Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

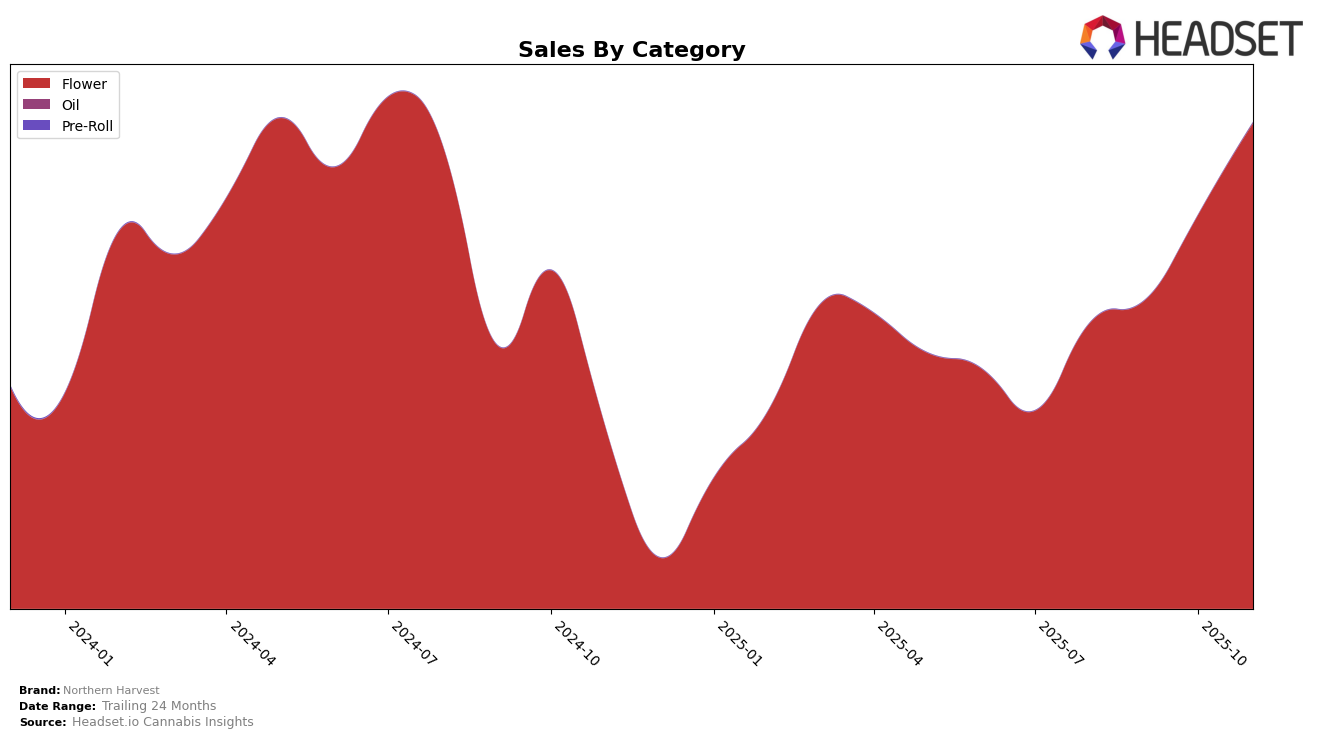

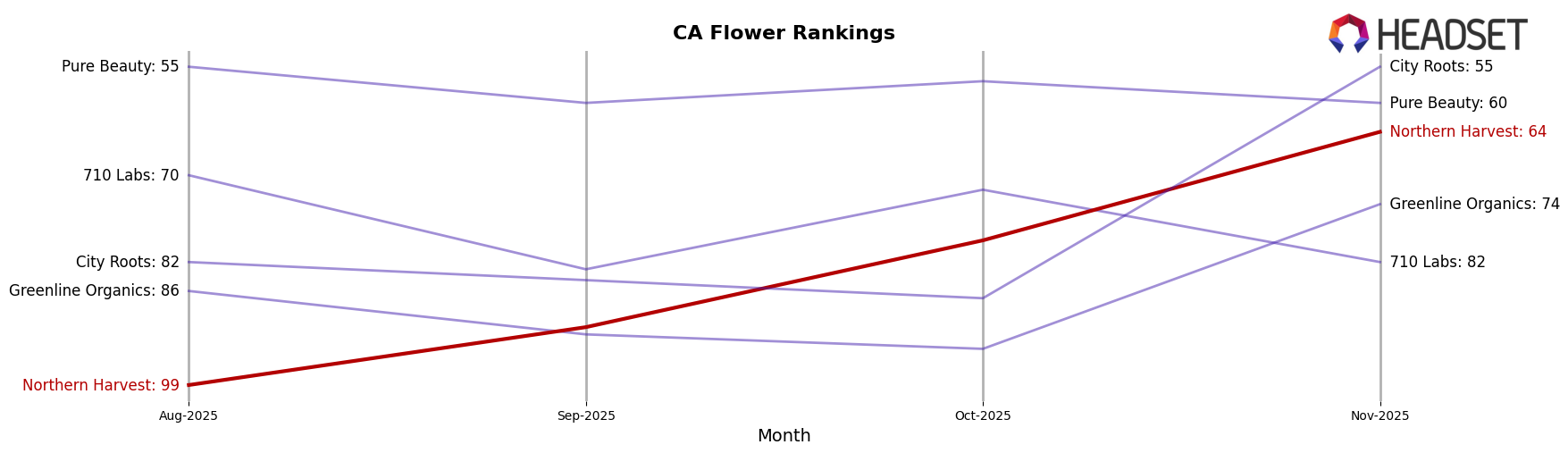

Northern Harvest has shown a notable improvement in its performance within the Flower category in California. Over the past few months, the brand has climbed significantly in the rankings, moving from the 99th position in August 2025 to the 64th position by November 2025. This upward trajectory indicates a strong market presence and increasing consumer preference for their products. The sales figures reflect this positive trend, with a steady increase in sales volume from August through November, culminating in a robust sales figure in the last month.

While Northern Harvest's performance in California's Flower category is commendable, it's important to note that the brand has not yet appeared in the top 30 rankings for other states or categories during this period. This absence suggests potential areas for growth and expansion, as they are currently not competing at the highest levels across different markets. The brand's ability to replicate its success in California could be key to enhancing its overall market position and reaching new consumer bases in other regions.

Competitive Landscape

In the competitive California flower market, Northern Harvest has shown a noteworthy upward trajectory in recent months. Starting from a rank of 99 in August 2025, Northern Harvest improved its position to 64 by November 2025, indicating a significant climb in the rankings. This positive trend is reflected in their sales, which