Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

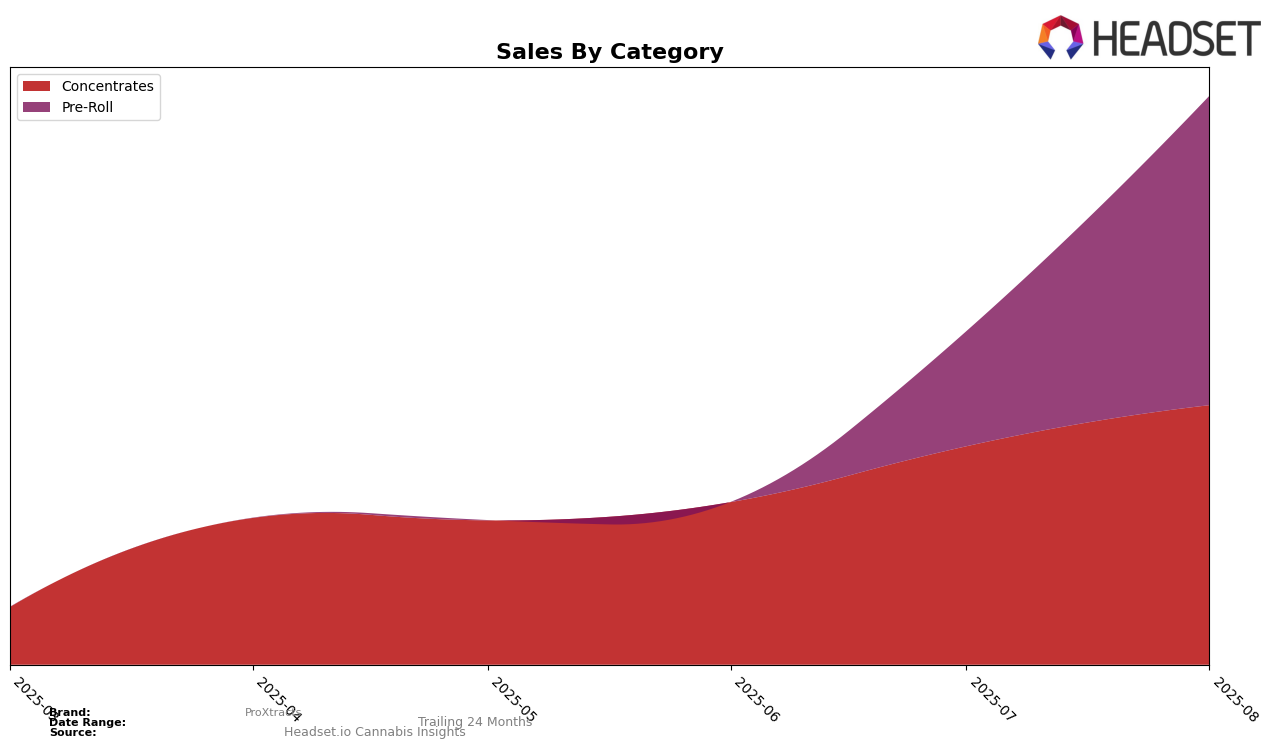

ProXtracts has shown a notable performance in the New York concentrates market over the summer months of 2025. The brand was not ranked in the top 30 in May, but it made a significant leap to 32nd position in June, followed by a rise to 30th place in both July and August. This upward movement indicates a growing presence and acceptance in the market, suggesting that ProXtracts is gaining traction among consumers. The steady climb into the top 30 by August is a positive sign, highlighting the brand's potential to further solidify its position in the New York concentrates category.

Despite the absence of a ranking in May, the subsequent months have seen ProXtracts make consistent gains, which can be attributed to a strategic approach or perhaps an increase in consumer interest in their products. The sales data reflects this upward trajectory, with a notable increase in sales figures from June through August. This trend is an encouraging indicator for the brand's future performance in the New York market. However, the absence of rankings in other states or provinces suggests that ProXtracts may still have room to expand its reach beyond New York, potentially tapping into other lucrative markets in the future.

Competitive Landscape

In the competitive landscape of the New York concentrates market, ProXtracts has shown a steady improvement in its ranking from June to August 2025, moving from 32nd to 30th place. This upward trend in rank is mirrored by a consistent increase in sales, suggesting a positive reception among consumers. However, ProXtracts faces stiff competition from brands like Mind Melters and UMAMII, which have maintained higher ranks throughout the same period. Notably, UMAMII experienced a drop in rank from 24th in June to 31st in August, potentially opening up opportunities for ProXtracts to capture market share. Meanwhile, High Peaks and Lola Lola have shown fluctuations in their rankings, indicating a volatile market environment. ProXtracts' ability to maintain and improve its position amidst these dynamics will be crucial for its continued growth in the New York concentrates category.

Notable Products

In August 2025, the top-performing product from ProXtracts was Melon Force One Infused Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one spot from its previous second-place ranking in July, achieving sales of 210 units. Mango Trop Cherry Hashish Temple Ball (1g) in the Concentrates category improved its position to second place, up from third in the previous month. Midnight Envy Hash Infused Pre-Roll (1g) debuted in the rankings at third place, showing strong initial sales. Supreme Purps Infused Pre-Roll (1g) rose to fourth place from its previous fifth-place ranking in July. Finally, Sativa Pre-Roll (1g) entered the rankings at fifth place, rounding out the top products for August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.