Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

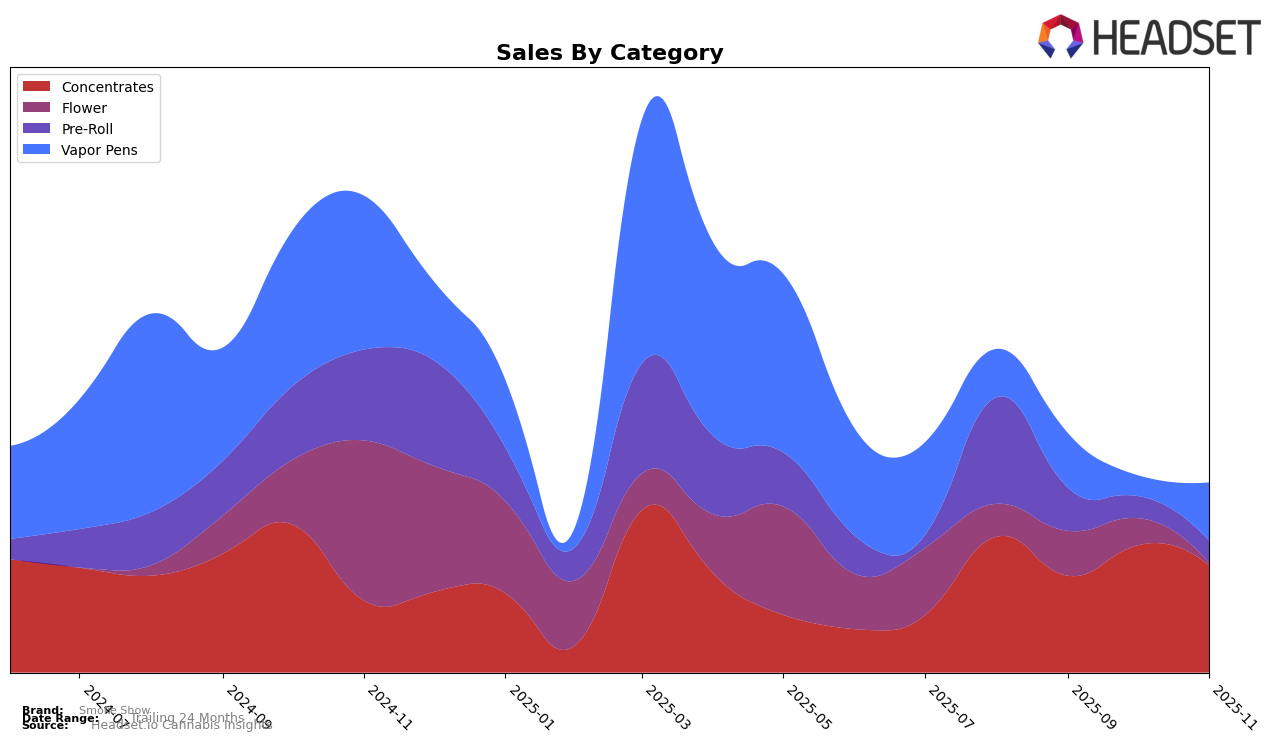

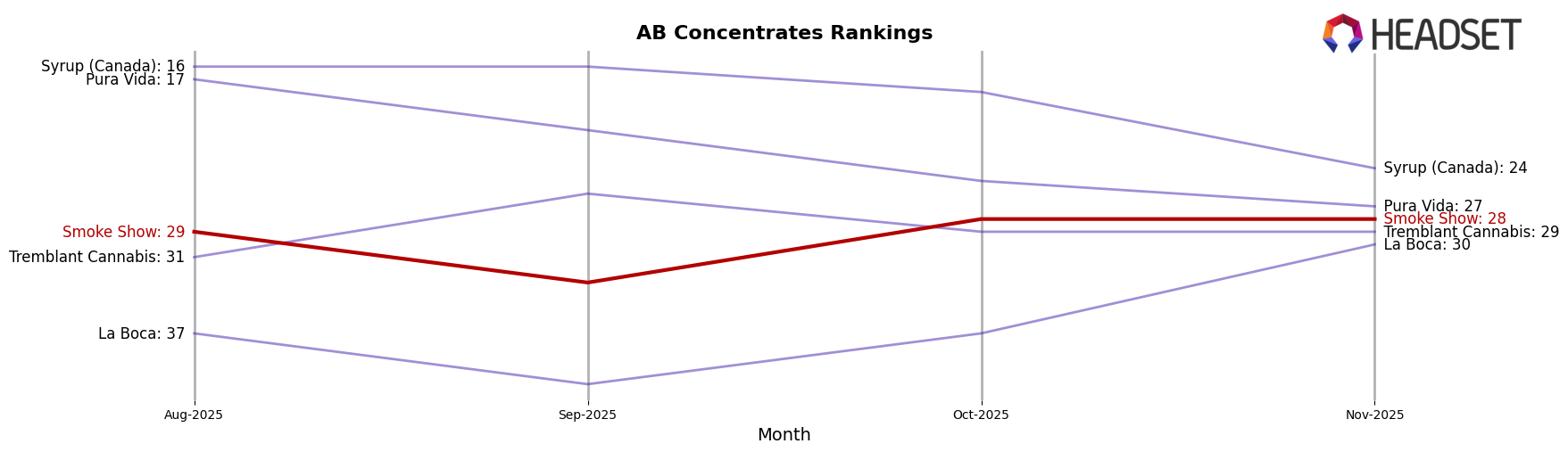

Smoke Show has demonstrated a notable performance in the Alberta market, particularly in the Concentrates category. Over recent months, the brand has maintained a consistent presence in the top 30, with a rank of 28th in both October and November 2025. This stability is a positive indicator of their foothold in the market, despite a dip in sales from August to November. The brand's ability to remain within the top ranks, even as sales figures fluctuate, suggests a loyal customer base and effective market strategies in this category.

In contrast, Smoke Show's performance in the Vapor Pens category in Alberta has been more volatile. The brand was ranked 85th and 84th in August and September 2025, respectively, but did not make it into the top 30 in October. However, a recovery is evident with a jump to 80th place in November, accompanied by an increase in sales. The absence from the top 30 in October highlights a challenge for Smoke Show in maintaining consistent visibility in this competitive category. Nonetheless, the rebound in November indicates potential for growth and suggests that strategic adjustments may be yielding positive results.

Competitive Landscape

