Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

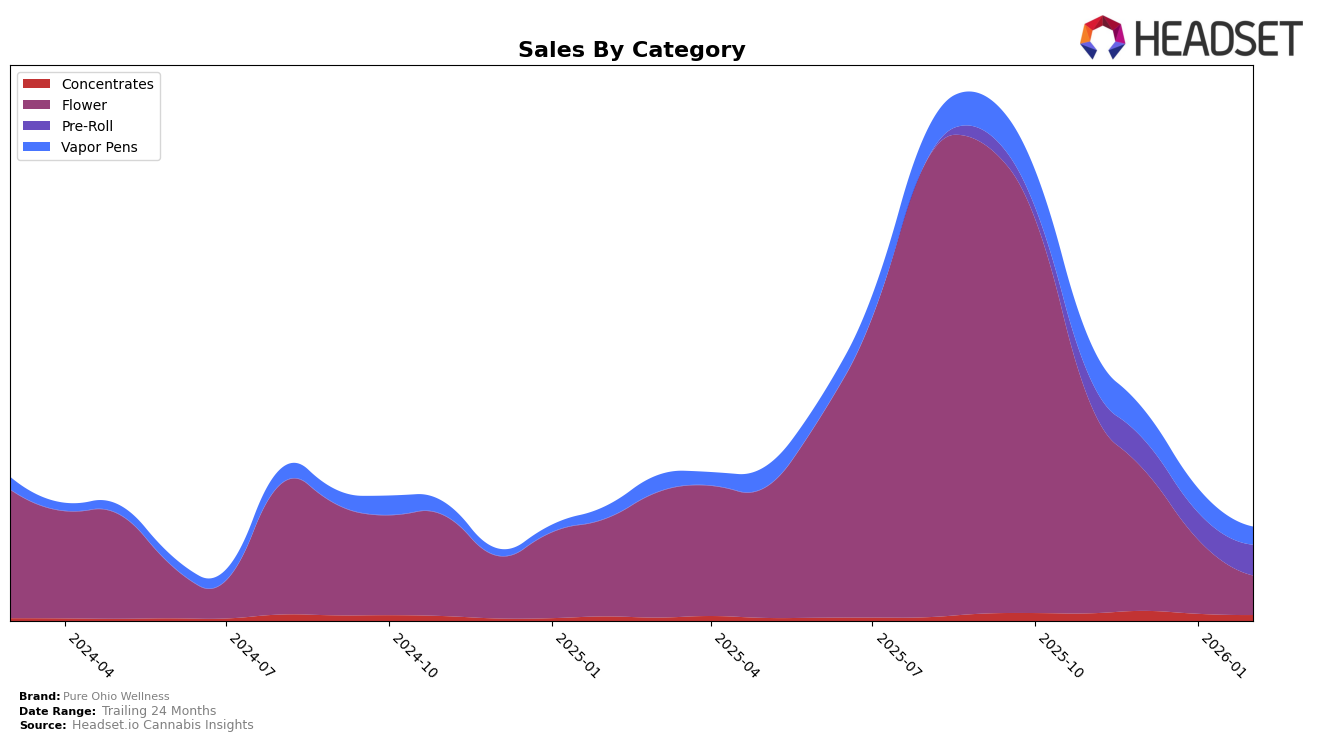

Pure Ohio Wellness has demonstrated varied performance across different product categories in Ohio. In the Concentrates category, the brand maintained a steady position around the mid-teens, ranking 18th in November 2025 and slightly improving to 16th in both December 2025 and January 2026 before slipping to 19th in February 2026. This indicates a relatively stable presence in the Concentrates market, although the decline in February suggests some competitive pressures or shifts in consumer preferences. The Pre-Roll category shows a more positive trajectory, with the brand improving from 11th in November 2025 to 9th in December 2025, before stabilizing around 10th to 12th in the following months. This stability in rankings, coupled with a rise in sales to 208,540 in February 2026, suggests a strong and possibly strengthening position in the Pre-Roll market.

Conversely, the Flower and Vapor Pens categories present more challenging scenarios for Pure Ohio Wellness. For Flower, the brand's ranking fell from 13th in November 2025 to 31st by February 2026, indicating a significant decline in market presence. This downward trend could be attributed to increased competition or changing consumer preferences. The Vapor Pens category also saw a decline, with the brand dropping from 25th to outside the top 30 by February 2026. The absence from the top 30 in February highlights potential challenges in maintaining competitiveness within this category. These movements suggest areas where Pure Ohio Wellness might need to focus on strategic improvements to regain market share.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Pure Ohio Wellness has experienced a notable decline in its ranking over the months from November 2025 to February 2026. Initially holding a strong position at rank 13 in November 2025, Pure Ohio Wellness saw a drop to rank 31 by February 2026. This downward trend in rank coincides with a significant decrease in sales, suggesting a potential loss of market share. In contrast, competitors such as Later Days and Wellspring Fields have shown upward momentum. Later Days improved from rank 54 to 29, and Wellspring Fields maintained a more stable position, fluctuating slightly but ending at rank 30. These shifts indicate that while Pure Ohio Wellness was once a leading player, it faces increasing competition from brands that are gaining traction in the market. This dynamic suggests a need for Pure Ohio Wellness to reassess its strategies to regain its competitive edge in the Ohio flower market.

Notable Products

In February 2026, the top-performing product for Pure Ohio Wellness was Animal Mints Pre-Roll (1g) in the Pre-Roll category, achieving the highest rank for the month. Skunky Jack (2.83g) in the Flower category followed closely, securing the second position with sales of 2,955 units, marking a recovery from its fourth position in December 2025. Frozen Bananas Pre-Roll 2-Pack (1g) debuted in the rankings at third place, indicating strong consumer interest. Hell on Wheels (2.83g), also in the Flower category, dropped to fourth place, reflecting a decline from its peak position in December 2025. Hiker's Blend Pre-Roll (1g) completed the top five, maintaining its fifth-place ranking from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.