Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

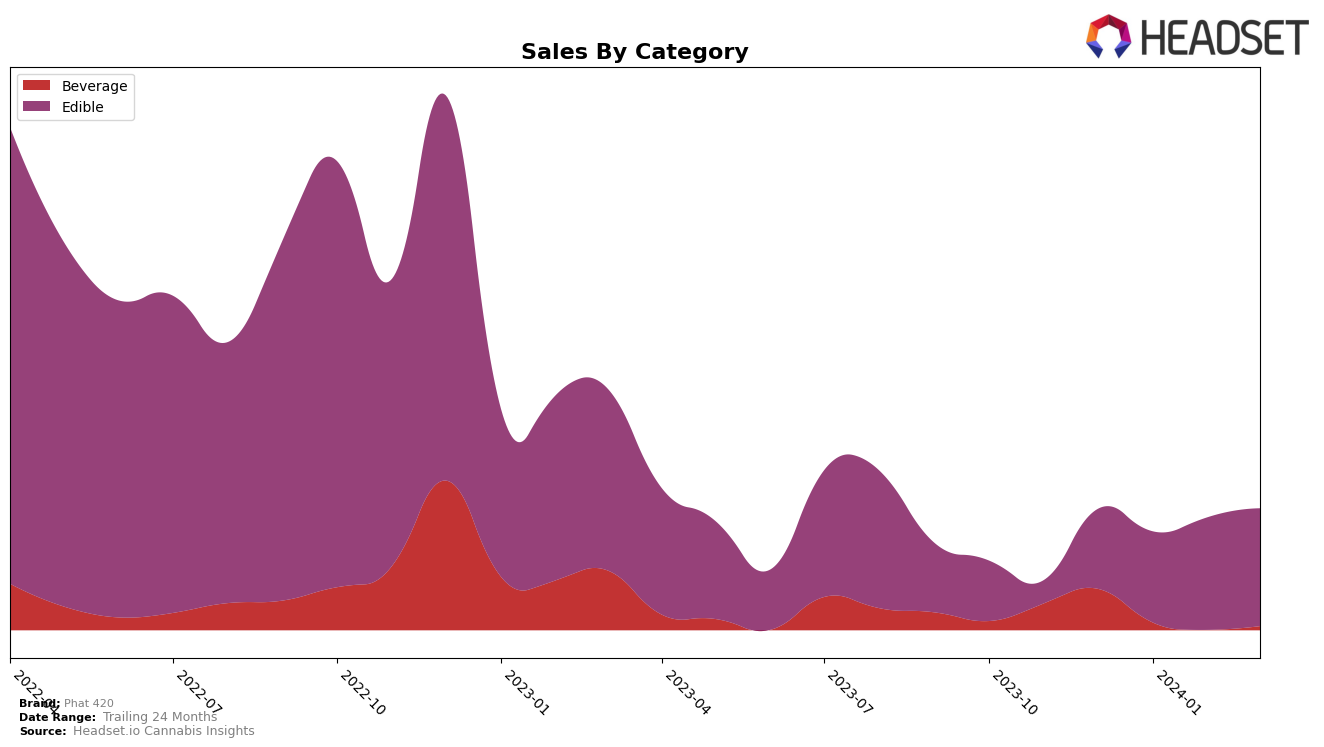

In the dynamic landscape of cannabis markets across Canada, Phat 420 has shown varying degrees of success and challenges. In Alberta, the brand's performance in the Edibles category has seen a fluctuating trajectory, with rankings moving from 63rd in December 2023 to a peak of 52nd in February 2024, before sliding back to 65th in March 2024. This inconsistency might raise concerns, especially considering the drop in rankings despite an initial increase in sales from December 2023 to February 2024. Contrastingly, in British Columbia, Phat 420 has demonstrated stronger performance in the Edibles category, maintaining a stable position around the mid-20s in rankings from December 2023 to March 2024, alongside a remarkable growth in sales, culminating in 8,050 units sold in March 2024. This indicates a solid foothold in the British Columbia market, suggesting a well-received product line within the Edibles category.

However, the brand's endeavors in other categories and provinces present a mixed bag of outcomes. In the Beverages category in British Columbia, Phat 420 experienced a modest fluctuation in rankings, with a slight improvement from 21st in December 2023 to 26th in March 2024, despite a significant drop in sales after December 2023. This could imply challenges in sustaining consumer interest or competitive pressures in the Beverages sector. Meanwhile, in Ontario, the brand's performance within the Edibles category is notably struggling, with rankings declining from 74th in December 2023 to 88th in March 2024, alongside a decrease in sales. This downward trend in Ontario, Canada's largest market, could be particularly concerning for Phat 420's overall performance and market strategy. Additionally, the absence of Phat 420 from the top 30 brands in certain months and categories, such as in Saskatchewan for Edibles, highlights the brand's inconsistent market presence across provinces, underscoring the importance of strategic adjustments to enhance market penetration and consumer engagement.

Competitive Landscape

In the competitive landscape of the edible cannabis market in British Columbia, Phat 420 has shown a notable trajectory despite not breaking into the top 20 brands as of March 2024. Starting from a lower rank and sales in December 2023, Phat 420 has seen a consistent upward trend in both rank and sales through to March 2024, indicating a growing consumer interest and market share. This is in contrast to some of its competitors like White Rabbit OG and BLAST, which, despite higher initial ranks and sales, have experienced more significant fluctuations and, in the case of BLAST, a notable decline in sales. Meanwhile, brands like Olli and Rosin Heads have also shown volatility in their rankings and sales figures, suggesting a highly competitive and dynamic market. Phat 420's steady growth amidst this fluctuating competitive environment highlights its potential resilience and appeal in the edibles category, suggesting a brand on the rise, albeit from a lower starting point.

Notable Products

In March 2024, Phat 420's top-selling product was the CBD Infused Sugar 20-Pack (600mg CBD) within the Edible category, achieving sales of 207 units. Following closely, the Milk Chocolate Bar (10mg) secured the second position, showcasing a consistent performance in the top ranks across previous months. The THC Infused White Sugar (10mg) dropped to the third spot in March after leading the sales in February, indicating a shift in consumer preference. The Dark Chocolate With Almonds Bar (10mg) made a notable climb to the fourth rank, despite not being in the top ranks in the earlier months, reflecting a growing interest in diverse flavors. Lastly, the Wicked Mug Brownie (10mg), despite being the top seller in January, fell to the fifth position, underscoring the competitive and changing nature of product preferences within Phat 420's Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.