Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

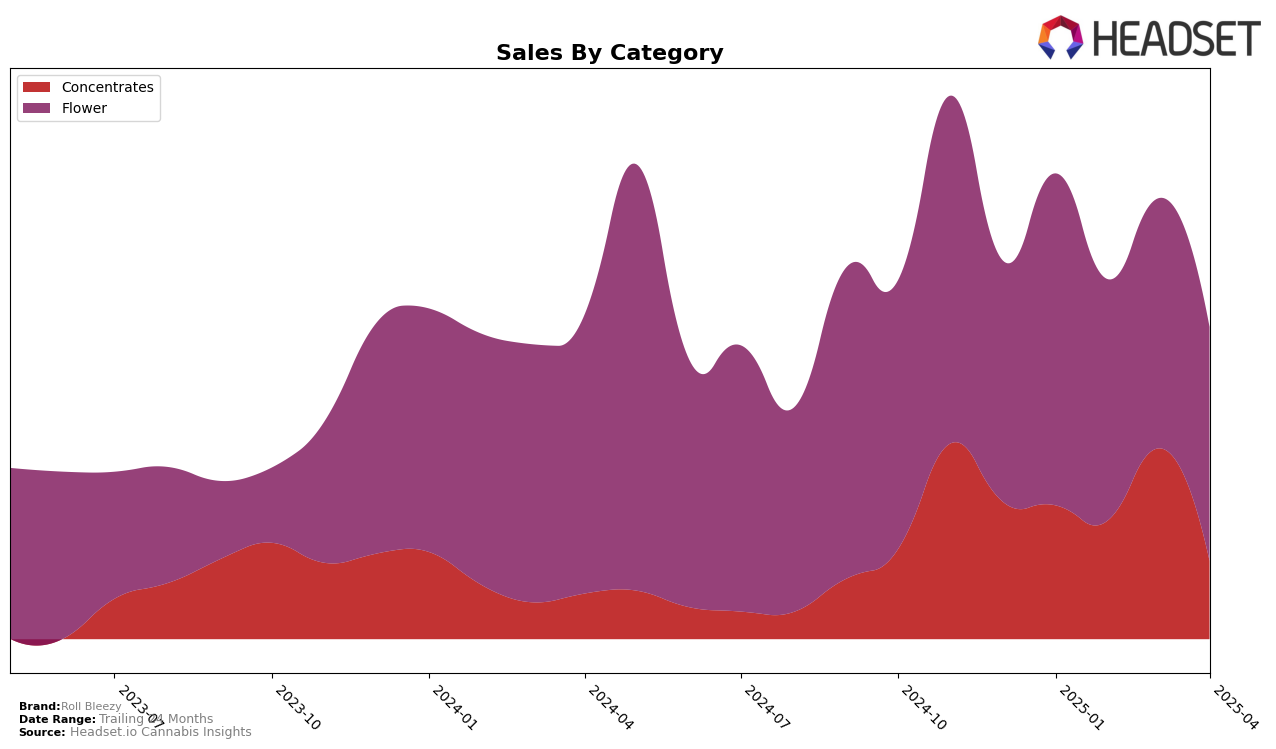

Roll Bleezy has shown some interesting dynamics in the California market, particularly in the Concentrates category. Starting the year in 17th position, the brand experienced a dip to 18th in February but made a notable comeback to rank 12th in March. However, April saw a sharp decline to 27th, indicating potential challenges or increased competition in the category. Such fluctuations suggest that while Roll Bleezy has the potential to perform well, maintaining consistent top-tier performance remains a challenge. This volatility underscores the competitive nature of the Concentrates market in California.

In contrast, the Flower category presents a more stable yet modest performance for Roll Bleezy in California. The brand did not break into the top 30 rankings, with positions ranging from 57th to 75th over the first four months of 2025. This consistent placement outside the top 30 could be seen as a disadvantage, suggesting that Roll Bleezy might need to reassess its strategy or offerings in the Flower category to increase its competitiveness. The data indicates a need for strategic adjustments to improve market positioning in this segment.

Competitive Landscape

In the competitive California flower market, Roll Bleezy has experienced notable fluctuations in its ranking, which may impact its sales trajectory. Starting at 57th in January 2025, Roll Bleezy saw a decline to 75th by April 2025. This downward trend in rank is mirrored by a decrease in sales, suggesting a potential challenge in maintaining market share. Competitors like Autumn Brands and Pure Beauty have also experienced rank changes, with Autumn Brands dropping from 69th to 81st and Pure Beauty fluctuating between 62nd and 71st. Meanwhile, TRENDI made a notable entry into the rankings in March at 97th, climbing to 72nd by April, indicating a potential rising competitor. As Roll Bleezy navigates this competitive landscape, understanding these shifts can provide strategic insights to bolster its market position.

Notable Products

In April 2025, the top-performing product for Roll Bleezy was Sour D Watermelon Z Sauce (1g) from the Concentrates category, which climbed to the number one rank with sales reaching 10,926 units. Honey Banana Sauce (1g), also from the Concentrates category, improved its position to rank second, up from fourth in March. Lanimal Sherb (3.5g) in the Flower category rose to third place, showing a steady increase from its debut at fifth in March. Lava Cake (3.5g) entered the rankings at fourth in April, while 707 Headband (3.5g) followed closely in fifth place. The notable upward movement of Sour D Watermelon Z Sauce and the entry of new products into the top five highlight a dynamic shift in product popularity for Roll Bleezy.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.