Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

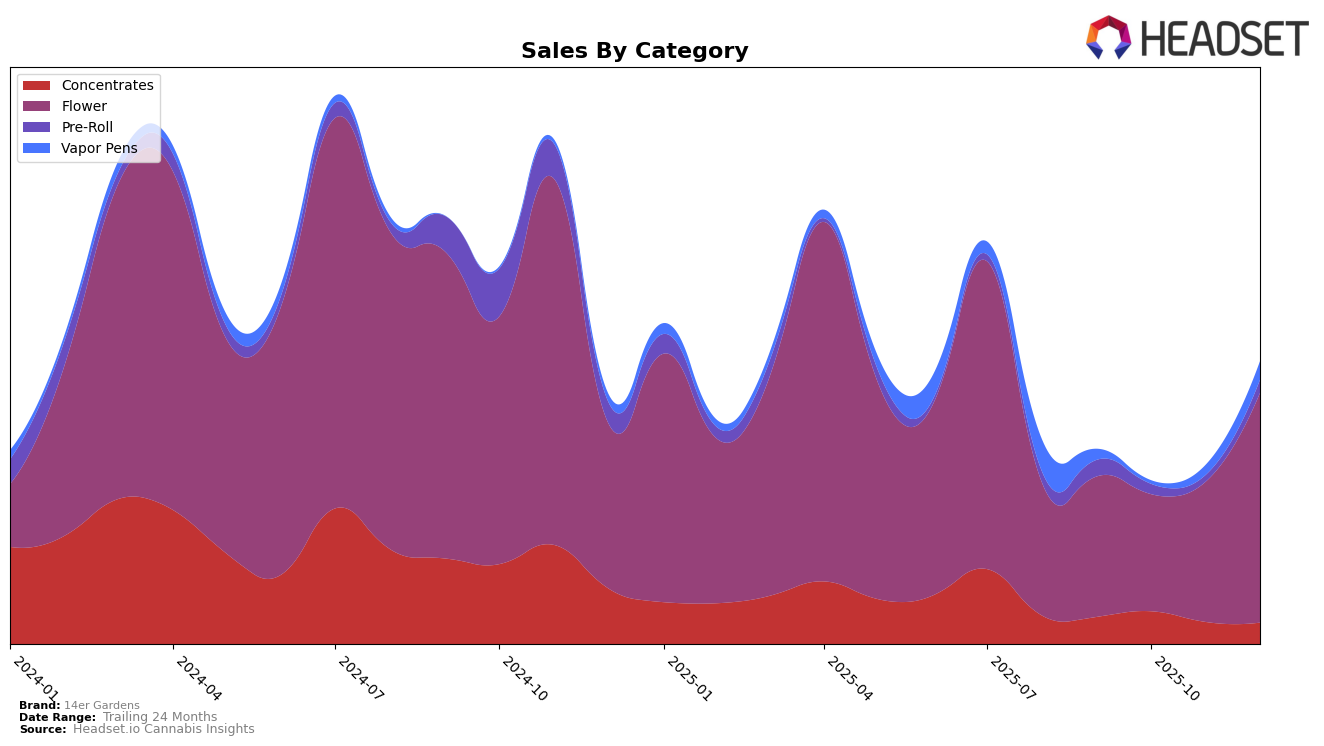

14er Gardens has demonstrated varied performance across different product categories in Colorado. In the Concentrates category, the brand has consistently ranked outside the top 30, with a slight improvement in October 2025 before slipping again by December. This indicates a challenging market for their concentrates, despite an initial uptick in sales. Conversely, their Flower category has shown a strong upward trajectory, moving from a rank of 47 in September to breaking into the top 30 by December. This significant climb in rank suggests an increased consumer preference or successful marketing efforts in this category.

