Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

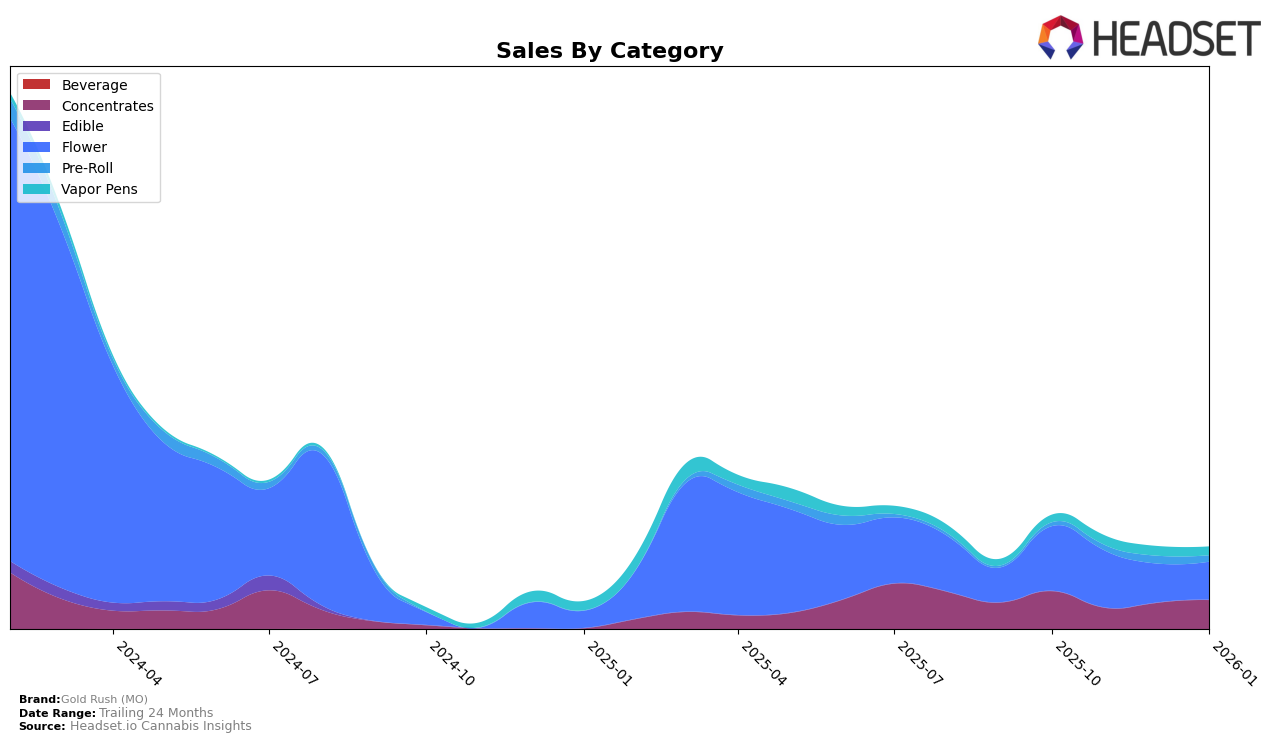

Gold Rush (MO) has shown varied performance across different product categories in Missouri. In the Concentrates category, the brand maintained a position within the top 30, experiencing a slight rise from 30th place in November 2025 to 25th in January 2026. This upward trend suggests a steady recovery after a dip in sales in November. However, their performance in the Flower category has not been as strong, with the brand consistently ranking outside the top 30, peaking at 48th in October and November 2025, and then slightly dropping to 53rd by January 2026. This indicates challenges in gaining a competitive edge in this highly competitive category.

The Pre-Roll category presents another area of concern, as Gold Rush (MO) did not rank within the top 30 throughout the observed period, beginning at 88th in November and marginally improving to 82nd by January 2026. Meanwhile, in the Vapor Pens category, the brand showed a positive trajectory, improving from 84th in October 2025 to 77th by January 2026. This improvement in ranking, despite the competitive market, indicates potential growth opportunities. Overall, while Gold Rush (MO) has faced challenges, particularly in the Flower and Pre-Roll categories, there are signs of progress in Concentrates and Vapor Pens that could be leveraged for future growth.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Gold Rush (MO) has experienced fluctuations in its market position, which could impact its strategic decisions moving forward. Notably, Gold Rush (MO) maintained a stable rank of 48 in October and November 2025 but saw a decline to 54 and 53 in December 2025 and January 2026, respectively. This downward trend in rank coincides with a significant drop in sales, from 134,043 in October to 78,463 by January. In contrast, Old Pal showed a positive trajectory, improving its rank from 55 in October to 44 in January, with a corresponding increase in sales. Similarly, Happy Eddie climbed from a rank of 63 in October to 52 in January, reflecting a steady rise in sales. Meanwhile, Monopoly Melts and Asteroid Cannabis experienced more stability, with minor rank fluctuations. These dynamics suggest that Gold Rush (MO) may need to reassess its market strategies to regain its competitive edge and address the sales decline in the Missouri Flower market.

Notable Products

In January 2026, Gold Rush (MO) saw Goofiez Pre-Roll (1g) maintain its top position from December as the leading product with sales of 669 units. Wil-Omb Pre-Roll (1g) also held steady in second place, reflecting consistent demand. First Class Funk (3.5g) improved its ranking to third, up from fourth in December, indicating a rising preference for this flower product. Lemon Cherry Gelato Sugar Wax (1g) entered the top rankings at fourth place, marking its first appearance on the list. Meanwhile, Banana Foster Sugar Wax (1g) dropped to fifth, having previously been unranked in the last two months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.