Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

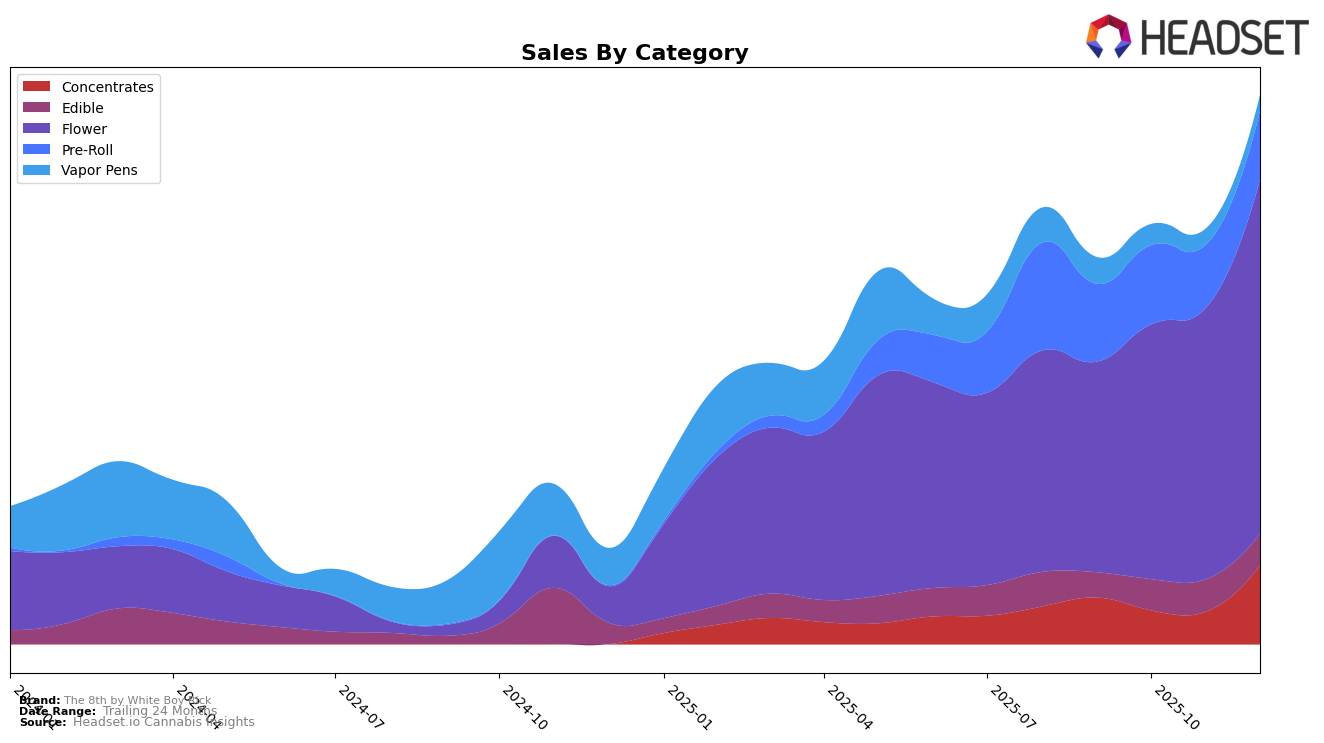

The performance of The 8th by White Boy Rick in the Michigan market has shown varied trends across different product categories. In the Concentrates category, the brand experienced a notable resurgence, climbing from a rank of 63 in November 2025 to 28 by December 2025. This movement suggests a strong recovery and potentially successful marketing or product adjustment strategies. However, the Edible category has shown more stability, maintaining a consistent rank of 62 in November and December 2025, indicating steady consumer interest but lacking the upward momentum seen in Concentrates.

The Flower category has shown significant improvement, moving from a rank of 63 in October and November 2025 to 43 in December 2025, which could be indicative of increased consumer preference or competitive pricing strategies. On the other hand, despite the Pre-Roll category not breaking into the top 30 rankings, there was a slight improvement from rank 81 in November 2025 to 78 in December 2025. This suggests that while the brand is not yet a leading player in Pre-Rolls, there is potential for growth. Such data points highlight the brand's strengths and areas for potential growth in the Michigan market, offering insights into consumer behavior and market dynamics.

Competitive Landscape

In the competitive landscape of the Michigan flower category, The 8th by White Boy Rick has demonstrated a notable upward trajectory in terms of rank and sales from September to December 2025. Starting at rank 74 in September, The 8th climbed to rank 43 by December, indicating a significant improvement in market position. This rise is particularly impressive when compared to competitors such as Cloud Cover (C3), which only entered the top 100 in November at rank 95 and improved to rank 37 by December. Meanwhile, Strane and Springtime maintained more stable positions, with Strane improving from rank 66 to 44 and Springtime from 70 to 45 over the same period. The Fresh Canna consistently outperformed The 8th, holding a top 40 position throughout these months, though it experienced a slight dip from rank 29 in November to 35 in December. The 8th's sales growth trajectory, culminating in a December sales figure that surpassed several of its competitors, underscores its growing consumer appeal and market presence in Michigan's flower category.

Notable Products

In December 2025, Miami Wowie Infused Pre-Roll (1.2g) emerged as the top-performing product for The 8th by White Boy Rick, climbing from the second position in November to first place with sales reaching 8201. Blue Dream Infused Pre-Roll (1.2g) held a strong position, moving to second place after leading in October and November. Lemon Diesel Infused Pre-Roll (1.2g) consistently maintained its third-place ranking from September through December. White Boy Runtz Infused Pre-Roll (1.2g) returned to the rankings in December at fourth place after being unranked in October and November. Strawberry Cough Infused Pre-Roll (1.2g) showed a stable performance by securing the fifth position, up from being unranked in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.