Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

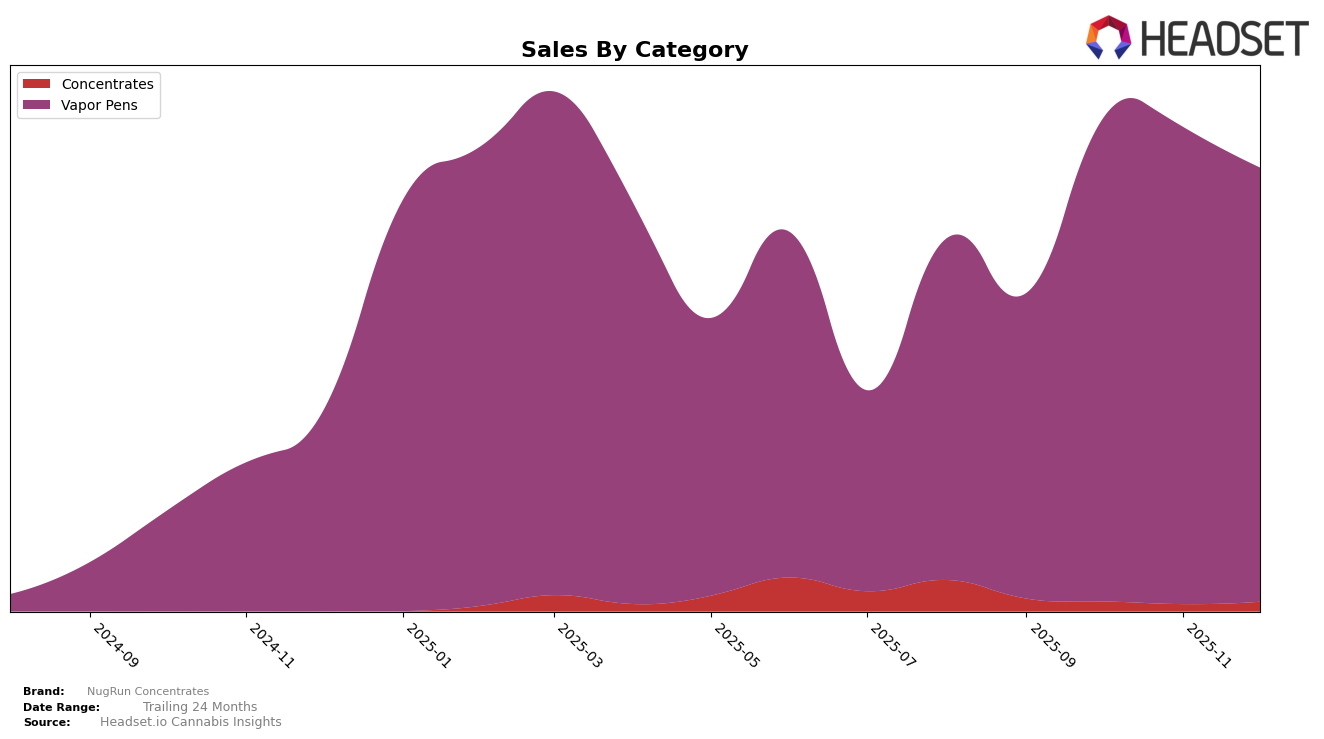

NugRun Concentrates has shown a notable presence in the Arizona market, particularly in the Vapor Pens category. Starting from a rank of 26 in September 2025, the brand made a significant leap to rank 19 by October and maintained this position through November and December. This consistent ranking in the top 20 indicates a stable demand and possibly effective market strategies that have resonated well with consumers in Arizona. Although the sales figures saw a slight decline from November to December, the brand's ability to hold its rank suggests resilience in a competitive market.

However, it's important to note that NugRun Concentrates did not appear in the top 30 rankings for other categories or states during this period, which might indicate areas for potential growth or challenges in expanding their market footprint beyond Arizona's Vapor Pens category. This absence from other rankings could be viewed as a missed opportunity or a strategic focus on strengthening their position within a specific niche. The brand's concentrated efforts in Arizona could serve as a foundation for broader expansion strategies in the future, should they choose to diversify their product offerings or enter new markets.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, NugRun Concentrates has shown a notable improvement in rank from September to December 2025, moving from 26th to 19th position, indicating a positive trend in market presence. This upward movement is significant when compared to competitors like IO Extracts, which experienced a slight decline from 15th to 17th place over the same period. Meanwhile, Big Bud Farms has been climbing steadily, improving from 29th to 21st, showcasing a competitive threat. Drip Oils + Extracts maintained a stable position around the 20th rank, while Fenix saw a decline from 13th to 18th, potentially opening up opportunities for NugRun Concentrates to capture more market share. Despite the fluctuations in sales figures, NugRun Concentrates' consistent rank improvement suggests a strengthening brand presence in the Arizona vapor pen market.

Notable Products

In December 2025, NugRun Concentrates' top-performing product was the Modified Rootbeer Live Resin Disposable (1g) in the Vapor Pens category, maintaining its number one rank from November. The Fritter Fuel Live Resin Cartridge (1g) secured the second position with notable sales of 1003 units. Shibui Live Resin Disposable (1g) improved its standing, climbing from fourth to third place, while Cajun Berries Live Resin Disposable (1g) experienced a decline from second to fourth. Jenny Kush Live Resin Cartridge (1g) made its debut in the rankings at fifth place, indicating a growing interest in this product. These shifts highlight dynamic changes in consumer preferences within the Vapor Pens category over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.