Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

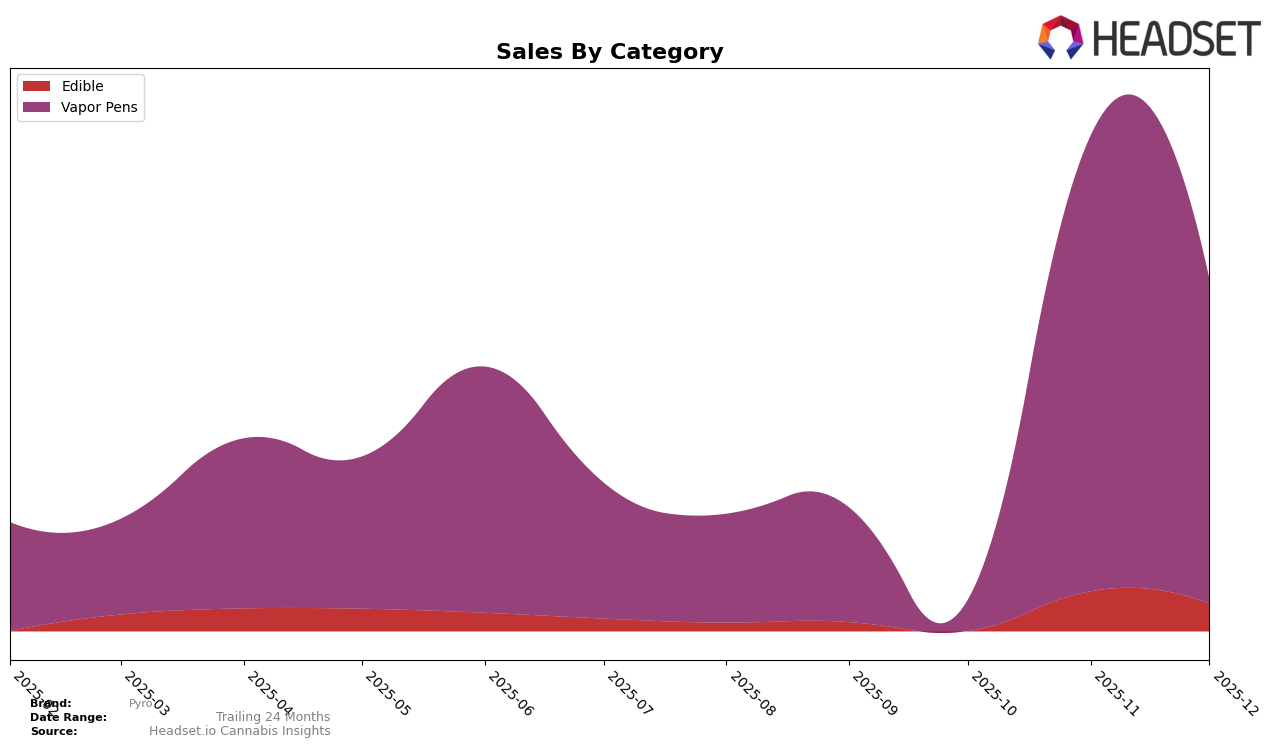

In the state of Missouri, Pyro has shown notable fluctuations across different product categories. Within the Edible category, Pyro's presence has been somewhat inconsistent, with rankings outside the top 30 in September and October 2025, before climbing to the 37th position in November and slightly declining to 40th in December. This suggests a growing but volatile interest in Pyro's edibles, possibly indicating seasonal influences or promotional impacts. On the other hand, the Vapor Pens category has been a stronger suit for Pyro in Missouri, with a significant jump from the 61st position in October to the 18th position in November, before settling at 23rd in December. This upward trend in the Vapor Pens category highlights Pyro's increasing market penetration and consumer acceptance in this segment.

Pyro's performance across these categories in Missouri offers a mixed bag of insights. The brand's ability to break into the top 30 for Vapor Pens suggests a competitive edge and potential for further growth, especially considering the impressive sales surge observed in November. However, the Edible category's ranking fluctuations indicate challenges that Pyro may need to address to achieve stable growth in this segment. The absence from the top 30 in the earlier months for edibles might reflect market saturation or the need for more targeted marketing strategies. Pyro's journey through the rankings provides a glimpse into the dynamics of consumer preferences and market competition in Missouri, offering valuable lessons for future strategic planning.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Pyro has experienced notable fluctuations in its market position from September to December 2025. Pyro's rank saw a dramatic improvement from 61st in October to 18th in November, before settling at 23rd in December. This upward trajectory in November suggests a significant boost in consumer interest or successful marketing strategies during that period. In contrast, Platinum Vape maintained a relatively stable position, hovering around the 15th to 20th ranks, but their sales showed a declining trend, potentially indicating market saturation or increased competition. Meanwhile, Safe Bet and Flora Farms remained outside the top 20 for most of the period, with Flora Farms showing a slight upward trend in sales, possibly hinting at a growing customer base. Pyro's ability to leap into the top 20 in November highlights its potential to capture market share, though sustaining this momentum will be crucial in the face of established competitors.

Notable Products

In December 2025, Pyro's top-selling product was the Blueberry Diesel Distillate Cartridge (1g) in the Vapor Pens category, which achieved the number one rank with sales of 1555 units. Following closely was the Sunset Sherbert Distillate Cartridge (1g), also in the Vapor Pens category, securing the second position. The Green Crack Distillate Cartridge (1g) maintained a strong presence, ranking third, consistent with its September performance. Notably, the Edible category saw the Cheddar Cheesepuffs (200mg) rise to the fourth position. The Blackberry Kush Distillate Premium Disposable (1g) rounded out the top five, climbing from its previous fourth position in October to fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.