Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

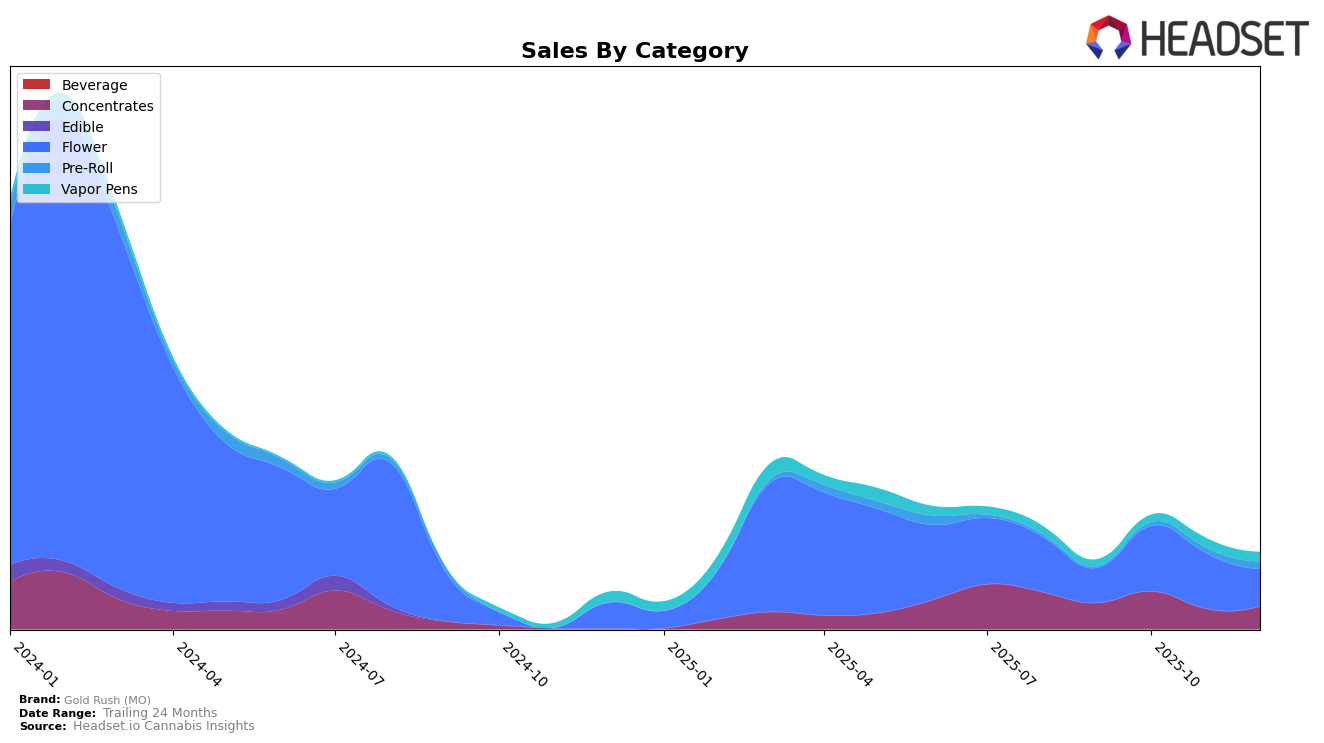

Gold Rush (MO) has shown varied performance across different product categories in Missouri. In the Concentrates category, the brand has experienced a slight upward trajectory, moving from the 25th position in September to the 20th in October, although it slipped to 30th in November before recovering to 29th in December. This fluctuation suggests a competitive market where Gold Rush (MO) is striving to maintain its presence. Meanwhile, in the Flower category, the brand has not been able to break into the top 30 consistently, peaking at 47th in October but dropping to 54th by December, indicating potential challenges in this segment.

In the Pre-Roll category, Gold Rush (MO) emerged into the rankings in November and December, securing the 83rd and 81st positions, respectively. This late entry into the rankings could suggest a new or expanding product line that is beginning to gain traction. On the other hand, the Vapor Pens category has seen a relatively stable performance, with the brand hovering around the 77th to 81st positions throughout the last quarter of 2025. This stability could reflect a steady consumer base for their vapor pen offerings in Missouri, despite not breaking into the top 30, which might be an area for potential growth.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Gold Rush (MO) has shown fluctuating performance in recent months. While it achieved a notable improvement in rank from 57th in September 2025 to 47th in October, it faced a slight decline to 54th by December. This indicates a dynamic competitive environment where brands like Old Pal and Monopoly Melts are also vying for market share. Notably, Old Pal maintained a stronger position, consistently ranking higher than Gold Rush (MO) throughout the period, with a peak at 47th in November. Meanwhile, Monopoly Melts showed resilience, ending December at 51st, slightly ahead of Gold Rush (MO). The sales trajectory for Gold Rush (MO) mirrored its rank fluctuations, with a peak in October followed by a decline, suggesting potential challenges in sustaining momentum against these competitors. As the market evolves, understanding these dynamics is crucial for stakeholders looking to capitalize on growth opportunities in Missouri's Flower category.

Notable Products

In December 2025, the top-performing product from Gold Rush (MO) was Wil-Omb Pre-Roll (1g), which climbed to the number one spot with sales of 605 units. First Class Funk Pre-Roll (1g) dropped to second place after leading in November, with a notable decline in sales to 577 units. Goofiez Pre-Roll (1g) improved its position to third place from fourth in November. First Class Funk (3.5g) ranked fourth, showing a resurgence after not being in the top ranks for the previous months. London Pound Cake (3.5g) entered the top five for the first time, securing the fifth position in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.