Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

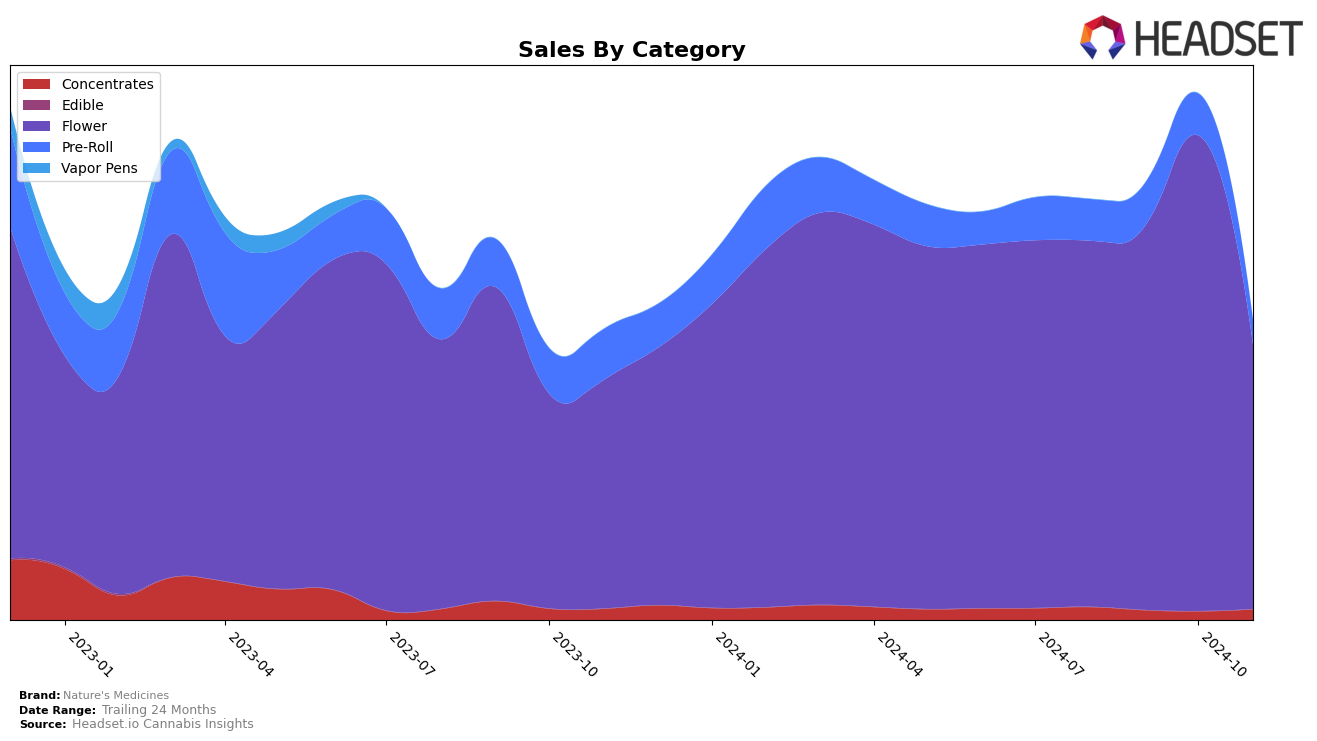

In Michigan, Nature's Medicines has shown varied performance across different product categories. Notably, in the Flower category, the brand demonstrated strong growth, climbing from the 21st position in August to the 14th position by October, before experiencing a drop to 28th in November. This fluctuation suggests a competitive market landscape, with Nature's Medicines needing to maintain its momentum to remain in the top tier. In contrast, the Concentrates category saw the brand fall out of the top 30 in October, only to re-emerge at 65th in November. This indicates a challenging environment for Concentrates, where maintaining visibility and market share is crucial.

The Pre-Roll category presented its own set of challenges for Nature's Medicines in Michigan. The brand's ranking remained relatively stable from August to October, hovering around the 50s, but it dropped significantly to 78th in November. This decline could be attributed to increased competition or changes in consumer preferences. Overall, while Nature's Medicines has shown resilience in certain categories, such as Flower, the brand faces hurdles in maintaining a consistent presence across all product lines. The fluctuations in rankings across these categories highlight the dynamic nature of the cannabis market in Michigan, where adaptability and strategic positioning are key to sustained success.

Competitive Landscape

In the competitive landscape of the Michigan Flower category, Nature's Medicines experienced notable fluctuations in its ranking over the past few months. Starting from a rank of 21 in August 2024, it climbed to 14 by October, only to fall out of the top 20 by November. This volatility highlights the intense competition in the market. Brands like Glacier Cannabis and North Cannabis Co. have shown similar trends, with Glacier Cannabis peaking at rank 14 in September before dropping to 26 in November, and North Cannabis Co. maintaining a competitive edge close to Nature's Medicines. Meanwhile, Candela and Mooon Juice have remained relatively stable, with Candela showing a slight improvement in November. The sales trends indicate that while Nature's Medicines saw a significant boost in October, the subsequent decline in November suggests a need for strategic adjustments to maintain its competitive position in this dynamic market.

Notable Products

In November 2024, Don Mega Pre-Roll (1g) emerged as the top-performing product for Nature's Medicines, climbing from a consistent second-place ranking in September and October to first place, with notable sales of 20,695 units. Seriotica (3.5g) made a significant debut, securing the second spot in the rankings. Sub Zero (3.5g) improved from fifth place in October to third place in November. Grease Monkey Pre-Roll (1g) experienced a decline, dropping from first place in October to fourth place in November. Gold Cash Gold (3.5g) retained its presence in the top five, maintaining the fifth position for November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.