Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

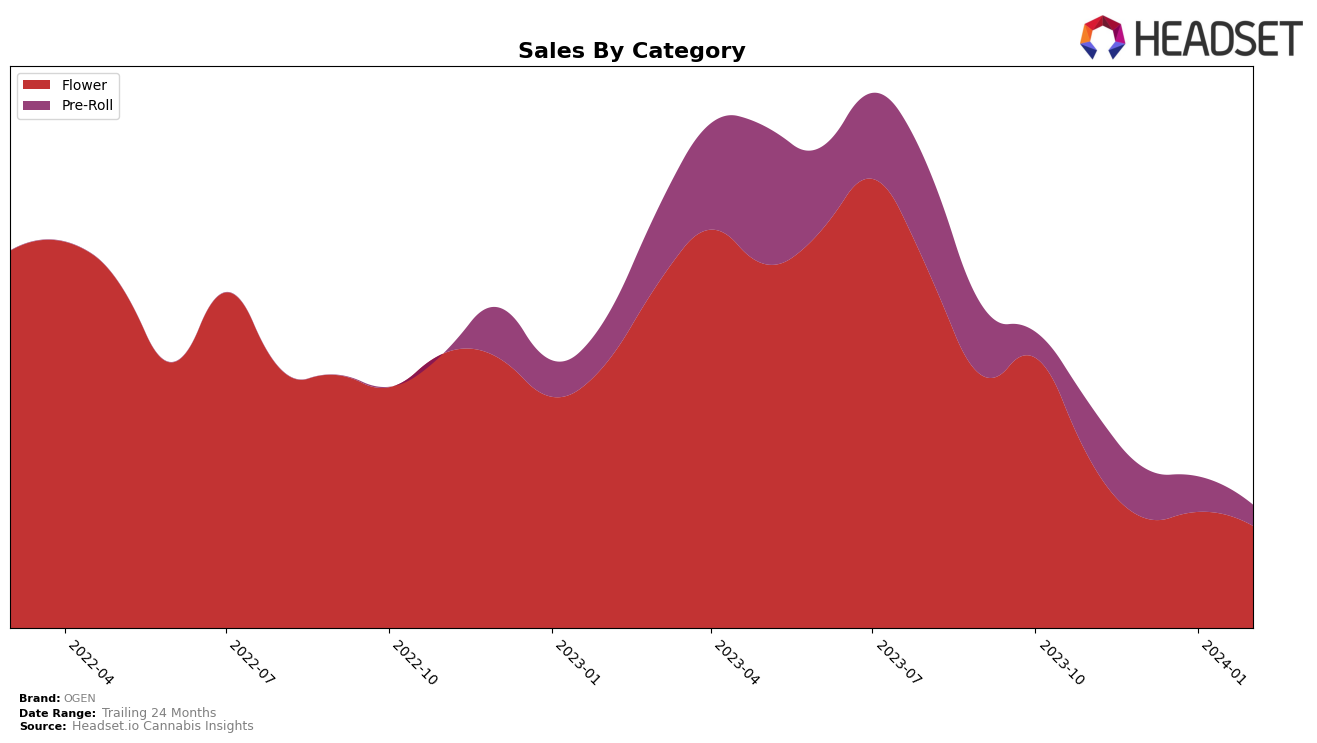

In Alberta, OGEN has shown a fluctuating performance across different cannabis categories, with its presence most notably in the Flower and Pre-Roll categories. For the Flower category, OGEN maintained a position within the top 30 brands from November 2023 to February 2024, peaking at rank 14 in November 2023 but experiencing a slight dip to rank 23 by February 2024. This movement indicates a strong but slightly declining market presence in the Flower category. However, the brand's performance in the Pre-Roll category tells a different story, with rankings starting outside the top 30 in November 2023 at rank 43 and significantly dropping to rank 75 by February 2024, signaling a considerable decrease in market competitiveness within this category.

The sales figures for OGEN in Alberta also reflect these trends, with Flower category sales peaking at $378,736 in November 2023 before experiencing a decline in subsequent months. This peak is a testament to OGEN's strong initial market penetration in the Flower category, though the declining trend suggests a need for strategic adjustments to maintain or enhance its market position. The Pre-Roll category, on the other hand, saw a consistent decline in sales from $134,816 in November 2023 to a much lower $54,006 by February 2024. This significant drop in sales, alongside the downward trend in category ranking, highlights the challenges OGEN faces in the Pre-Roll market within Alberta, suggesting a potential area for reevaluation and strategic realignment to boost its market performance and consumer appeal in this category.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Alberta, OGEN has experienced a fluctuating performance in terms of rank and sales over the recent months. Starting from November 2023, OGEN held the 14th position but saw a significant drop to the 32nd in December, before partially recovering to the 22nd and then slightly dropping again to the 23rd position by February 2024. This volatility is indicative of a fiercely competitive market. Notably, Tweed initially outperformed OGEN but experienced a decline, falling out of the top 20 by February. In contrast, Craftport showed remarkable improvement, jumping from a distant 52nd to the 25th position, surpassing OGEN by February despite starting from a much lower base. Virtue Cannabis and Dab Bods also displayed competitive dynamics, with Virtue Cannabis slightly outperforming OGEN by February, and Dab Bods maintaining a close competition. These shifts highlight the intense competition within the Alberta cannabis flower market, with OGEN facing challenges to maintain and improve its market position amidst these dynamic changes.

Notable Products

In February 2024, OGEN's top-performing product was Peach Chauffeur #15 (7g) in the Flower category, securing the first rank with sales figures reaching 2459 units. Following closely, Peach Chauffeur #15 (3.5g) also in the Flower category, took the second position, showing a slight rank improvement from January. The third spot was claimed by Craft Blend Milled (5g), marking its first appearance in the top rankings for the year. Notably, Peach Chauffeur #15 Pre-Roll 7-Pack (3.5g) from the Pre-Roll category, which held the top position in January, slipped to the fourth rank in February with sales significantly dropping to 781 units. Velvet Apples #14 (3.5g) managed to maintain its position within the top five, despite a decrease in sales, indicating a consistent demand for OGEN's Flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.