In the Alberta concentrates market, Smoke Show has shown a stable yet competitive presence, maintaining its rank at 28th place in both October and November 2025. Despite facing fierce competition, Smoke Show has managed to outperform brands like Tremblant Cannabis and La Boca, which ranked 29th and 30th respectively in November 2025. However, Smoke Show still trails behind Syrup (Canada), which, despite a drop from 16th to 24th place, remains a significant competitor with higher sales figures. Meanwhile, Pura Vida has seen a decline in rank from 17th in August to 27th in November, indicating a potential opportunity for Smoke Show to capture more market share if this trend continues. Overall, Smoke Show's consistent ranking suggests a steady foothold in the market, but there is room for growth by capitalizing on the declining performance of some competitors.

Notable Products

In November 2025, Sunny Daze Live Resin Crumble (1g) maintained its position as the top-performing product for Smoke Show, leading the Concentrates category with sales of 501 units. Train Wreck Live Resin Cartridge (1g) emerged as a strong contender, securing the second rank in the Vapor Pens category. Lemon OG Diamond Infused Pre-Roll 3-Pack (1.5g) was ranked third in Pre-Rolls, showing a decline from its previous first-place position in August 2025. Gelato 41 Live Resin (1g) experienced a slight drop, moving from second to fourth place in the Concentrates category. Notably, Strawberry Diamond Infused Pre-Roll 3-Pack (1.5g) entered the rankings for the first time in November, taking the fifth position in Pre-Rolls.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.