Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

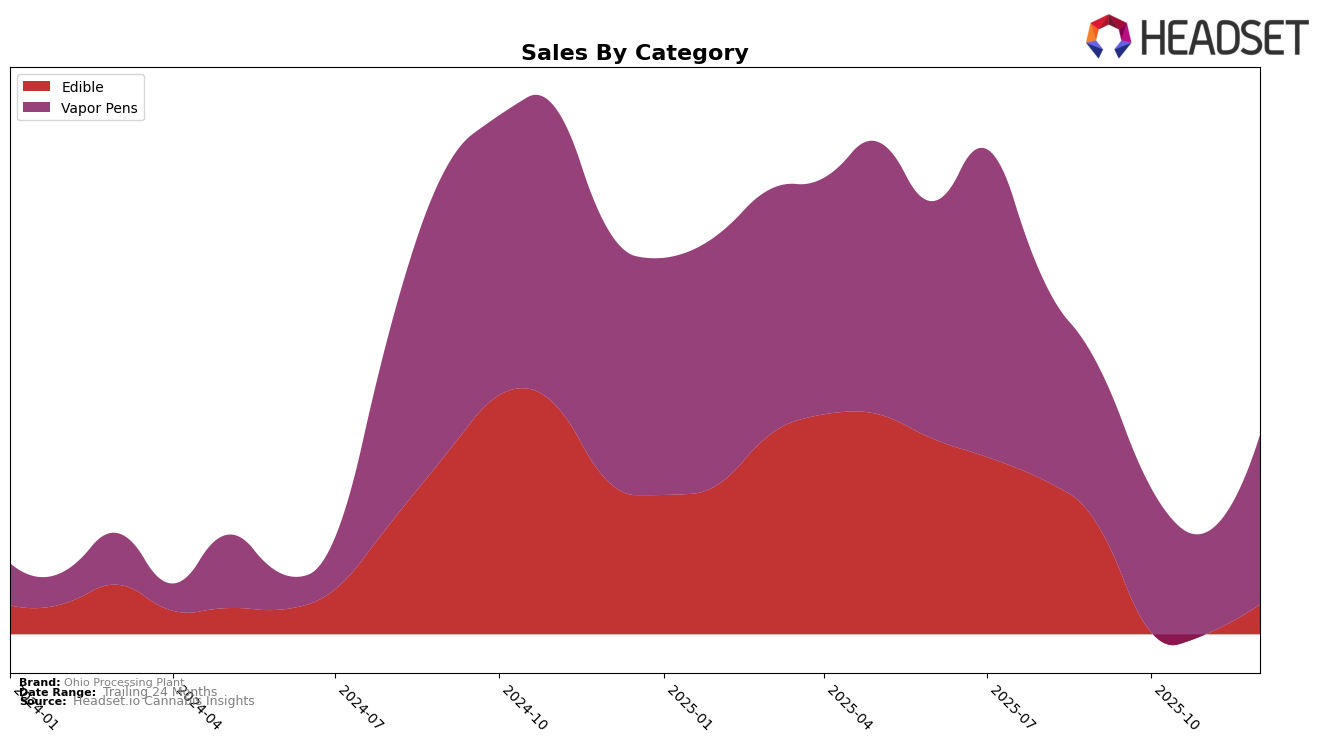

Ohio Processing Plant's performance in the Edible category in Ohio has shown a notable decline in the rankings over the last few months of 2025. Starting at the 18th position in September, the brand did not maintain a top 30 ranking in October and November, only to reappear at 43rd in December. This drop suggests potential challenges in maintaining consumer interest or increased competition within the state. The December sales figure of $35,508 indicates a significant decrease from September's sales, pointing to a need for strategic adjustments to regain market traction.

In contrast, the Vapor Pens category tells a different story. Ohio Processing Plant has demonstrated relative stability in Ohio, with rankings fluctuating slightly from 30th in September to 33rd in October, 36th in November, and back to 29th in December. Despite these minor shifts, the brand managed to close the year on a positive note with an increase in sales from November to December, reaching $203,304. This suggests that while there are challenges in the Edible segment, Ohio Processing Plant's Vapor Pens are maintaining a more consistent presence in the market.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, Ohio Processing Plant has experienced fluctuating rankings over the last few months of 2025, reflecting a dynamic market environment. In September 2025, Ohio Processing Plant held the 30th rank, but it slipped to 33rd and 36th in October and November, respectively, before rebounding to 29th in December. This volatility suggests challenges in maintaining consistent sales performance, especially when compared to competitors like Standard Farms, which improved its rank from 31st in September to 28th in December, and The Lab Concentrates, which made a significant leap from 37th to 27th during the same period. Despite these challenges, Ohio Processing Plant's December sales saw a notable recovery, surpassing its October and November figures, indicating potential for growth if they can sustain this upward momentum. The competitive pressure from brands such as AiroPro and Fuzed, both of which maintained relatively stable rankings, underscores the need for strategic adjustments to enhance Ohio Processing Plant's market position in the Ohio vapor pens category.

Notable Products

In December 2025, Ohio Processing Plant's top-performing product was Ghost Train Haze Distillate Cartridge (0.84g) in the Vapor Pens category, securing the first rank with sales reaching 1294 units. Diablo OG Distillate Cartridge (0.84g) followed closely in the second position. Maui Wowie Distillate Cartridge (0.84g) rose to third place, showing a notable improvement from its absence in November's rankings. Hippie Crasher Distillate Cartridge (0.84g) maintained its fourth position from October, while Northern Lights Distillate Cartridge (0.84g) consistently held the fifth rank, despite a sales decline over the months. These shifts highlight a dynamic competitive landscape among Ohio Processing Plant's Vapor Pens, with some products gaining traction while others stabilize in their positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.