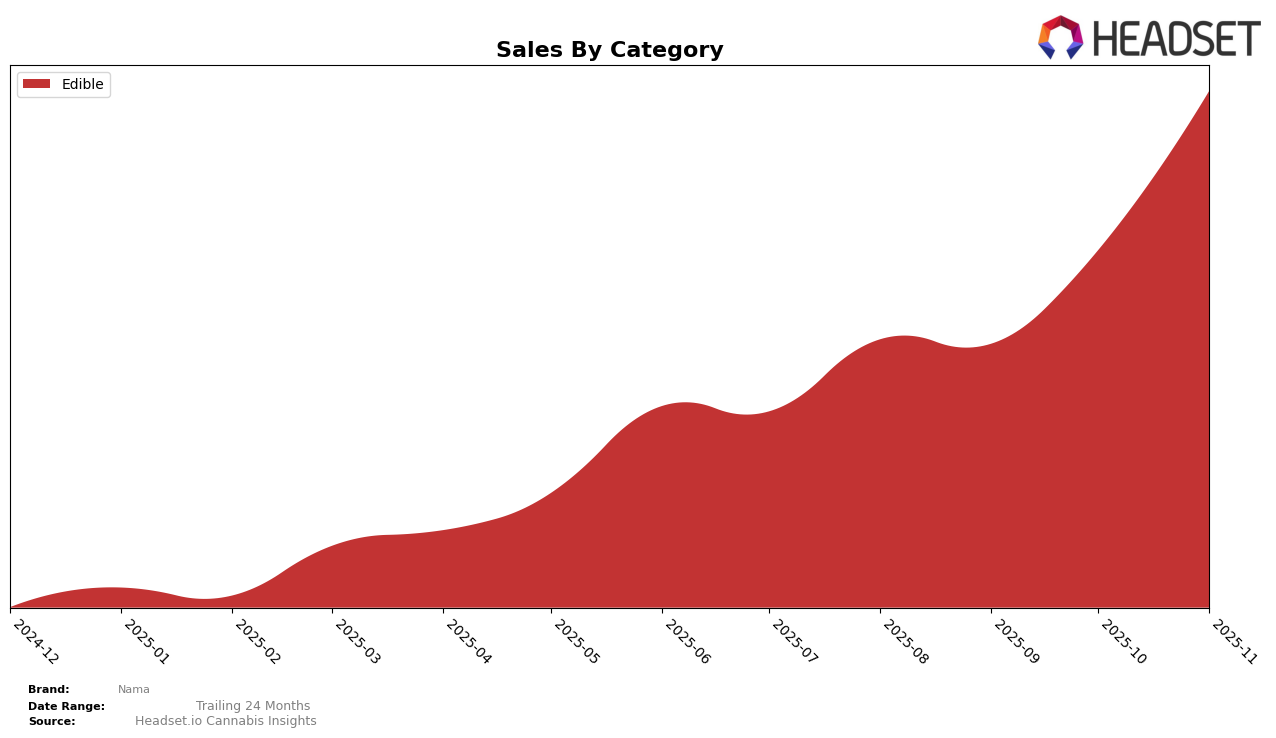

In the state of New Jersey, Nama has shown a gradual improvement in the Edible category. Despite not being in the top 30 brands in August and September 2025, Nama climbed to a rank of 51 in October and further improved to 48 by November. This upward movement is indicative of a positive trend, suggesting that the brand is gaining traction in the New Jersey market. The sales figures support this trend, with a notable increase from $16,871 in October to $19,429 in November. Such progress, while modest, highlights Nama's potential for further growth in this state.

Conversely, in New York, Nama has demonstrated a more consistent presence in the Edible category, maintaining a steady climb in rankings. Starting from a rank of 38 in August 2025, Nama improved to 33 in September, 31 in October, and finally reached the 30th position by November. This consistent upward movement in rankings is complemented by a substantial increase in sales, particularly evident from the jump to $90,678 in November. Nama's performance in New York suggests a strong foothold in the market, potentially setting the stage for continued success in the coming months.

Competitive Landscape

In the competitive landscape of the Edible category in New York, Nama has demonstrated a consistent upward trajectory in its rankings over the past few months. Starting from the 38th position in August 2025, Nama has climbed to the 30th rank by November 2025, indicating a positive trend in market presence and consumer preference. This improvement in rank is complemented by a notable increase in sales, particularly in October and November. In contrast, Kiva Chocolate has seen a decline in its ranking, dropping from 26th to 33rd, alongside a decrease in sales, which could suggest a shift in consumer loyalty or market strategy challenges. Meanwhile, Nyce has shown a remarkable rise, moving from 47th to 28th, potentially posing a competitive threat to Nama if this trend continues. The Green Lady Dispensary maintains a relatively stable position, hovering around the 27th to 29th ranks, while Spacebuds Moonrocks remains steady at the 35th rank. These dynamics suggest that while Nama is gaining momentum, it must continue to innovate and adapt to maintain its competitive edge in the evolving New York edible market.

Notable Products

In November 2025, Nama's top-performing product was Euphoria - Fresh Strawberry Gummies 2-Pack (100mg), maintaining its first-place ranking from the previous two months with impressive sales of 801 units. Euphoria - Sour Berry Gummies 2-Pack (100mg) rose to the second position, climbing from fifth place in October, and showing a significant increase in sales. The CBD/CBN/THC 1:1:1 Sleep Plus Midnight Berries Gummies 20-Pack (100mg CBN, 100mg CBD, 100mg THC) held steady in the third position, consistent with its ranking in September. Relax - CBD/CBC/THC 25:5:1 Plus Golden Peach Gummies 20-Pack (500mg CBD, 20mg CBC, 100mg THC) remained in fourth place, mirroring its performance since its entry into the rankings in October. Lastly, Euphoria - Super Lemon Haze x Blood Orange Live Resin Gummies 2-Pack (100mg) debuted in fifth place, signaling a strong entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.