Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

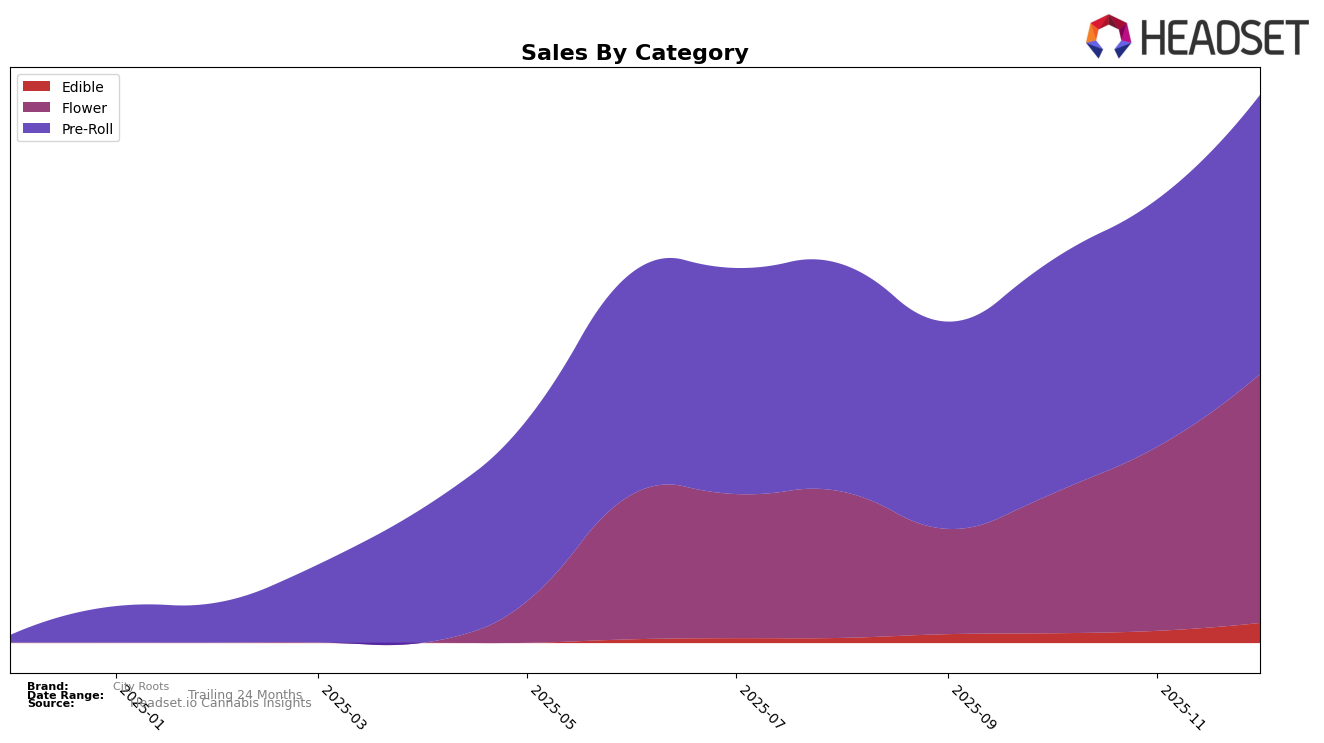

City Roots has shown significant movement in the California market across various categories. In the Edible category, the brand has made impressive progress, climbing from the 67th position in September to the 52nd position by December. This upward trajectory indicates a growing consumer preference for their edible products. In the Flower category, City Roots was not ranked in the top 30 in September, but by December, they had ascended to the 50th position, signifying a substantial improvement in their market presence. This suggests a strategic focus on enhancing their Flower offerings, which seems to be paying off as they gain traction among consumers.

In the Pre-Roll category, City Roots maintained a consistent presence within the top 30, starting at the 30th position in September and improving to the 25th position by December. This steady climb reflects a robust demand for their Pre-Roll products in California. Notably, their sales figures in this category have shown continuous growth throughout the months, highlighting their strong market performance. While City Roots has not yet broken into the top 30 for Edibles and Flower in earlier months, their recent movements suggest a positive trend that could potentially see them achieve higher rankings in the near future.

Competitive Landscape

In the competitive landscape of the California pre-roll market, City Roots has shown a promising upward trajectory in its rankings over the last few months of 2025. Starting from a rank of 30 in September, City Roots improved its position to 25 by December, indicating a steady climb amidst fierce competition. This positive trend in ranking is complemented by a consistent increase in sales, culminating in a notable surge in December. In comparison, Raw Garden experienced fluctuations, peaking at rank 22 in November before dropping to 26 in December, despite a significant sales increase in November. Meanwhile, PUFF maintained a relatively stable position, though it slipped to rank 23 in December, aligning with a decrease in sales. Sunset Connect held steady at rank 24 throughout the period, showing consistent sales figures. Coastal Sun Cannabis saw a decline in rank from 21 in September to 27 in December, reflecting a downward sales trend. These dynamics suggest that City Roots is effectively capitalizing on market opportunities, enhancing its competitive standing in the California pre-roll sector.

Notable Products

In December 2025, the top-performing product from City Roots was the Watermelon Kush Infused Pre-Roll 2-Pack (2.4g) in the Pre-Roll category, maintaining its number one rank with impressive sales of 5838 units. The Skywalker OG Pre-Roll (1g) secured the second position, consistent with its ranking in the previous two months. Mango Poison Infused Pre-Roll 2-Pack (2.4g) held steady at third place, showing a slight increase in sales. A new entry, the Durban Poison Pre-Roll (1g), debuted at fourth place. The Strawberry Cough Pre-Roll (1g) remained in fifth place, mirroring its November ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.