Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

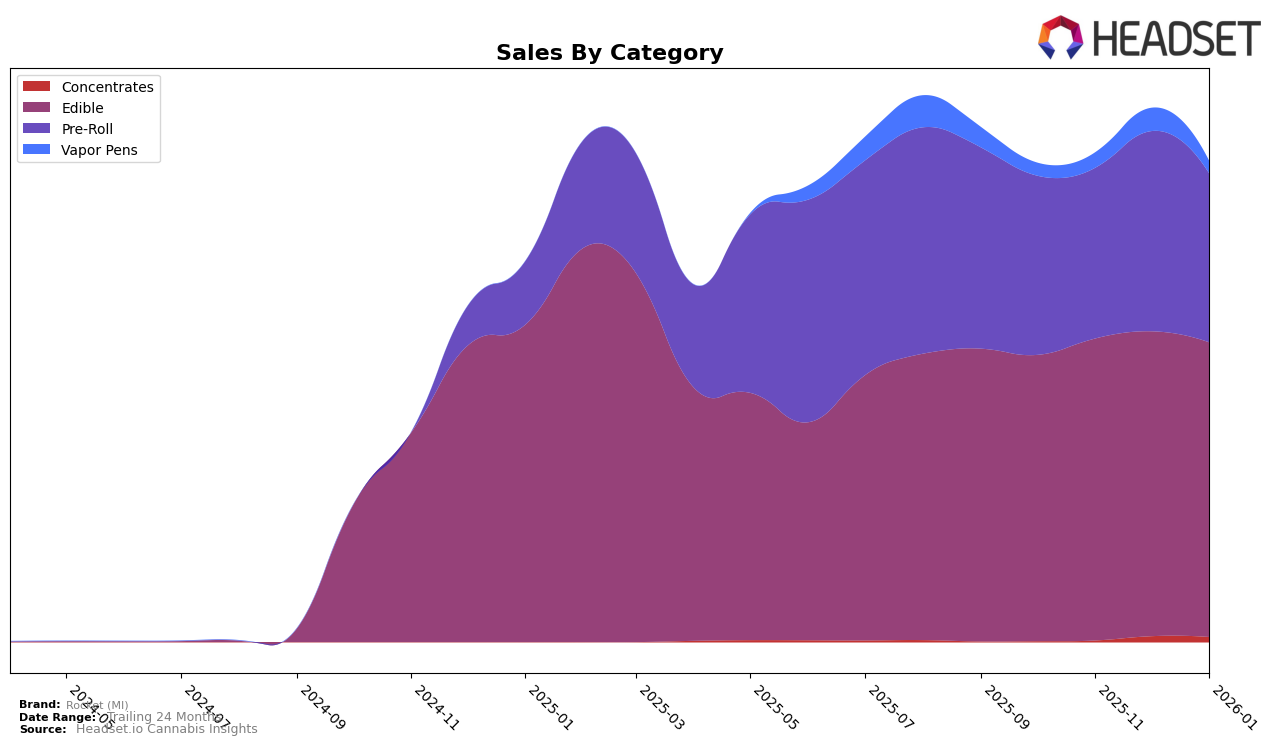

Rocket (MI) has shown a consistent performance in the Edible category within Michigan. Over the four-month period from October 2025 to January 2026, the brand has steadily improved its ranking, moving from 15th to 12th place. This upward trend suggests a growing consumer preference for Rocket (MI) edibles, as evidenced by an increase in sales from $483,289 in October to $497,277 by January. While the sales figures demonstrate some fluctuations, the overall trajectory remains positive, indicating a strengthening position in the market.

In contrast, Rocket (MI)'s performance in the Pre-Roll category in Michigan has been more volatile. Although they managed to break into the top 30 by December 2025, landing at 30th place, their rank only slightly improved to 29th in January 2026. This indicates a more challenging competitive landscape for their pre-roll products. Despite a notable spike in sales in December, reaching $337,701, the subsequent decline to $284,475 in January highlights the brand's struggle to maintain consistent growth in this category. This mixed performance across categories suggests that while Rocket (MI) is gaining traction with edibles, there is room for improvement in their pre-roll offerings.

Competitive Landscape

In the competitive landscape of the Michigan edible cannabis market, Rocket (MI) has shown a promising upward trajectory in recent months. From October 2025 to January 2026, Rocket (MI) improved its rank from 15th to 12th, indicating a positive trend in consumer preference and market penetration. This improvement in rank is noteworthy, especially when compared to competitors like Detroit Edibles / Detroit Fudge Company, which slipped from 9th to 11th place, and NOBO, which maintained a relatively stable position around the 10th rank. Rocket (MI)'s sales figures also reflect this upward momentum, showing a consistent performance that surpassed Banned Cannabis Edible Co. and Dope Rope throughout the period. This data suggests that Rocket (MI) is effectively capturing market share and could continue to climb the ranks if current trends persist.

Notable Products

In January 2026, the top-performing product for Rocket (MI) was the Cotton Candy Clouds Gummies 10-Pack (200mg) in the Edible category, maintaining its first-place rank from October through January, despite a slight decrease in sales to 36,085 units. Strawberry Supernova Gummies 10-Pack (200mg) moved up to the second rank from fifth in December, showing a notable increase in sales. The Sour Green Apple Infused Pre-Roll (1.2g) dropped from the first rank in December to third in January, reflecting a decrease in sales from its peak. Fruity Flash Gummies 10-Pack (200mg) entered the rankings for the first time in January, achieving a fourth-place rank. Blazing Starfruit Gummies 10-Pack (200mg) also made its debut in the rankings, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.