Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

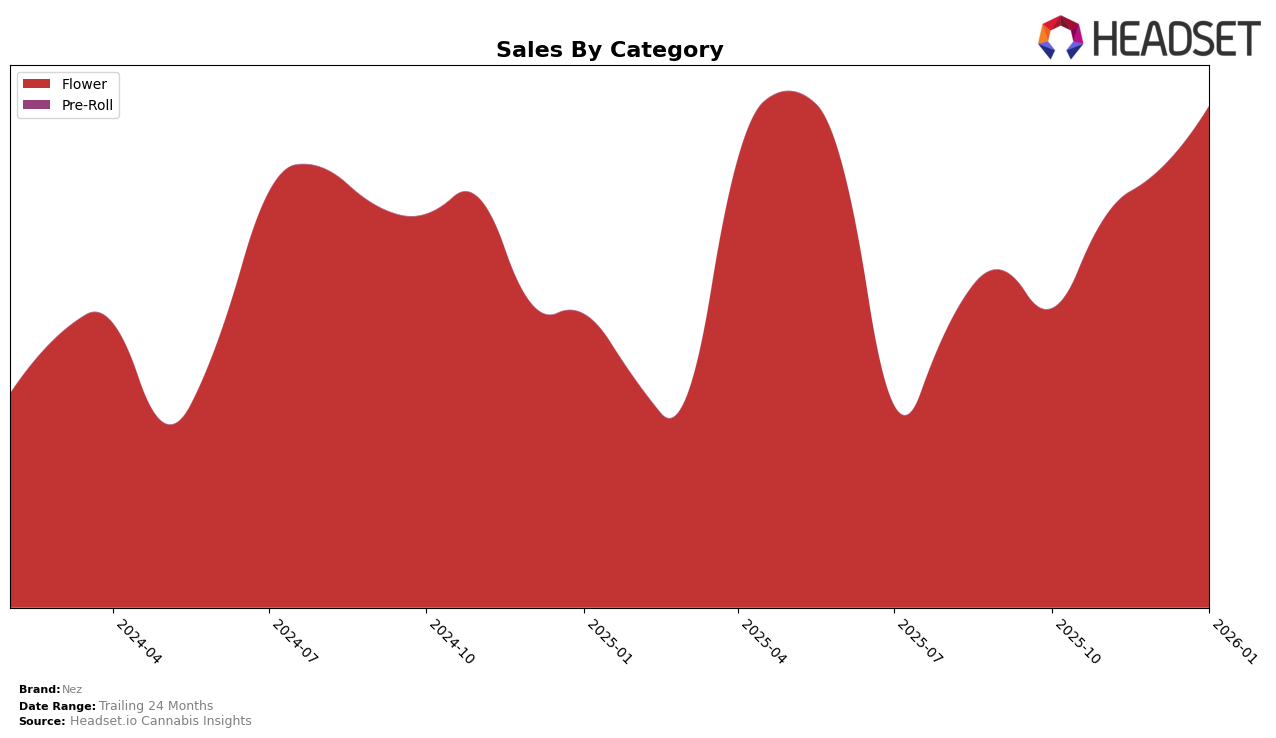

In the state of Illinois, Nez has shown a commendable upward trajectory in the Flower category over the past few months. Starting from a rank of 35 in October 2025, the brand has climbed to 26 by January 2026. This consistent rise in rankings indicates a growing presence and acceptance among consumers in Illinois. Although Nez was not initially in the top 30 brands in October, their subsequent entry and steady ascent into the top 30 by November reflects positively on their market strategies and consumer engagement efforts. The brand's sales figures have also seen a notable increase, with a significant jump from October to January, highlighting a robust demand for their products.

Despite the positive trends in Illinois, Nez's performance across other states remains undisclosed, which could suggest either a lack of presence or a less competitive stance in those markets. The absence of rankings for other states and categories implies that Nez might not yet be a significant player elsewhere, or they are focusing their efforts primarily on the Illinois market. Such a strategy could be advantageous if Illinois is a key market for their brand, but it also raises questions about their plans for expansion and market penetration in other regions. Observers might want to keep an eye on whether Nez will leverage their success in Illinois to bolster their presence in other states or categories in the near future.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Nez has shown a promising upward trajectory in its rankings over the past few months, moving from 35th place in October 2025 to 26th by January 2026. This improvement is indicative of a robust growth strategy, as Nez's sales have consistently increased, contrasting with some competitors who have experienced more fluctuating performance. For instance, IC Collective has seen its rank oscillate between 22nd and 26th, while The Botanist dropped from 20th to 27th, despite a strong showing in December. Meanwhile, Bedford Grow has maintained a relatively stable position around the mid-20s, and Lula's has shown slight improvement but remains behind Nez. This trend suggests that Nez is effectively capturing market share and could continue to climb the ranks if it sustains its current growth momentum.

Notable Products

In January 2026, Cadillac Rainbows (3.5g) maintained its top position in the Flower category with impressive sales of 1153 units, marking a consistent rise from its third-place rank in October 2025. Cap Junky (3.5g) secured the second spot, despite not being ranked in November and December 2025, showing a remarkable resurgence. Baby Yoda (3.5g) climbed to third place from its consistent fifth-place ranking in the previous months, indicating a growing popularity. Black Maple #22 (3.5g) slipped to fourth position from its previous top rankings, suggesting a shift in consumer preference. MAC Stomper (3.5g) entered the rankings at fifth place, showing potential for growth in future months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.