Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

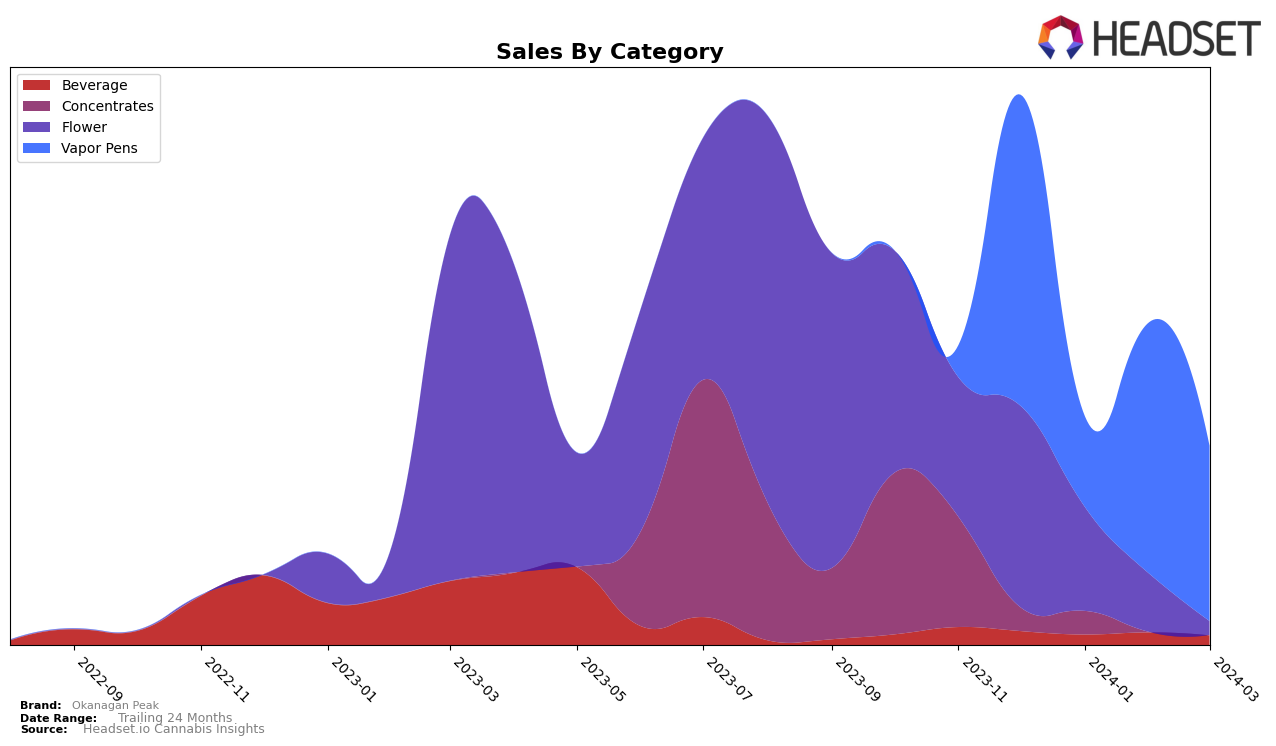

In British Columbia, Okanagan Peak has shown a diverse presence across multiple cannabis categories, yet its performance indicates room for growth and stabilization. The brand's venture into the Beverage category saw a fluctuation, entering the rankings at 29th in December 2023, disappearing in January 2024, and then reappearing at 30th in February before stabilizing back at 29th in March. This inconsistency in ranking, coupled with the absence in January, highlights a potential volatility in consumer demand or distribution challenges within the province. Meanwhile, in the Concentrates category, the brand faced a slight decline, dropping from a rank of 49th in December 2023 to 50th in January 2024, and then disappearing from the top 30 rankings altogether. This disappearance could be interpreted as a significant downturn, suggesting either a loss in market share or a shift in consumer preferences away from Okanagan Peak's offerings in this category.

Okanagan Peak's performance in the Vapor Pens category within British Columbia presents a mixed picture. Beginning at 48th in December 2023, the brand experienced a notable dip to 62nd in January 2024, followed by a recovery to 58th in February and a slight drop to 60th in March. This trajectory indicates a struggle to gain a solid foothold in the competitive Vapor Pens market, despite a significant sales figure of 5,745 in December 2023. On the other hand, in Ontario, Okanagan Peak made a singular appearance in the Beverage category at 66th in January 2024 but failed to maintain a position in the top 30 rankings thereafter. This singular data point suggests an attempt to penetrate the Ontario market, though the lack of subsequent data points may imply challenges in establishing a consistent presence or consumer base in this new market.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in British Columbia, Okanagan Peak has experienced notable fluctuations in its market position from December 2023 to March 2024, moving from the 48th rank in December to the 60th in March. This shift indicates a challenging period for Okanagan Peak, especially when compared to its competitors. For instance, Purefarma has shown a consistent improvement in rank and a significant increase in sales, moving from the 50th to the 57th position and achieving the highest sales among the mentioned competitors in March 2024. Similarly, LoFi Cannabis has also seen a positive trend, improving its rank and surpassing Okanagan Peak in both rank and sales by March 2024. On the other hand, San Rafael '71 and Solei have had varied performances but still remain competitive, with San Rafael '71 notably increasing its sales in March. The data suggests that while Okanagan Peak faces stiff competition, there are opportunities for growth and recovery if it can leverage market insights and adjust its strategies accordingly.

Notable Products

In Mar-2024, Okanagan Peak's top-selling product was Death Bubba Live Resin Disposable (1g) from the Vapor Pens category, securing the first rank with notable sales of 78 units. The second position was a tie between CBD Powdered Milk Creamer 10-Pack (500mg CBD) from the Beverage category and Runtz (3.5g) from the Flower category, both showing a significant rise in popularity. Notably, Death Bubba Live Resin Disposable climbed from the second position in Feb-2024 to the top spot by Mar-2024, highlighting a growing consumer preference for vapor pens. The CBD Powdered Milk Creamer 10-Pack remained consistent in its ranking, gradually moving up to the second spot by Mar-2024, indicating a steady demand. This period marked a dynamic shift in consumer preferences within Okanagan Peak's product range, with particular emphasis on the rising popularity of vapor pens and CBD-infused beverages.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.