Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

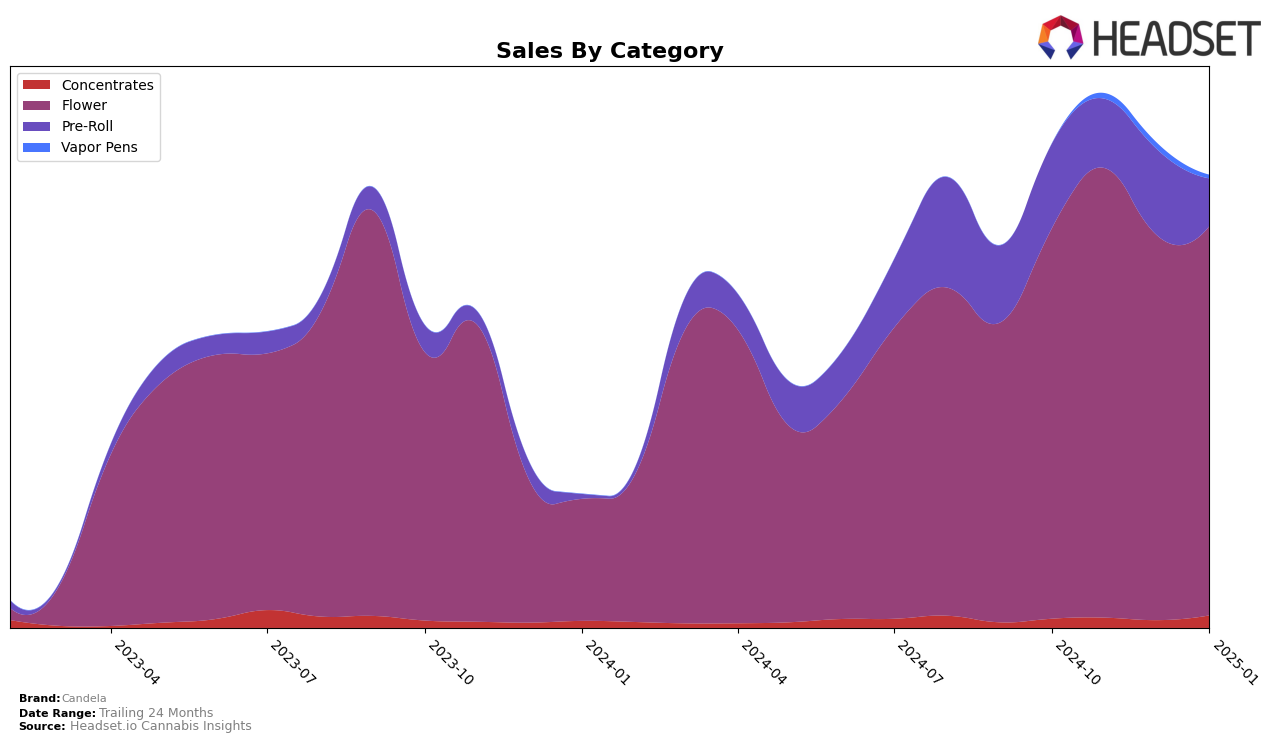

Candela's performance in the Michigan market shows a varied trajectory across different product categories. In the Flower category, Candela maintained a relatively stable presence, ranking within the top 33 to 27 from October 2024 to January 2025. This consistency suggests a steady demand and possibly loyal consumer base for their Flower products. However, in the Concentrates category, Candela's absence from the top 30 rankings for most months, except November 2024 where they ranked 88th, indicates a potential area for growth or a need for strategic adjustments to increase market penetration.

On the other hand, the Pre-Roll category in Michigan presents a more fluctuating performance for Candela. From ranking 44th in October 2024 to dropping to 65th by January 2025, there is a noticeable decline in their standing. This downward trend might be attributed to changes in consumer preferences or increased competition within the category. Despite these challenges, the brand's ability to rank within the top 100 across all categories at different times highlights potential opportunities for targeted marketing efforts to regain and bolster their standings in these segments.

Competitive Landscape

In the competitive landscape of the Michigan Flower category, Candela has demonstrated a consistent presence, maintaining a relatively stable rank from October 2024 to January 2025. While Candela's rank fluctuated slightly, peaking at 27th in November and January, it faced stiff competition from brands like Glorious Cannabis Co., which surged from 52nd in October to 19th in December, indicating a strong upward trend. Meanwhile, Grown Rogue and Franklin Fields experienced more volatility, with Grown Rogue dropping out of the top 20 in November and Franklin Fields showing a significant improvement from 65th in November to 29th in January. Despite these shifts, Candela's sales remained relatively stable, suggesting a loyal customer base, though the brand may need to innovate or enhance its marketing strategies to compete with the rising popularity of competitors like Glorious Cannabis Co.

Notable Products

In January 2025, the top-performing product for Candela was Sherb Cream Pie (3.5g) in the Flower category, securing the number one rank with impressive sales of 6,963 units. Jelly Rancher (3.5g) followed closely in the second position, while Tahitian Tundra (3.5g) held the third spot. Gelato Mints (3.5g) and Lemon Oreoz (3.5g) rounded out the top five, ranking fourth and fifth, respectively. Compared to previous months, these products have maintained consistent top rankings, indicating a stable demand for these offerings. Notably, the top three products have shown a steady climb in popularity, as they were not ranked in the months leading up to January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.