have consistently increased over the same period. In comparison, 710 Labs experienced fluctuating ranks, moving from 70 in August to 82 in November, with a corresponding decline in sales. Meanwhile, Greenline Organics saw a notable improvement in rank from 94 in October to 74 in November, surpassing Northern Harvest's earlier positions. However, Northern Harvest's consistent sales growth suggests a strengthening market presence. Pure Beauty maintained a relatively stable rank around the 60s but experienced a decline in sales, which could indicate potential market share opportunities for Northern Harvest. Additionally, City Roots made a significant leap to rank 55 in November, showcasing the competitive nature of the market. Overall, Northern Harvest's upward rank and sales trajectory highlight its growing influence in the California flower category.

Notable Products

In November 2025, Northern Harvest's top-performing product was Jack Herer (3.5g), maintaining its number one rank from October with a notable sales figure of 1888 units. GMO x OZ Kush (3.5g) followed closely in second place, holding steady from the previous month with 1869 units sold. Berry Pie (3.5g) emerged as a new contender, ranking third with 1267 units in its first recorded month. Super Lemon Haze (3.5g) saw a drop to fourth place from its previous high of second in August, with sales at 1047 units. Super Silver Haze (3.5g) entered the rankings for the first time at fifth place, indicating a growing interest in this product.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.