Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

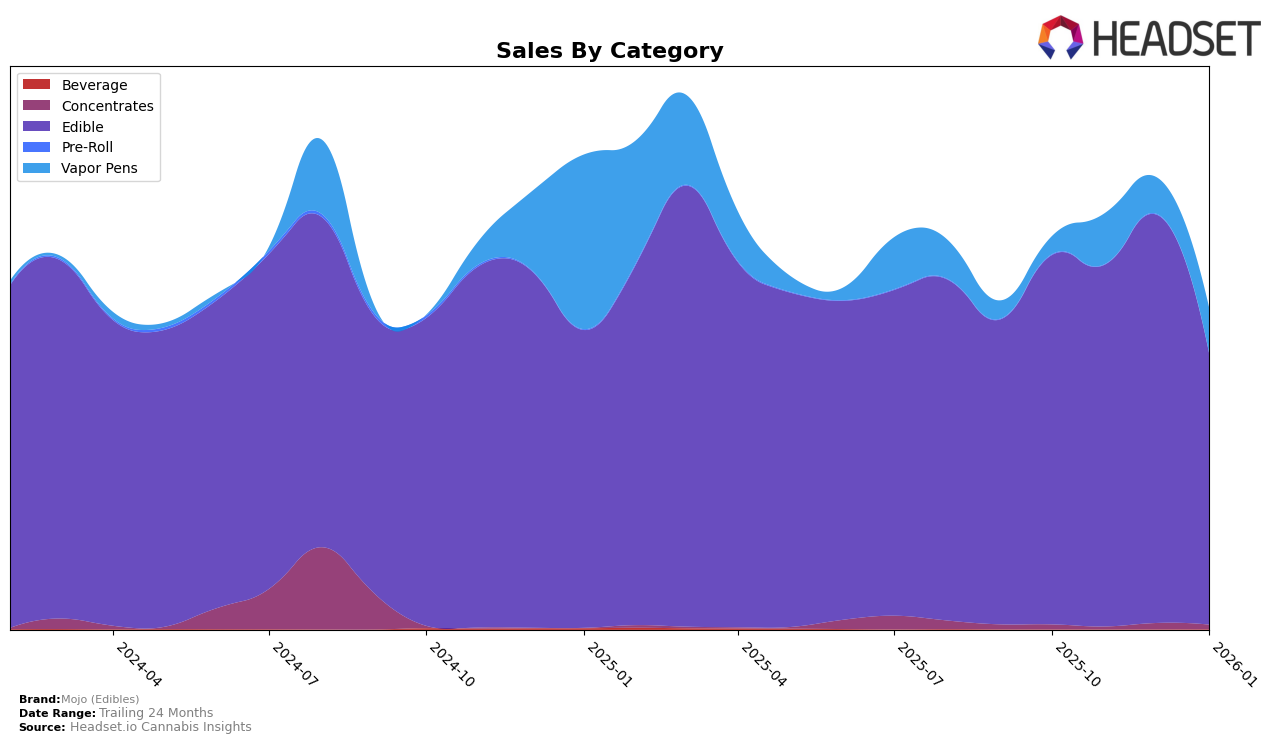

In the Michigan market, Mojo (Edibles) has demonstrated fluctuating performance in the Edible category. Starting at rank 13 in October 2025, the brand experienced a slight dip to 15 in November, before climbing back to 12 in December. However, by January 2026, they had fallen to rank 16. Despite these ranking shifts, the sales figures reveal an interesting trend; while there was a decline in sales from October to November, a notable increase occurred in December, indicating a possible seasonal boost, before sales dropped again in January. This pattern suggests that while Mojo (Edibles) has a solid presence, maintaining consistent growth remains a challenge.

In contrast, the Nevada market presents a different scenario for Mojo (Edibles) in the Vapor Pens category. The brand was not in the top 30 in October 2025 but managed to enter the rankings at number 30 in November. This entry was followed by a slight drop to 32 in December and January. The initial surge in rank suggests successful strategic adjustments or product launches that allowed them to break into the competitive space. However, maintaining this position will require further analysis and strategy, as the rankings have not improved since their initial entry into the top 30. This highlights the challenges of sustaining momentum in a highly competitive category.

Competitive Landscape

In the competitive landscape of the Michigan edible market, Mojo (Edibles) has experienced fluctuating rankings over the past few months, indicating a dynamic competitive environment. In October 2025, Mojo (Edibles) held the 13th position, but by January 2026, it had slipped to 16th. This decline in rank is mirrored by a decrease in sales from November to January, suggesting potential challenges in maintaining market share. Meanwhile, Cannalicious Labs and Banned Cannabis Edible Co. have shown resilience, with Cannalicious Labs consistently ranking close to Mojo (Edibles) and Banned Cannabis Edible Co. even surpassing it in certain months. Notably, Amnesia, which was outside the top 20 in October, has made significant strides, reaching 18th by January, highlighting a potential emerging competitor. These shifts underscore the importance for Mojo (Edibles) to innovate and adapt strategies to regain and enhance its competitive positioning in the Michigan edible market.

Notable Products

In January 2026, the top-performing product from Mojo (Edibles) was the Crispy Wafer High Dose Chocolate Bites (200mg), which rose to the number one rank with sales of 8,213 units. Following closely was the Nuggy Caramel Peanut Bites Chocolates 10-Pack (200mg), which maintained a strong presence at the second spot despite a slight dip in sales. The Sativa Mini Peppermint Patties Chocolate 10-Pack (200mg) made a notable entry into the rankings at third place, showing a resurgence from previous months. Dubai Chocolate Bites 10-Pack (200mg) debuted at fourth place, marking its first appearance in the rankings. The Peanut Butter Chocolate Mini Bites 10-Pack (200mg), which previously held the top position, fell to fifth place, reflecting a significant decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.