Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

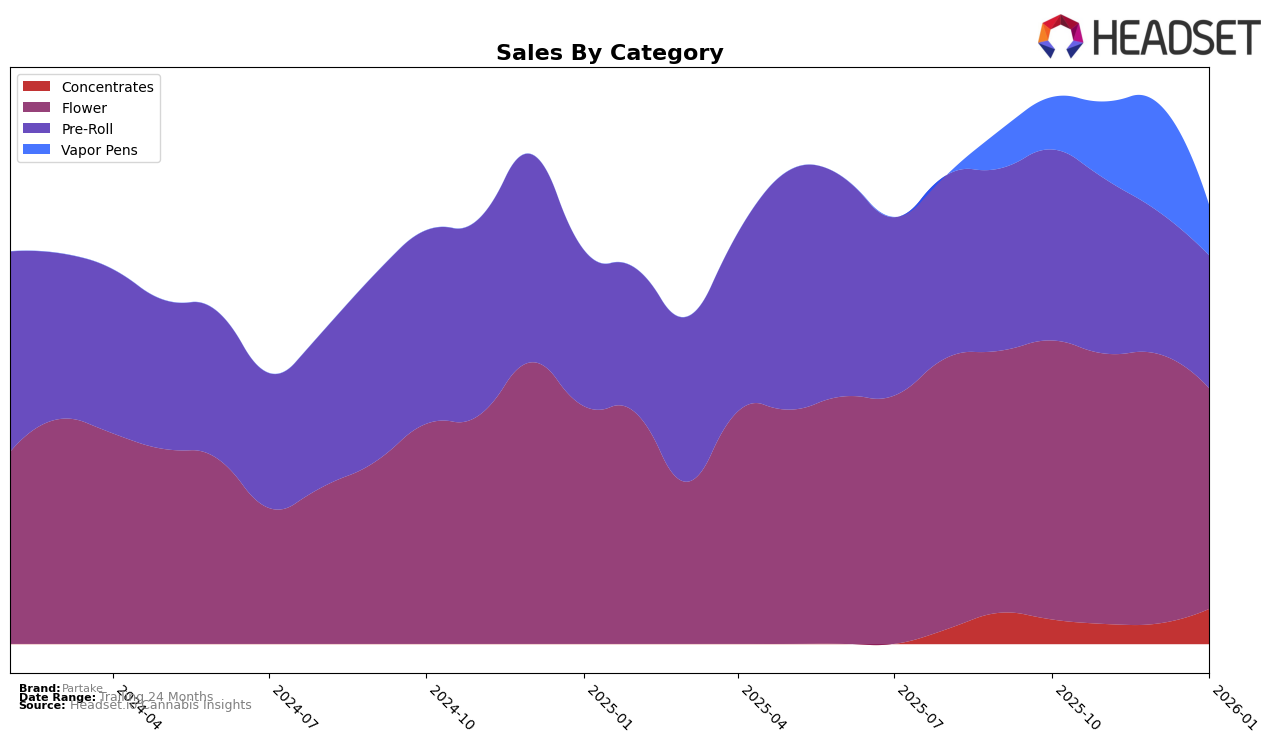

In the province of Alberta, Partake's performance across various cannabis categories has shown notable fluctuations over recent months. In the Concentrates category, Partake demonstrated a positive trajectory by climbing from 33rd place in December 2025 to 28th place by January 2026, indicating a strengthening presence in this segment. Conversely, the Flower category saw a decline, with Partake slipping from 25th in November to 30th in January, which could suggest increasing competition or shifting consumer preferences. Interestingly, in the Pre-Roll category, Partake has not managed to secure a position within the top 30, peaking at 45th place in October and dropping to 50th by January, which may be an area of concern or potential improvement for the brand.

The Vapor Pens category in Alberta offers a mixed picture for Partake. After achieving a better rank of 39th in December 2025, the brand saw a decline to 53rd by January 2026, suggesting volatility in consumer demand or perhaps challenges in maintaining market share. Despite these fluctuations, Partake's sales in the Concentrates category experienced a significant boost from December to January, indicating that while overall rankings might not always reflect it, there is underlying growth potential. These insights into Partake's performance across different categories and timeframes highlight areas of both opportunity and challenge, providing a nuanced view of the brand's current market standing.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Partake has experienced fluctuations in its market position, indicating a dynamic and challenging environment. As of January 2026, Partake ranked 30th, a slight decline from its 27th position in October 2025. This drop in rank is accompanied by a decrease in sales, from a high of 226,691 in October to 180,558 in January. Notably, Potluck has shown significant volatility, with its rank plummeting from 13th in November to 33rd in January, despite leading in sales during the earlier months. Meanwhile, Good Buds has made a notable climb from 52nd to 29th, suggesting a strong upward trend in both rank and sales. Versus has maintained a relatively stable position, closely trailing Partake with a rank of 31st in January. The competitive shifts highlight the importance for Partake to strategize effectively to regain and sustain a higher market position amidst these dynamic changes.

Notable Products

In January 2026, Partake's top-performing product was the Pink Drip Pre-Roll 3-Pack, which ascended to the first place ranking with notable sales of 966 units. The Premium Apricot Frost Glass Tip Pre-Roll moved up to the second position, demonstrating a significant improvement from its previous fifth-place ranking in October 2025. Cement Shoes Pure Cold Cured Live Rosin gained traction, achieving the third rank, marking its debut in the top rankings. The Gorilla Zkittlez Pure Cold Cure Live Rosin Cartridge, previously holding the first position for three consecutive months, dropped to fourth place, reflecting a decrease in sales. Lastly, Apricot Frost Pre-Roll 3-Pack entered the rankings at fifth place, showcasing its rising popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.