Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

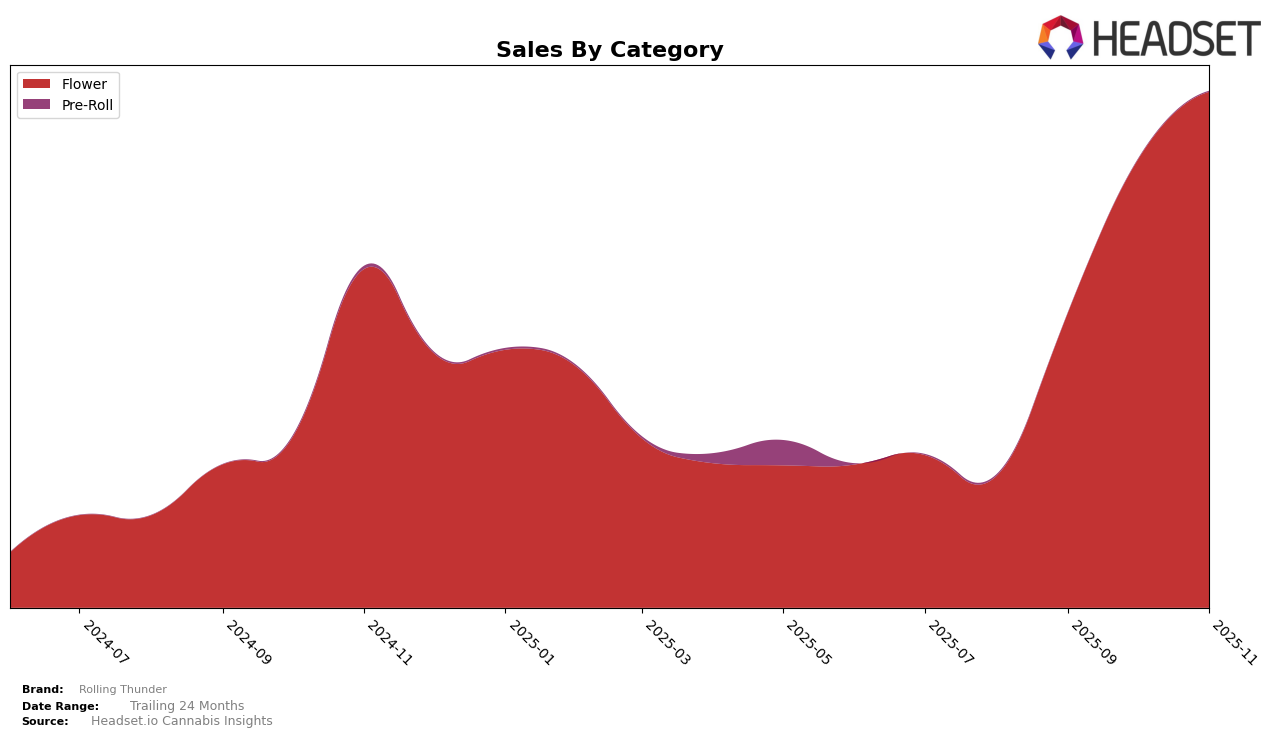

Rolling Thunder has demonstrated notable progress in the Flower category in Michigan over the past few months. In August 2025, the brand was not even in the top 30, but by November 2025, it had climbed to the 27th position. This upward trajectory suggests a strong market presence and increasing consumer preference for their products. The brand's sales in November reached $882,223, indicating a significant growth from previous months. Such a trend is indicative of strategic improvements in either product offerings or market reach, contributing to their rising popularity in the state.

While the Flower category in Michigan has shown promising developments for Rolling Thunder, it is important to note that their absence from the top 30 in August highlights potential areas for improvement or untapped opportunities. The rapid ascent from outside the top 30 to ranking 27th by November could suggest effective marketing strategies or shifts in consumer preferences that the brand has capitalized on. However, without further data on other states or categories, it remains to be seen if this success is replicated elsewhere. The focus on Michigan's market dynamics offers valuable insights into Rolling Thunder's performance, providing a glimpse into their strategic positioning in a competitive landscape.

Competitive Landscape

In the competitive landscape of Michigan's flower category, Rolling Thunder has shown a promising upward trajectory in recent months. After not ranking in the top 20 in August 2025, Rolling Thunder made a significant leap to 46th place in September and continued to climb to 31st in October and 27th in November. This upward trend suggests a growing market presence and increasing consumer interest. In comparison, Peninsula Cannabis also improved its ranking from 53rd in August to 26th in November, indicating strong performance. Meanwhile, Skymint and North Cannabis Co. experienced fluctuations, with Skymint peaking at 17th in October before dropping to 28th in November, and North Cannabis Co. slipping from 21st in September to 29th in November. Carbon also saw a decline, moving from 16th in August to 25th in November. These shifts highlight Rolling Thunder's potential to capitalize on the dynamic market conditions and continue its ascent in the rankings.

Notable Products

In November 2025, Creamery (3.5g) emerged as the top-performing product from Rolling Thunder, leading the sales with a significant figure of 17,905 units. Island Trop (3.5g) maintained its position as the second-best seller, showing a consistent performance from September. Pound Cake (3.5g) secured the third spot, marking its first appearance in the top five for the year. Sticky Glue (3.5g), which was the leader in October, fell to fourth place with a notable decrease in sales. Honolulu Blue Shake (28g) rounded out the top five, indicating a steady demand for larger quantity purchases within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.