Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

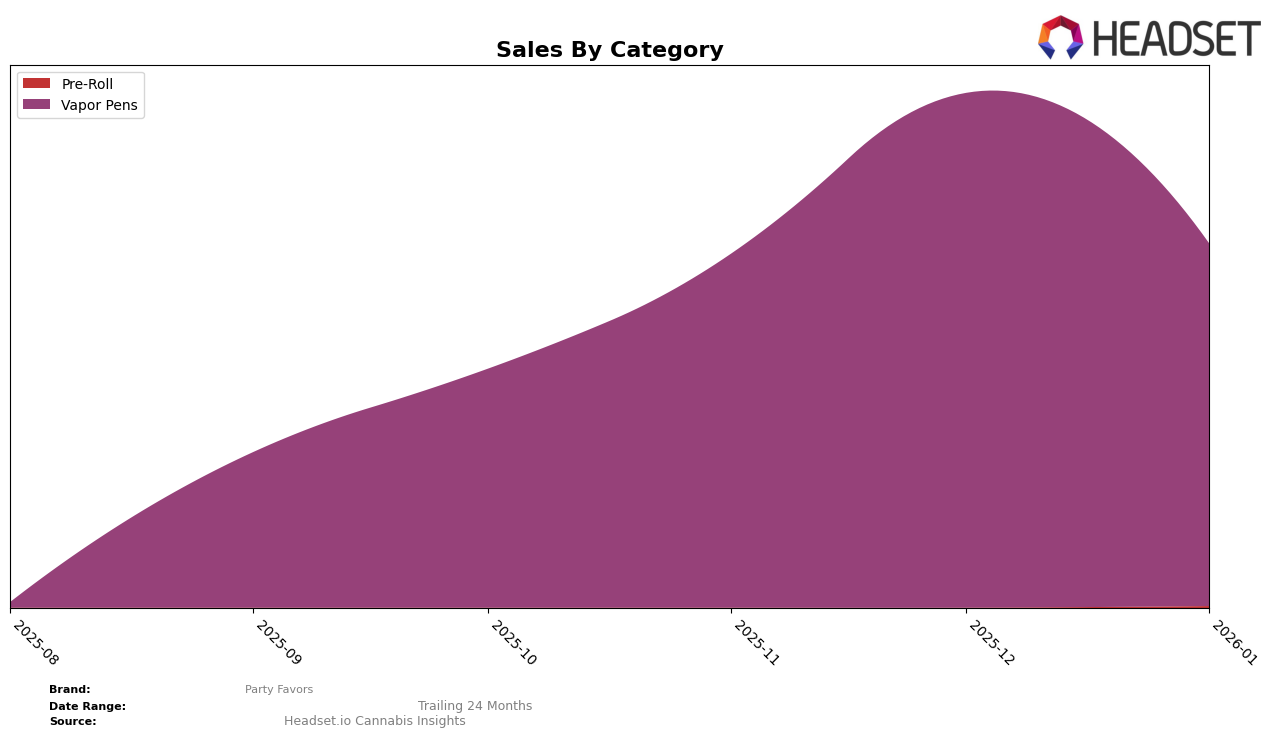

Party Favors has shown notable progress in the Vapor Pens category within Michigan. Over the span from October 2025 to January 2026, the brand has climbed the rankings significantly, starting outside the top 30 in October and reaching the 28th position by January 2026. This upward movement indicates a strong response to their product offerings or marketing strategies in this category. The sales figures reflect this positive trend, with a substantial increase from October to December, though there was a slight dip in January. This suggests that while the brand is gaining traction, maintaining momentum in the competitive landscape of Michigan's vapor pen market remains crucial.

Across other states and categories, Party Favors' presence is less prominent, as they did not appear in the top 30 brands in any other state or category during this period. This absence highlights areas for potential growth and expansion. For instance, the brand might explore opportunities in other regions or diversify its product offerings to capture a broader audience. By analyzing the success factors in Michigan, Party Favors could replicate similar strategies to improve its standings in other markets. As the cannabis industry continues to evolve, staying adaptive and responsive to market demands will be key for Party Favors to enhance its performance across various states and categories.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Party Favors has demonstrated a notable upward trajectory in terms of rank and sales over the past few months. Starting from a rank of 42 in October 2025, Party Favors climbed to 30 by November and further improved to 25 in December, although it slightly dipped to 28 in January 2026. This positive trend in rank is mirrored by a significant increase in sales, which more than doubled from October to December. In comparison, Batch Extracts and Sauce Essentials both experienced a decline in sales and rank, with Batch Extracts dropping out of the top 20 by December and Sauce Essentials following suit. Meanwhile, Legit Labs maintained a relatively stable position, and North Cannabis Co. showed some improvement but remained outside the top 20. This competitive analysis suggests that Party Favors is gaining momentum in the Michigan vapor pen market, potentially positioning itself as a rising contender against more established brands.

Notable Products

In January 2026, the top-performing product from Party Favors was Peach Rings Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from December 2025 with sales of 3,240 units. Bubble Gum Burst Distillate Cartridge (1g) made a notable entry into the rankings, securing the second spot. Apples & Bananas Distillate Cartridge (1g) dropped from second place in December to third in January, indicating a slight decline in performance. Lemon Cherry Gelato Distillate Cartridge (1g) re-entered the rankings at fourth place, while Acapulco Gold Distillate Cartridge (1g) fell to fifth, continuing its downward trend from previous months. These shifts highlight the dynamic changes in consumer preferences within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.