Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

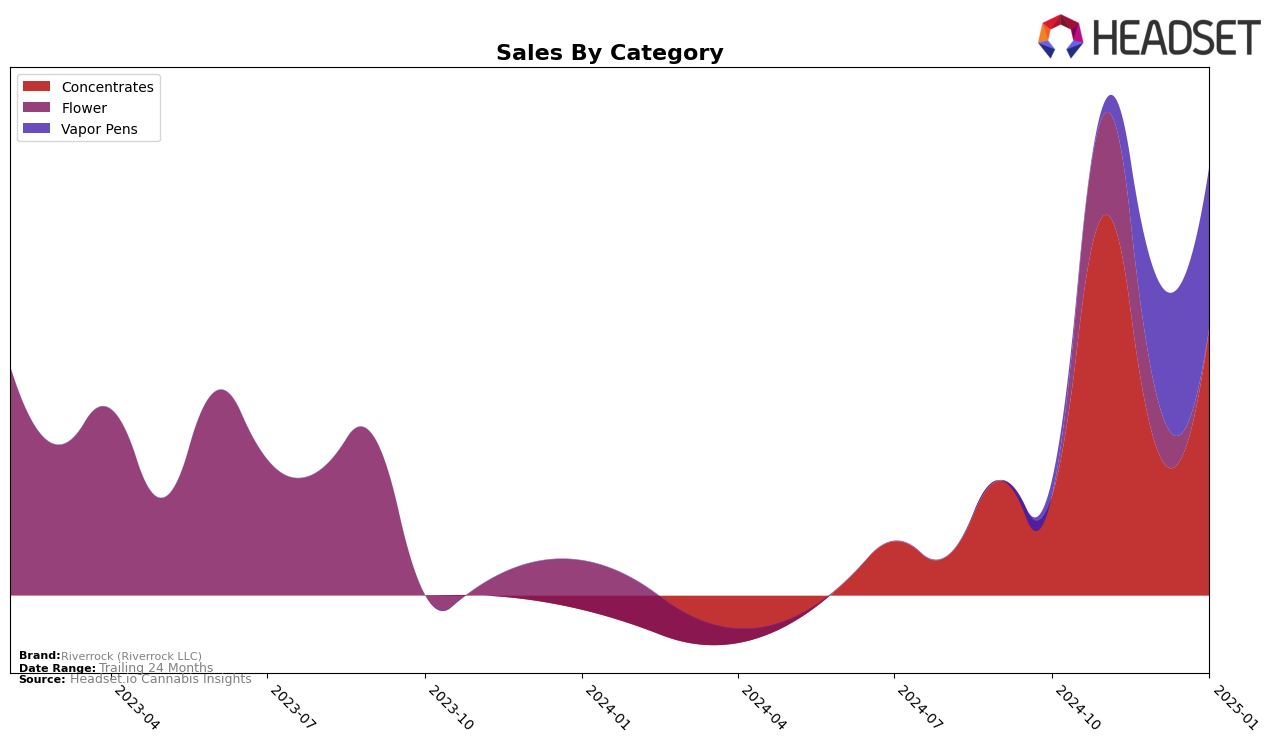

Riverrock (Riverrock LLC) has shown notable performance in the Colorado market, particularly within the Concentrates category. After not appearing in the top 30 brands in October 2024, Riverrock made a significant leap to rank 30th in November, though it slipped to 45th in December before regaining the 30th position by January 2025. This fluctuation in rankings coincides with a notable increase in sales from October to November, followed by a dip in December and another increase in January, indicating a dynamic market presence. In contrast, Riverrock's performance in the Flower category in Colorado was less impressive, not breaking into the top 30 at any point, with a ranking of 98th in November 2024, suggesting room for growth in this category.

In the Vapor Pens category, Riverrock's trajectory in Colorado has been more stable, with an entry into the rankings at 75th in December 2024 and an improvement to 64th by January 2025. This upward trend, coupled with increasing sales figures, suggests growing consumer acceptance and a positive reception of their vapor pens. The absence of Riverrock in the top 30 in October and November highlights the brand's late but promising entry into the competitive landscape of vapor pens, indicating potential for further growth and increased market share in the coming months.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, Riverrock (Riverrock LLC) has shown a notable improvement in rank from October 2024 to January 2025, climbing from 58th to 30th place. This upward trajectory suggests a significant increase in market presence and consumer preference. In contrast, competitors like Newt Brothers Artisanal and The Greenery Hash Factory have experienced fluctuations in their rankings, with Newt Brothers Artisanal dropping out of the top 20 altogether by January 2025. Meanwhile, 14er Gardens maintained a relatively stable position, though it too saw a decline from 17th to 31st place over the same period. This indicates a shifting competitive dynamic where Riverrock (Riverrock LLC) is gaining ground against established brands, potentially due to strategic marketing efforts or product innovations that resonate with consumers. For businesses seeking to understand market trends, these insights underscore the importance of agility and adaptation in maintaining competitive advantage.

Notable Products

In January 2025, Riverrock (Riverrock LLC) saw Boof Almighty Live Rosin (1g) as their top-performing product, securing the number one rank in sales among all offerings. The Super Boof Rosin Cartridge (1g) followed closely, ranking second, having previously held the top spot in December 2024. The Grape Cake Live Rosin (1g) entered the rankings at third place, showcasing strong performance in the concentrates category. Ice Cream Cake Rosin Cartridge (0.5g) maintained a steady position at fourth place, consistent with its ranking in December 2024. Notably, Super Boof Live Rosin (1g) dropped from its previous top positions in October and November 2024 to fourth place in January 2025, indicating a shift in consumer preferences within the concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.