In other categories, 14er Gardens has experienced mixed results. The Pre-Roll category saw the brand drop out of the top 30 in November, only to re-enter in December, suggesting a fluctuating demand or supply issues during that period. Meanwhile, the Vapor Pens category showed a positive trend, with the brand improving its ranking from 81 in September to 68 in December, despite not ranking in October. This improvement could indicate growing consumer interest or effective distribution strategies in this product line. Overall, while some categories present growth opportunities, others highlight areas that may require strategic adjustments for 14er Gardens.

Competitive Landscape

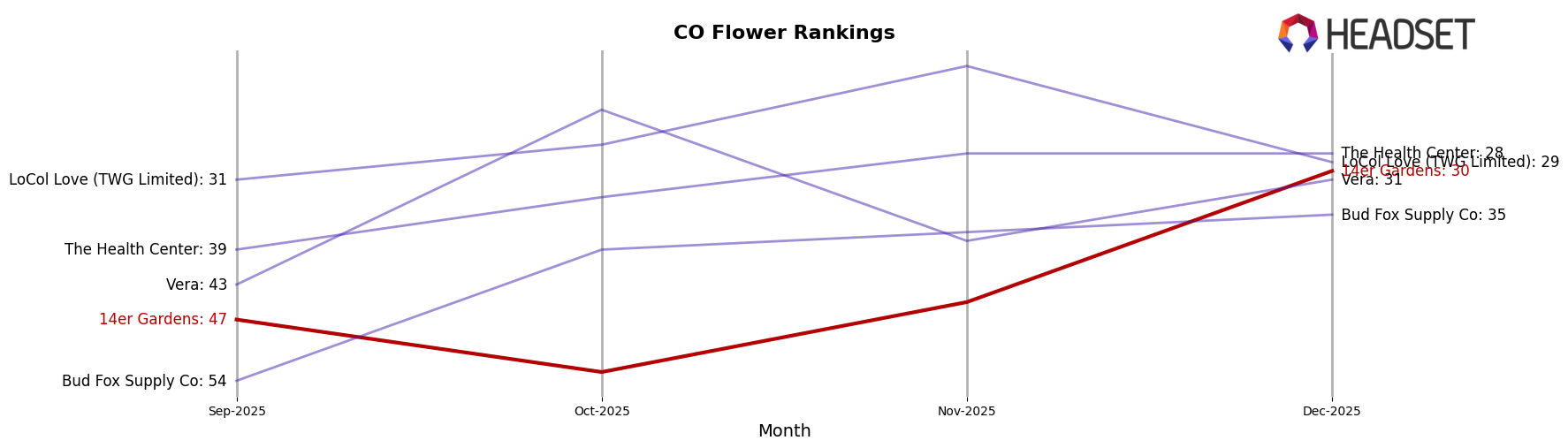

In the competitive landscape of the Flower category in Colorado, 14er Gardens has demonstrated a notable upward trajectory in its rank from September to December 2025. Initially positioned at 47th in September, 14er Gardens climbed to 30th by December, indicating a significant improvement in market presence. This positive trend contrasts with competitors such as LoCol Love (TWG Limited), which experienced fluctuations, peaking at 18th in November but dropping to 29th by December. Similarly, Vera saw a decline from 23rd in October to 31st in December, while Bud Fox Supply Co maintained a relatively stable position, ending at 35th. The consistent rise in 14er Gardens' rank suggests a strengthening brand presence and potentially increasing consumer preference, which could be leveraged for strategic marketing initiatives to further enhance sales and brand loyalty in the competitive Colorado market.

Notable Products

In December 2025, the top-performing product from 14er Gardens was Strawberry Blondie (3.5g) in the Flower category, which rose to the first position with sales of 1640. The Citrus Grove CannaTerp Cartridge (1g) in the Vapor Pens category jumped to second place, improving from fourth in November, with notable sales of 1262. Blue Garlic (3.5g) made a debut at third place, while Premium Pupcake (3.5g) slipped from second to third place, maintaining strong sales at 1126. Crepe De La Crepe (3.5g) entered the rankings at fourth position, showing a competitive sales figure of 1098. This month saw significant shifts in rankings, with several new entries and movements among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.