Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

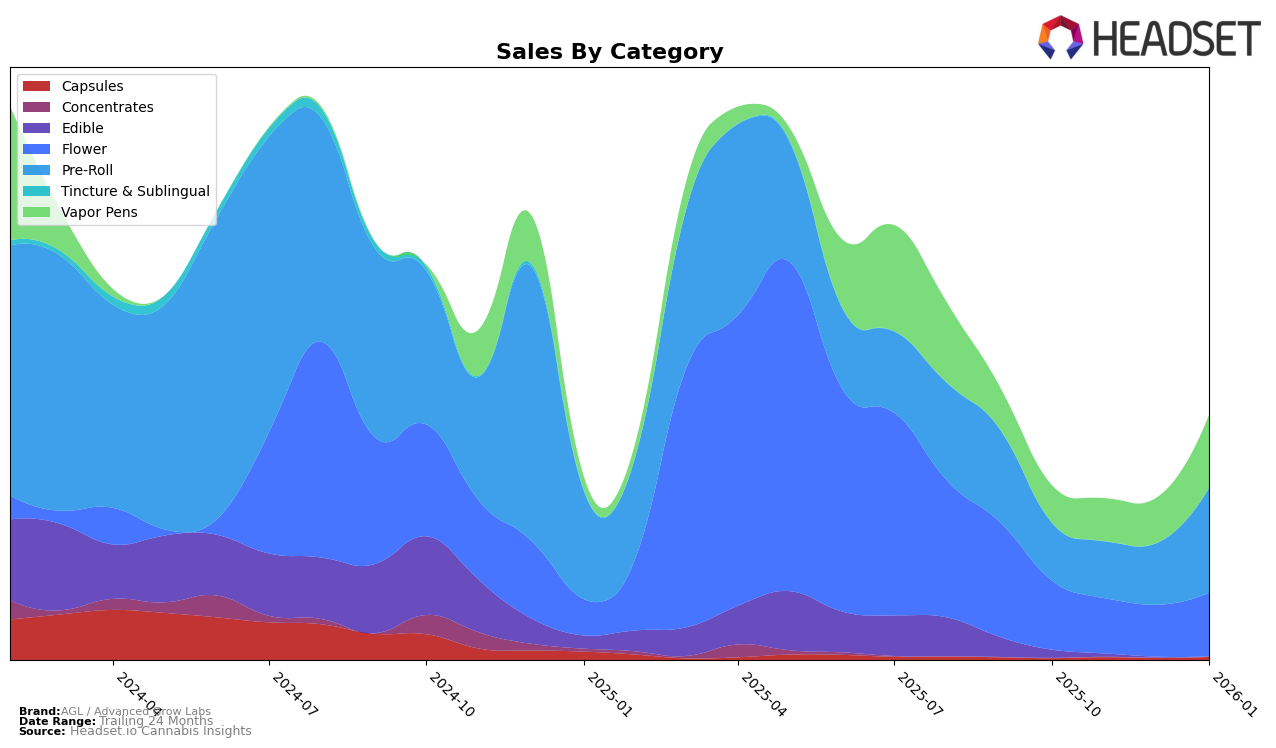

AGL / Advanced Grow Labs has demonstrated varied performance across different product categories in Connecticut. In the Edible category, the brand was ranked 15th in October 2025, but did not maintain a top 30 position in the subsequent months, suggesting a decline in their competitive standing within this segment. Conversely, in the Flower category, AGL / Advanced Grow Labs showed a gradual decline from 13th in October 2025 to 16th by January 2026, indicating a slight dip in their market position. Despite this, the brand's Pre-Roll category exhibited a remarkable improvement, climbing from 9th place in October to an impressive 4th place by January, showcasing a strong upward trajectory.

In the Vapor Pens category, AGL / Advanced Grow Labs experienced fluctuations, starting at 14th place in October 2025, dropping to 17th in November and December, and then recovering to 13th by January 2026. Notably, this category saw a significant increase in sales from November to January, highlighting a positive trend despite the ranking instability. The absence of AGL / Advanced Grow Labs from the top 30 in the Edible category after October could be seen as a missed opportunity for growth in this segment. These dynamics underscore the brand's mixed performance across categories, with some areas showing promise and others indicating potential challenges.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Connecticut, AGL / Advanced Grow Labs has shown a notable upward trajectory in rank and sales. From October 2025 to January 2026, AGL improved its rank from 9th to 4th, indicating a significant gain in market position. This upward movement is accompanied by a substantial increase in sales, particularly in January 2026, where sales nearly doubled compared to October 2025. In contrast, competitors like Curaleaf maintained a steady 3rd place rank, while Theraplant consistently held the 2nd position. Meanwhile, Brix Cannabis (CT) and Awssom experienced fluctuations, with Brix Cannabis dropping from 4th to 6th and Awssom moving from 5th to 5th, then 4th, and back to 5th. These dynamics suggest that AGL's strategic initiatives are effectively capturing market share, positioning it as a formidable contender in the Connecticut Pre-Roll market.

Notable Products

In January 2026, the top-performing product for AGL / Advanced Grow Labs was Hypnotik Pre-Roll (1g) in the Pre-Roll category, securing the number one rank with sales of 2957 units. Following closely was 95 Cook Pre-Roll (1g), which improved its standing from fourth in November 2025 to second in January 2026. Bubba F Select Grind Pre-Roll (1g) debuted at third place, while Bananaconda Pre-Roll (1g) maintained a consistent presence, moving from fifth in November to fourth in January. Lemon Drip Minis Pre-Roll 5-Pack (2.5g) also joined the top ranks, sharing the fourth position with Bananaconda. This shift illustrates a strong preference for pre-rolls in the market, with Hypnotik leading the charge in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.