Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

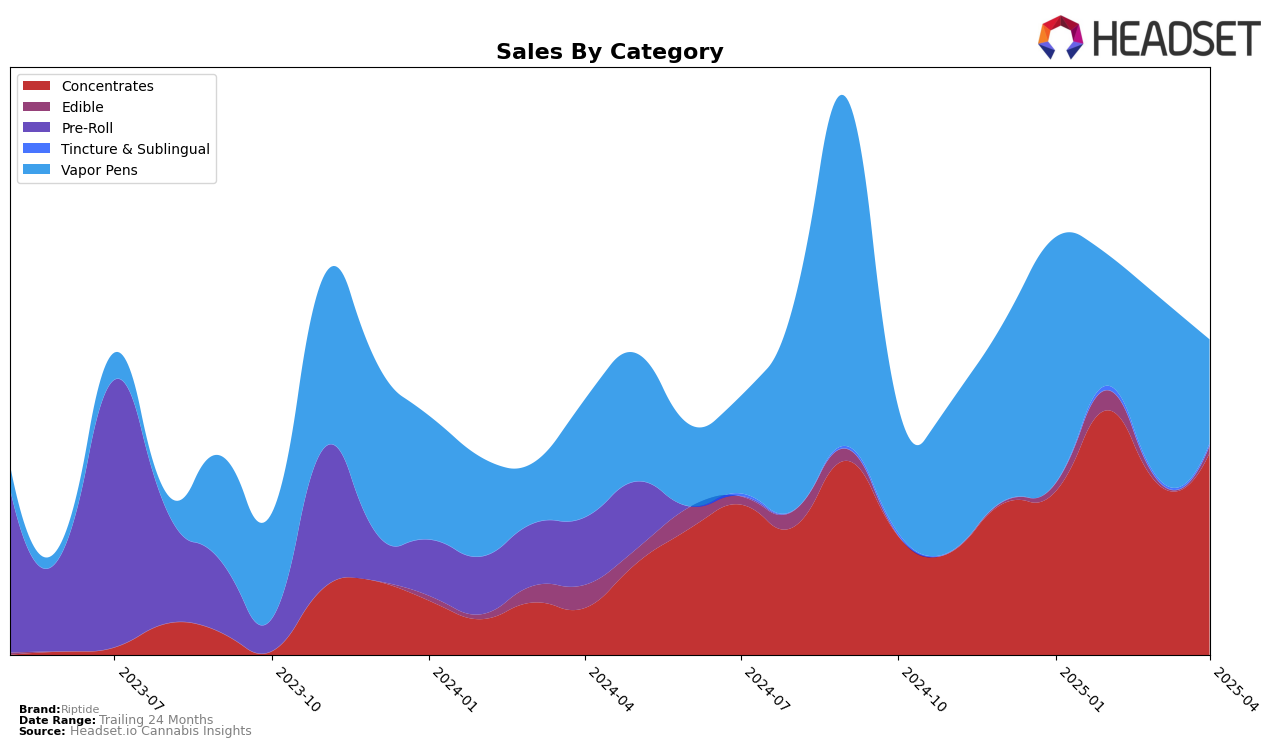

Riptide's performance in the Oregon market has shown some fluctuations across different product categories. In the Concentrates category, Riptide was not part of the top 30 brands, with rankings hovering outside the top 40 for the first four months of 2025. Specifically, they ranked 47th in January, improved to 40th in February, but then slipped back to 50th in March before slightly recovering to 44th in April. This indicates some volatility in their market position, although there was a noticeable sales increase from January to February, suggesting potential growth opportunities if they can stabilize their ranking.

In contrast, Riptide's presence in the Vapor Pens category in Oregon has been more challenging. They were ranked 61st in January and saw a decline to 77th in February, with a slight improvement to 71st in March, but then fell further to 88th in April. This downward trend in rankings, coupled with a decrease in sales from February to April, highlights a need for strategic adjustments to regain market share. The absence from the top 30 brands in both categories suggests that while Riptide has a presence, there's significant room for improvement to become a more dominant player in the Oregon market.

Competitive Landscape

In the competitive landscape of the Oregon concentrates market, Riptide has shown a fluctuating performance in the first quarter of 2025, with its rank moving from 47th in January to 44th in April. This indicates a slight improvement, albeit with some volatility, as it briefly dropped to 50th place in March. Notably, Eugreen Farms and Kaprikorn have consistently outperformed Riptide, maintaining higher ranks throughout the period, with Kaprikorn even climbing from 31st in February to 27th in March. Meanwhile, Hapy Kitchen and Rogue Gold have shown more erratic rankings, yet both managed to surpass Riptide in April. These dynamics suggest that while Riptide is making progress, it faces stiff competition from brands that are either consistently ahead or showing stronger upward trends in sales and rankings.

Notable Products

In April 2025, Riptide's top-performing product was Nimbus Snacks RSO Live Resin (1g) in the Concentrates category, climbing from second place in February to secure the top rank with sales reaching 170 units. Wonder Cakes Live Resin (1g) debuted in the rankings at the second position with sales of 161 units, while Truck Stop Edible Live Resin Oil (1g) entered the list at third place. Orange Cookies Live Resin Cartridge (1g) followed closely in fourth place, and Jungle Gym RSO (1g) rounded out the top five. This month marked the first appearance of several products in the rankings, indicating a significant shift in consumer preferences towards these new offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.